3 Middle Eastern Dividend Stocks Yielding Over 3%

As oil prices hold steady, most Gulf stock markets have seen a rise, with Saudi Arabia rebounding from a two-year low and Abu Dhabi snapping a losing streak. In this environment of cautious optimism, dividend stocks yielding over 3% can offer investors potential income stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.76% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.21% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.80% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.76% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.41% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.51% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.09% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.49% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.14% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.57% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

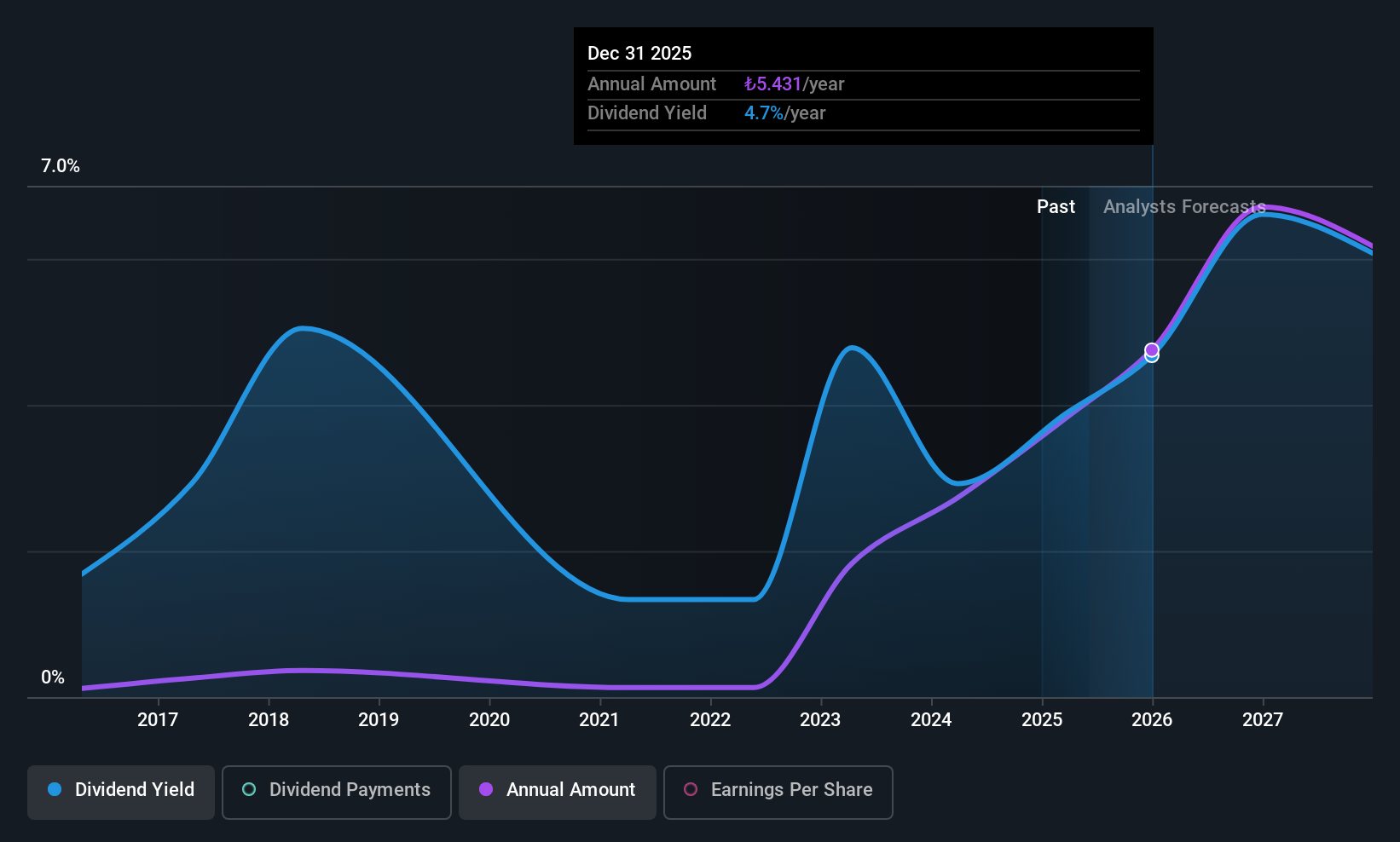

Turkiye Garanti Bankasi (IBSE:GARAN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Turkiye Garanti Bankasi A.S. offers a range of banking products and services in Turkey, with a market cap of TRY603.12 billion.

Operations: Turkiye Garanti Bankasi A.S. generates revenue from several segments, including Retail Banking (TRY208.71 billion), Corporate Banking (TRY188.84 billion), and Investment Banking (-TRY186.27 billion).

Dividend Yield: 3.1%

Turkiye Garanti Bankasi's dividend payments have been volatile over the past decade, with a low yield of 3.06%, slightly below the top 25% in Turkey. Despite this, dividends are well covered by earnings with a payout ratio of 17%. Recent financial results show strong earnings growth, enhancing its ability to sustain dividends. However, high non-performing loans at 2.8% present a risk factor. The bank recently secured significant international financing totaling US$433.4 million for sustainability initiatives.

