Village Farms (NasdaqCM:VFF): Valuation Check After Naming First Global Chief Strategy Officer

Village Farms International (VFF) just created a Global Chief Strategy Officer role and hired industry veteran Brian Stevenson, a move that signals a more deliberate push into regulated cannabis markets worldwide.

See our latest analysis for Village Farms International.

The timing of this hire lines up with a powerful run in the stock, with Village Farms International delivering a year to date share price return of roughly 394 percent and a one year total shareholder return of about 468 percent. This suggests momentum is building as investors reprice its growth potential.

If this kind of turnaround story has your attention, it could be a good moment to explore other potential leaders using our screener for fast growing stocks with high insider ownership.

With shares up several hundred percent and trading only modestly below analyst targets, investors now face a tougher question: Is Village Farms still mispriced, or has the market already baked in the next leg of growth?

Most Popular Narrative: 15% Undervalued

With the narrative fair value near $4.92 versus a last close of $4.18, the story hinges on earnings scaling far faster than the top line.

The company's ability to focus resources on cannabis, following the strategic privatization of produce operations and a robust cash position, allows it to pursue high margin opportunities and self fund growth projects, positively impacting future net margins and earnings quality.

Want to see why modest revenue expectations still support a richer future earnings profile? The core narrative leans on a powerful margin reset and a surprisingly restrained valuation multiple. Curious how those moving pieces line up to reach the projected fair value? Dive in to uncover the assumptions driving that price.

Result: Fair Value of $4.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained oversupply in Canadian cannabis and slower than expected regulatory progress in key European markets could quickly challenge the current margin expansion story.

Find out about the key risks to this Village Farms International narrative.

Another Lens on Valuation

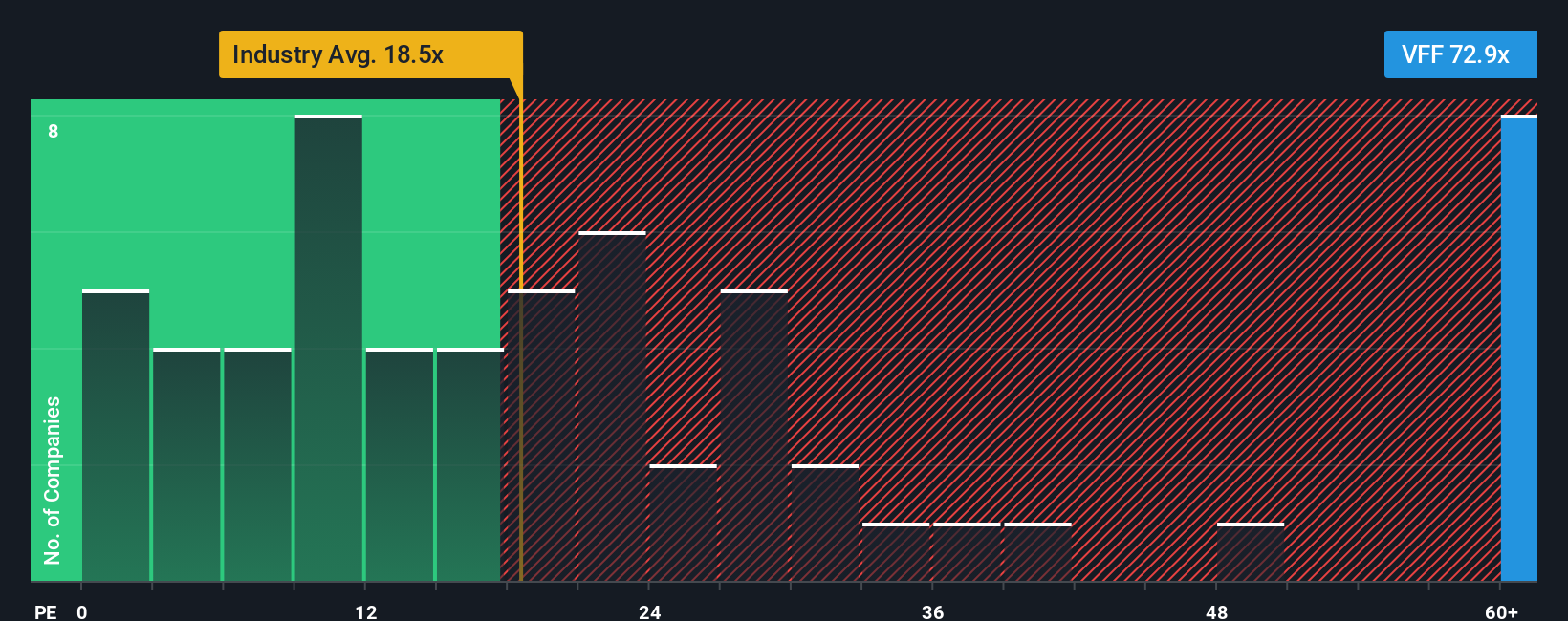

While the narrative model sees Village Farms as about 15 percent undervalued, the earnings multiple paints a very different picture. At roughly 86 times earnings versus an industry 19.8 times and a fair ratio near 53.3 times, the stock screens expensive, which raises the risk of a sharp reset if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Village Farms International Narrative

If you see the story differently, or want to stress test the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Village Farms International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one compelling opportunity. Use the Simply Wall St Screener to uncover fresh ideas that could reshape your portfolio before the crowd arrives.

- Capture potential bargain entries by targeting shares trading below intrinsic value with these 915 undervalued stocks based on cash flows that already pass key cash flow checks.

- Ride structural tailwinds in healthcare innovation by filtering companies powering medical breakthroughs with these 29 healthcare AI stocks at their core.

- Position ahead of speculative waves by sorting listed plays linked to digital assets and blockchain infrastructure through these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com