DreamCIS, Inc. (KOSDAQ:223250) Held Back By Insufficient Growth Even After Shares Climb 56%

Despite an already strong run, DreamCIS, Inc. (KOSDAQ:223250) shares have been powering on, with a gain of 56% in the last thirty days. The annual gain comes to 138% following the latest surge, making investors sit up and take notice.

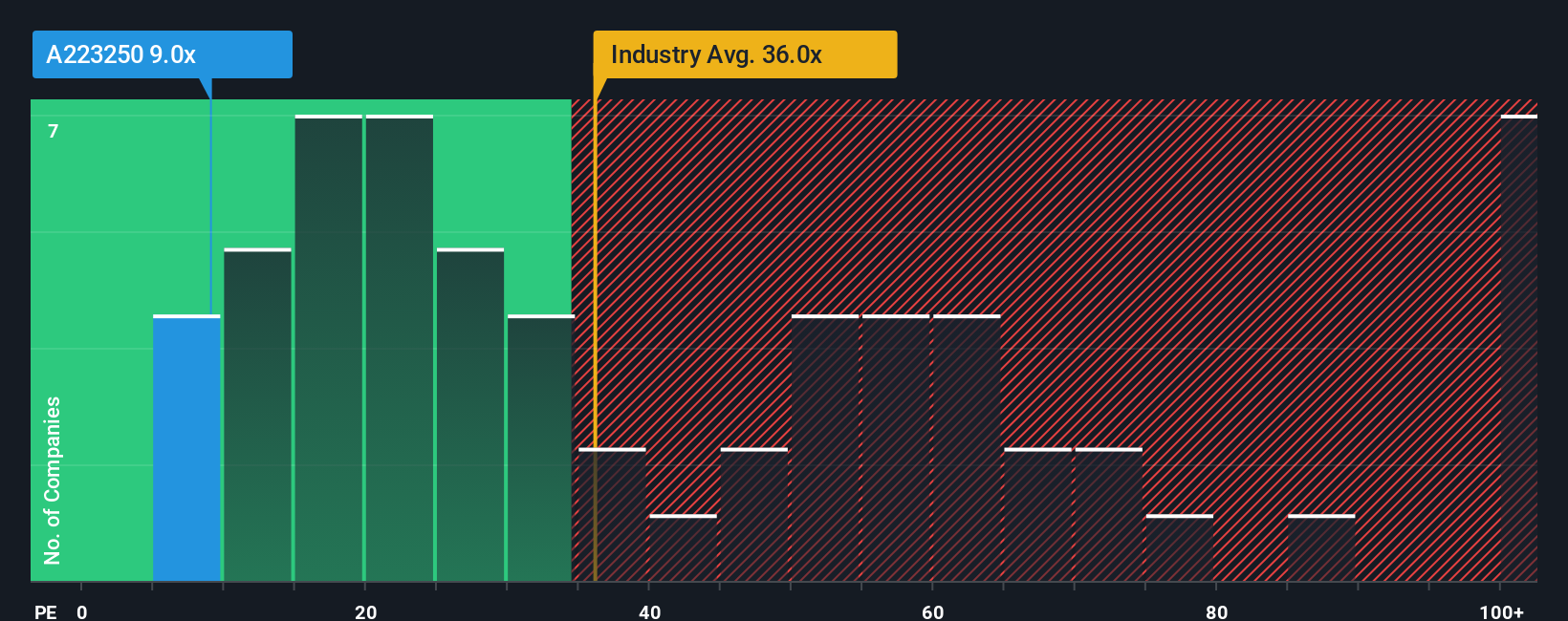

Even after such a large jump in price, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 14x, you may still consider DreamCIS as an attractive investment with its 9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for DreamCIS as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for DreamCIS

Is There Any Growth For DreamCIS?

In order to justify its P/E ratio, DreamCIS would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 297% gain to the company's bottom line. The latest three year period has also seen an excellent 39% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 38% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why DreamCIS is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From DreamCIS' P/E?

Despite DreamCIS' shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that DreamCIS maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with DreamCIS.

Of course, you might also be able to find a better stock than DreamCIS. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.