- Click here to discover the nuances of Turkiye Garanti Bankasi with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Turkiye Garanti Bankasi's share price might be too pessimistic.

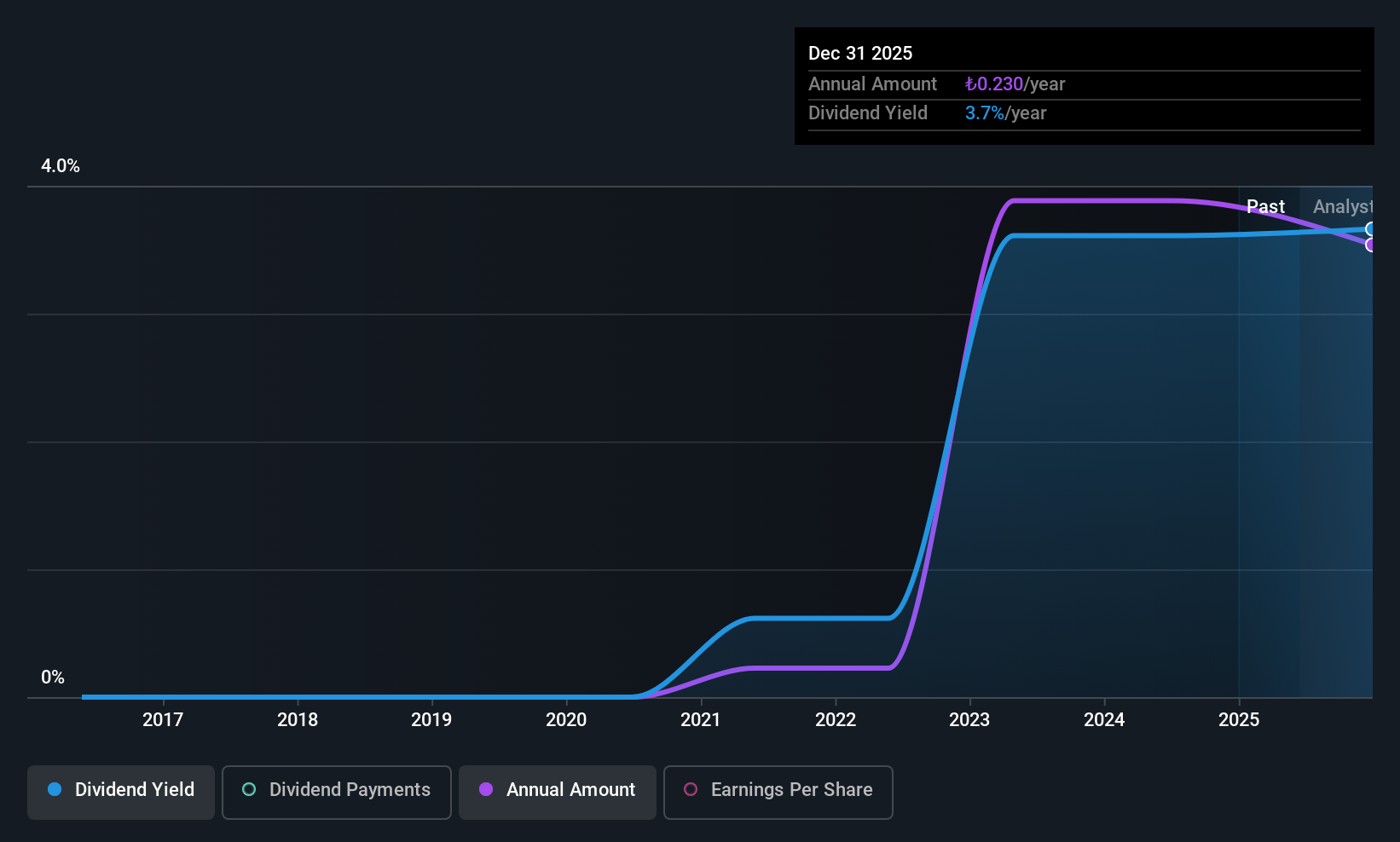

Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi (IBSE:INDES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi is a company that distributes IT products in Turkey, with a market cap of TRY5.29 billion.

Operations: Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi generates revenue primarily from Information Technologies and Telecom, amounting to TRY68.31 billion, and Logistics and Rental services, contributing TRY379.74 million.

Dividend Yield: 4.9%

Indeks Bilgisayar's dividends, with a payout ratio of 28.3%, are well-supported by earnings and cash flows, offering a yield of 4.91%—placing it among the top dividend payers in Turkey. Despite only five years of dividend history, payments have been stable and growing. Recent financials show increased sales to TRY 61.72 billion but a slight dip in net income to TRY 334.17 million, indicating potential pressure on future payouts if profitability doesn't improve.

- Unlock comprehensive insights into our analysis of Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi stock in this dividend report.

- The valuation report we've compiled suggests that Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi's current price could be quite moderate.

