Telecom Italia S.p.A.'s (BIT:TIT) Price In Tune With Revenues

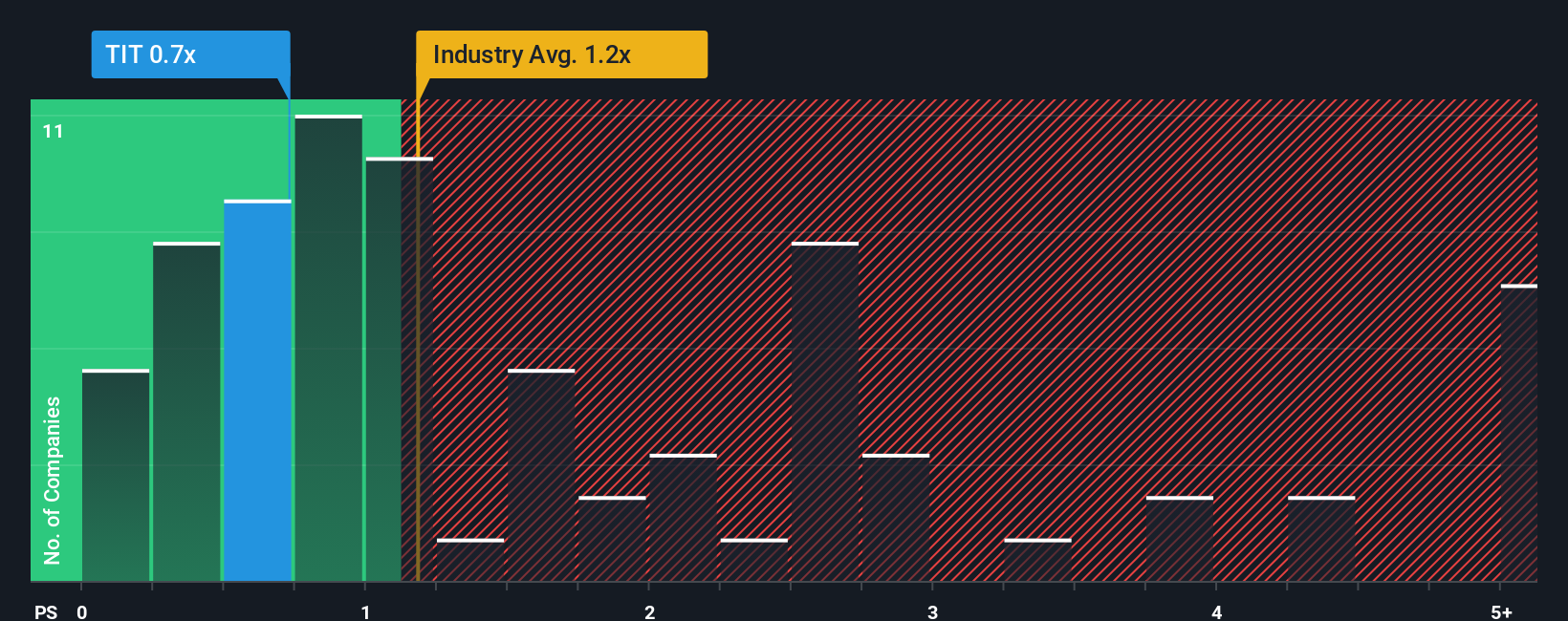

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Telecom industry in Italy, you could be forgiven for feeling indifferent about Telecom Italia S.p.A.'s (BIT:TIT) P/S ratio of 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Telecom Italia

What Does Telecom Italia's Recent Performance Look Like?

There hasn't been much to differentiate Telecom Italia's and the industry's revenue growth lately. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Telecom Italia.Is There Some Revenue Growth Forecasted For Telecom Italia?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Telecom Italia's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.8%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 6.9% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 1.0% each year as estimated by the twelve analysts watching the company. With the industry predicted to deliver 1.7% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Telecom Italia's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Telecom Italia's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Telecom Italia's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Telecom industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Telecom Italia with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.