Chokwang Paint (KRX:004910) Is Due To Pay A Dividend Of ₩200.00

The board of Chokwang Paint Ltd. (KRX:004910) has announced that it will pay a dividend on the 8th of April, with investors receiving ₩200.00 per share. This means the annual payment is 3.8% of the current stock price, which is above the average for the industry.

Chokwang Paint's Future Dividends May Potentially Be At Risk

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before this announcement, Chokwang Paint was paying out 31,588% of what it was earning, and not generating any free cash flows either. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high.

Looking forward, EPS could fall by 74.7% if the company can't turn things around from the last few years. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 130,255%, which could put the dividend under pressure if earnings don't start to improve.

See our latest analysis for Chokwang Paint

Chokwang Paint's Dividend Has Lacked Consistency

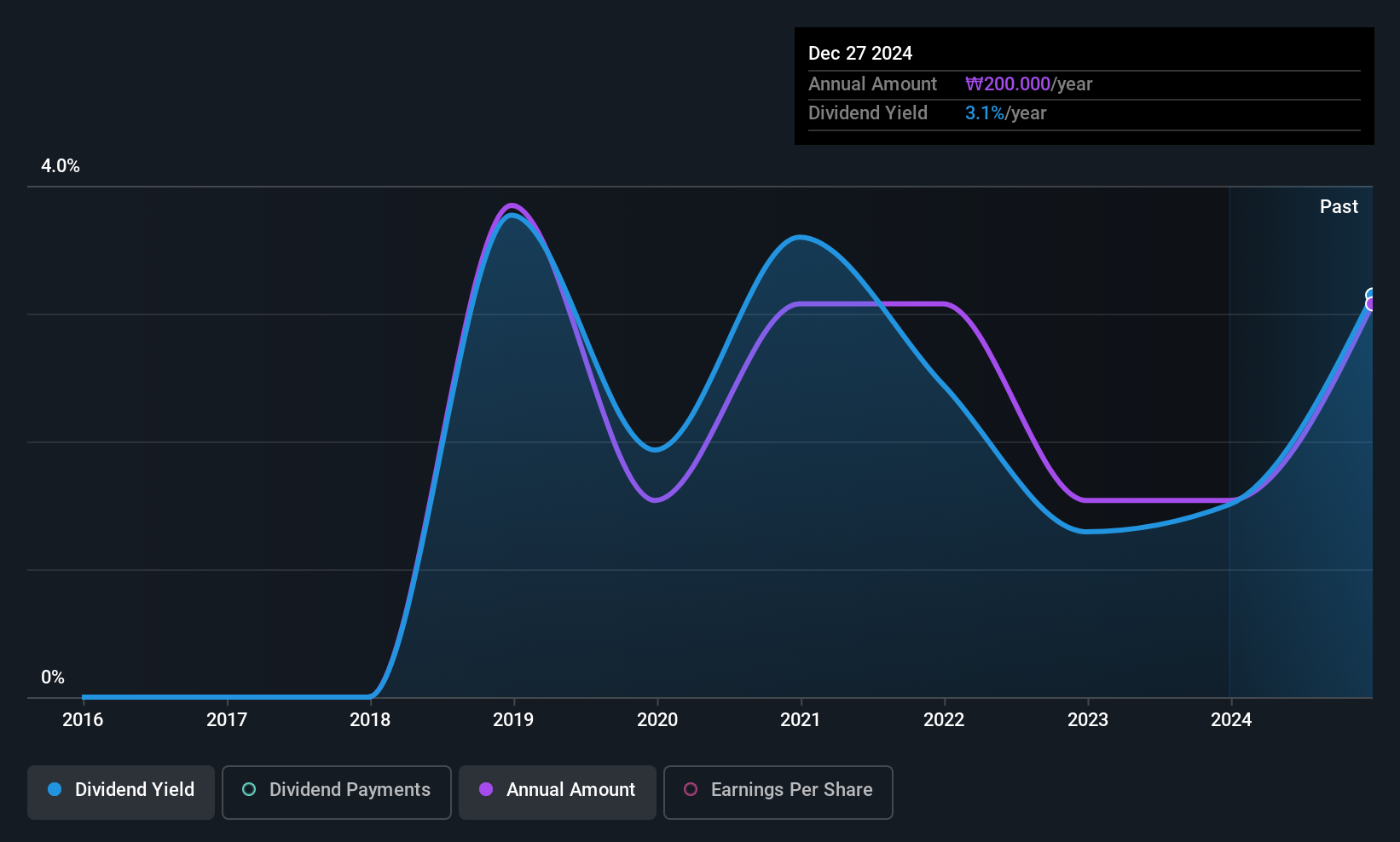

Looking back, Chokwang Paint's dividend hasn't been particularly consistent. This makes us cautious about the consistency of the dividend over a full economic cycle. The annual payment during the last 7 years was ₩250.00 in 2018, and the most recent fiscal year payment was ₩200.00. The dividend has shrunk at around 3.1% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Over the past five years, it looks as though Chokwang Paint's EPS has declined at around 75% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Chokwang Paint's Dividend Doesn't Look Great

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. The dividend doesn't inspire confidence that it will provide solid income in the future.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 5 warning signs for Chokwang Paint you should be aware of, and 2 of them can't be ignored. Is Chokwang Paint not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.