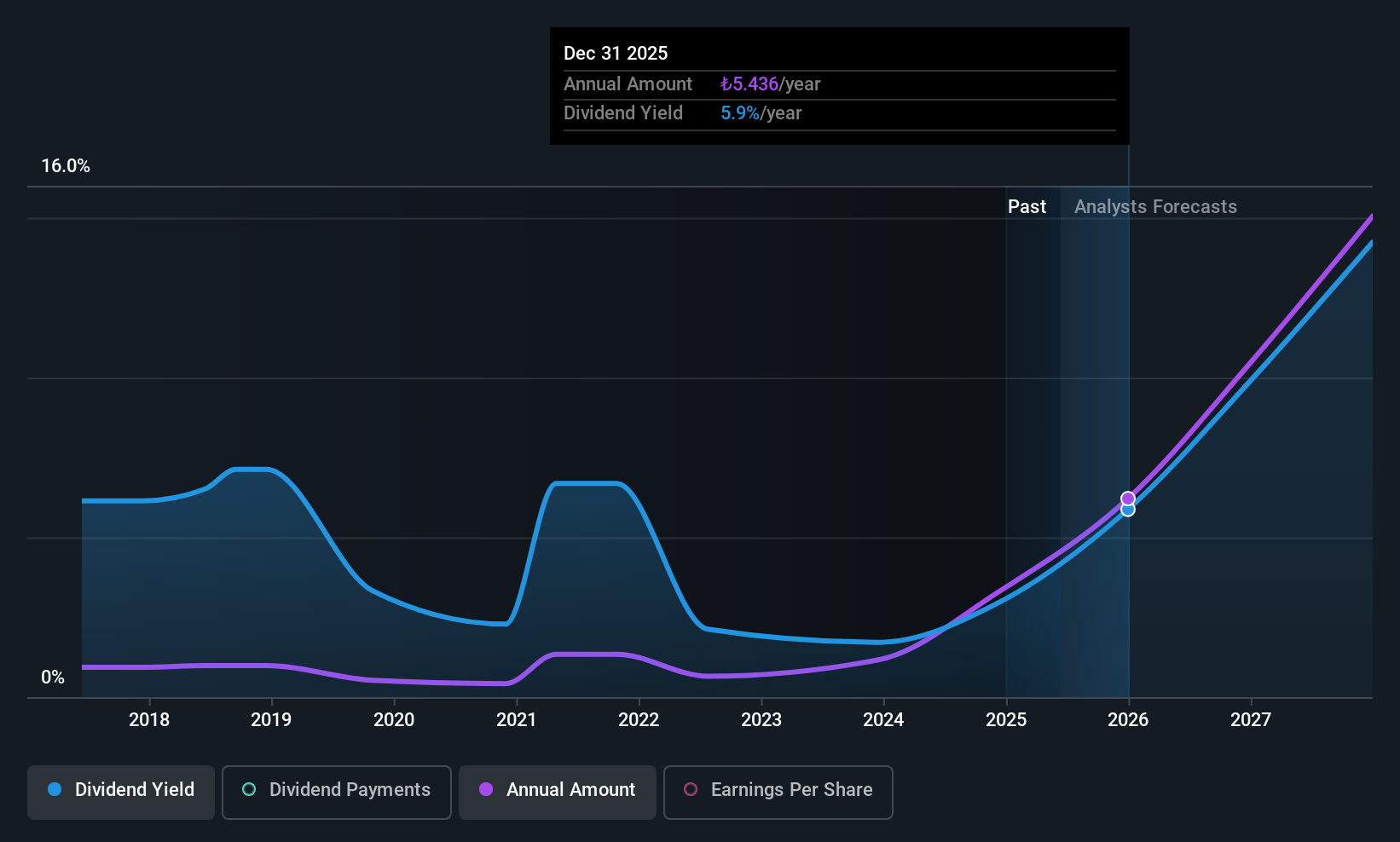

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Turkcell Iletisim Hizmetleri A.S. offers converged telecommunication and technology services across Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands, with a market cap of TRY221.78 billion.

Operations: Turkcell Iletisim Hizmetleri generates revenue primarily from its Turkcell Turkey segment, amounting to TRY159.86 billion, and its Techfin segment, contributing TRY10.54 billion.

Dividend Yield: 3.6%

Turkcell's dividends, though volatile over the past decade, are well-supported by earnings and cash flows with a payout ratio of 57.2% and a cash payout ratio of 25.8%. Recent strategic alliances, such as the partnership with Google Cloud, aim to bolster revenue growth in data center and cloud services. Despite declining net income to TRY 13.43 billion for nine months ending September 2025, Turkcell maintains a strong market position in Turkey's digital ecosystem through its expansive frequency portfolio for upcoming 5G deployment.

- Dive into the specifics of Turkcell Iletisim Hizmetleri here with our thorough dividend report.

- Our expertly prepared valuation report Turkcell Iletisim Hizmetleri implies its share price may be lower than expected.

Turning Ideas Into Actions

- Investigate our full lineup of 60 Top Middle Eastern Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com