The one-year decline in earnings for BNC Korea KOSDAQ:256840) isn't encouraging, but shareholders are still up 20% over that period

BNC Korea Co., Ltd. (KOSDAQ:256840) shareholders have seen the share price descend 12% over the month. But at least the stock is up over the last year. In that time, it is up 20%, which isn't bad, but is below the market return of 63%.

Since the long term performance has been good but there's been a recent pullback of 12%, let's check if the fundamentals match the share price.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, BNC Korea actually shrank its EPS by 10%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

However the year on year revenue growth of 13% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

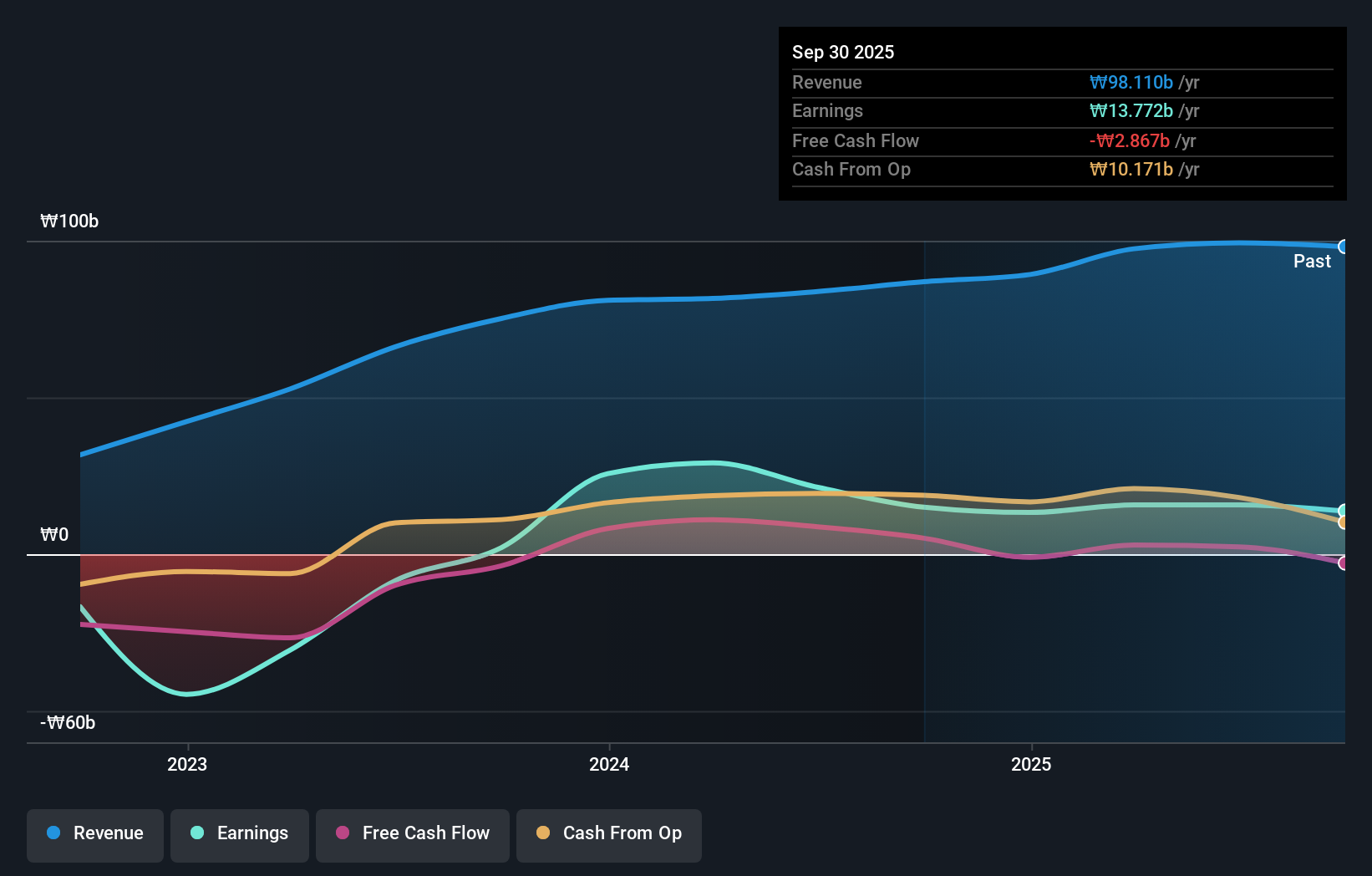

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling BNC Korea stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

BNC Korea shareholders are up 20% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 5% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with BNC Korea , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.