Western Digital (WDC): Taking Stock of Valuation as It Enters the Nasdaq-100 on Strong AI Storage Demand

Western Digital (WDC) is stepping into the Nasdaq 100 this month, a move that can draw fresh buying from index funds, even as AI driven demand keeps lifting its high capacity storage business.

See our latest analysis for Western Digital.

The index promotion comes after an exceptional run, with Western Digital’s share price delivering a roughly 169% year to date return and a 270% one year total shareholder return, even as the stock has recently pulled back from highs near $166. This pattern suggests momentum is still strong but becoming more sensitive to shifts in AI spending expectations and storage cycle headlines.

If Western Digital’s AI story has your attention, it is also worth scanning other data infrastructure names and high growth tech and AI stocks that could be setting up for the next leg of growth.

Yet with shares up nearly 170% year to date and trading only modestly below Wall Street targets, investors now have to ask if Western Digital is still undervalued or if the market has already priced in years of AI driven growth.

Most Popular Narrative: 8.4% Undervalued

With Western Digital last closing at $166.26 against a most followed fair value of about $181, the narrative leans toward further upside driven by AI centric storage demand and tighter industry supply.

The explosive increase in unstructured data generated by AI applications, Agentic AI, and cloud-based services across industries is driving unprecedented storage needs. Western Digital's deep integration with leading hyperscalers (for example, all top 5 with firm POs/LTAs covering the next 12 to 18 months) positions the company to benefit from secular demand, directly fueling higher long-term revenue growth.

Curious how moderate growth assumptions, rising margins, and a future earnings multiple usually reserved for sector leaders still point to upside from here? See what underpins that fair value call.

Result: Fair Value of $181.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could unravel if hyperscale customers pull back on AI infrastructure spending or if alternative storage technologies erode Western Digital’s HDD advantage.

Find out about the key risks to this Western Digital narrative.

Another Angle on Value

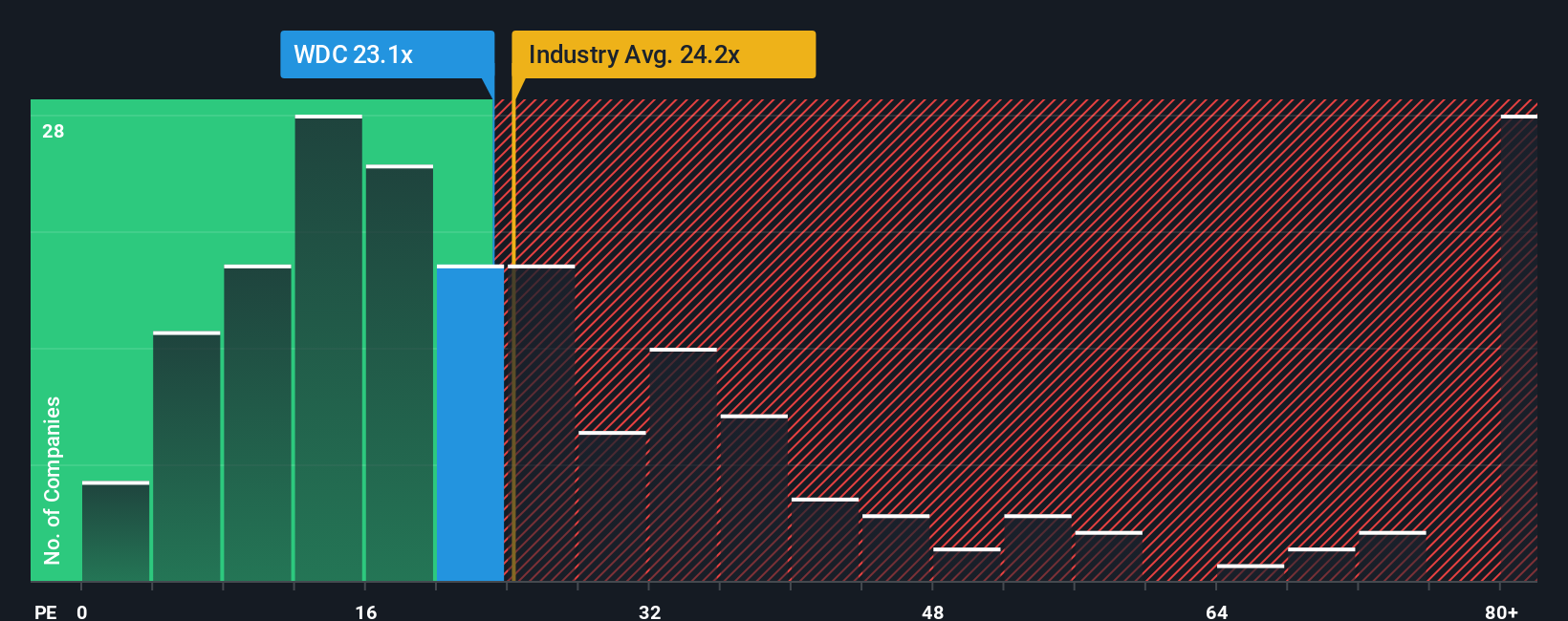

While narratives point to Western Digital being about 8% undervalued, its 21.9x earnings multiple is slightly richer than close peers at 19.8x and yet well below a 33.4x fair ratio. That gap hints at upside, but also raises the question: how much optimism is already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Western Digital Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Western Digital research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by using the Simply Wall Street Screener to uncover fresh, data driven ideas you will not want to miss.

- Capture early stage momentum by scanning these 3635 penny stocks with strong financials that combine higher risk with surprisingly resilient fundamentals and balance sheets.

- Position your portfolio for the next wave of automation and productivity gains by targeting these 24 AI penny stocks built around real, revenue generating AI solutions.

- Lock in stronger income potential by focusing on these 13 dividend stocks with yields > 3% that can support payouts while still leaving room for long term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com