Wave Life Sciences (WVE): Valuation Check After Positive WVE-007 Obesity Data And GlaxoSmithKline Backing

Wave Life Sciences (WVE) is back on investors radar after interim Phase 1 data for its obesity candidate WVE-007 showed healthier body composition changes along with a clean safety profile, sparking renewed interest.

See our latest analysis for Wave Life Sciences.

The excitement around WVE 007, along with Wave Life Sciences recent $350 million follow on equity raise and fresh backing from GlaxoSmithKline, has powered a 118.57% 1 month share price return and a 142.43% three year total shareholder return, even though momentum has cooled slightly in the past week.

If this obesity data has you rethinking your healthcare exposure, it might be worth exploring healthcare stocks for other potential winners in the space.

Yet with Wave still lossmaking, trading below a consensus price target near $31, and riding a sharp post trial rebound, should investors treat the current pullback as a fresh entry point, or assume the market is already discounting years of future growth?

Most Popular Narrative Narrative: 42.9% Undervalued

With Wave Life Sciences last closing at $15.54 against a narrative fair value near $27.21, the story hinges on aggressive long term growth and margin assumptions.

The expansion and clinical validation of Wave's proprietary RNA editing and siRNA platforms, including the emergence of new wholly-owned pipeline candidates for both rare and prevalent diseases, position the company to benefit from growing market adoption of RNA-based and precision therapies, underpinning longer-term top-line growth and partnership revenue potential.

Want to see what powers that valuation gap? This narrative leans on rapid revenue expansion, a dramatic margin shift, and a punchy future earnings multiple. Curious how those pieces fit together?

Result: Fair Value of $27.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained operating losses and reliance on a narrow set of high stakes clinical programs mean that any trial setback could quickly erode today’s valuation upside.

Find out about the key risks to this Wave Life Sciences narrative.

Another View: Market Multiples Flash a Warning

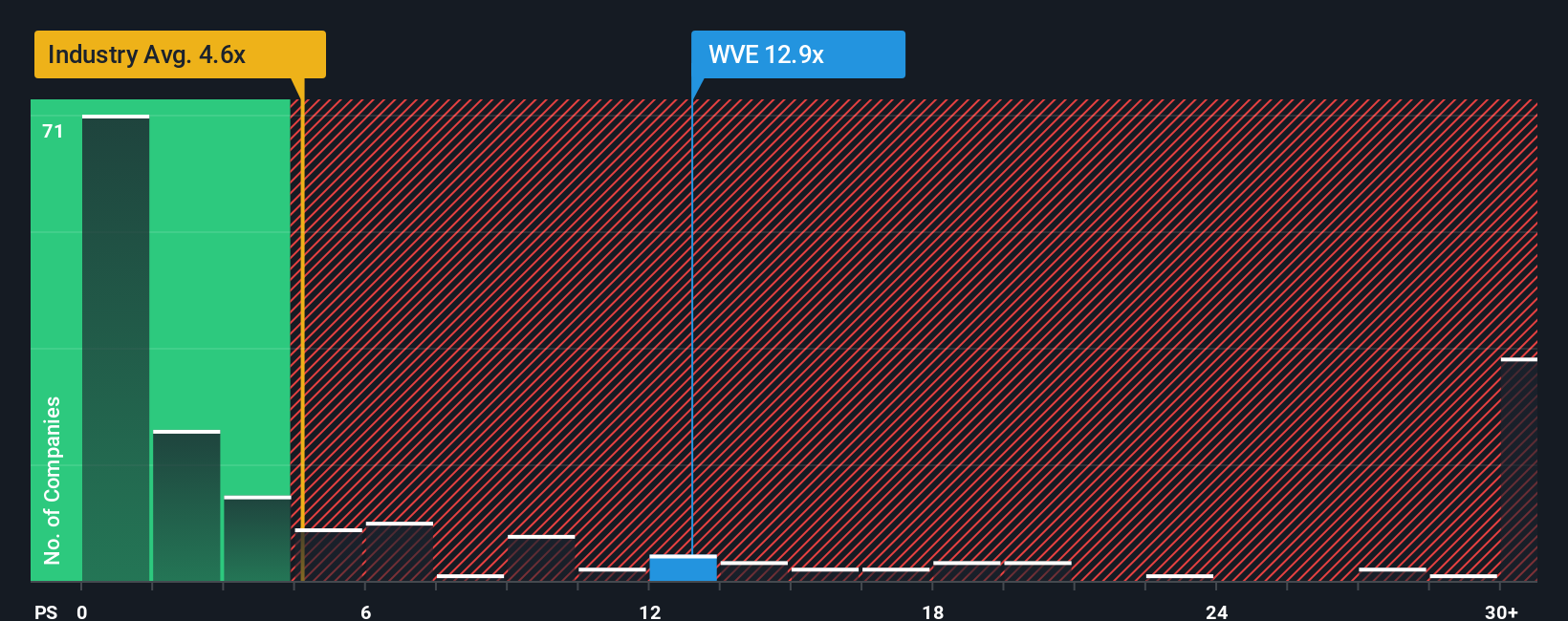

While the narrative model suggests upside, the market is already paying a steep 26 times sales for Wave Life Sciences, versus about 4.1 times for the US pharma sector and 13.5 times for peers, and a fair ratio near 2.8 times. That gap points to real valuation risk if sentiment cools. Are you comfortable paying so far ahead of today’s fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wave Life Sciences Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Wave Life Sciences research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Wave, you could miss standout opportunities. Let Simply Wall Street’s powerful Screener line up your next high conviction ideas in minutes.

- Capitalize on mispriced quality by scanning these 918 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride structural growth trends by targeting these 24 AI penny stocks positioned at the forefront of intelligent automation and data driven innovation.

- Lock in potential income streams by focusing on these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s yield profile over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com