Is Visa’s Premium Price Still Justified After Its Digital Payments Expansion in 2025?

- Wondering if Visa at around $346 is still a smart buy after its long run, or if most of the upside is already priced in? This breakdown will help you separate durable value from headline hype.

- Despite a modest 0.5% slip over the last week, Visa is still up 6.8% over the past month and 10.1% year to date, with a strong 71.9% gain over both 3 and 5 years that keeps expectations high.

- Recent headlines have focused on Visa expanding its digital payments ecosystem and striking new partnerships with fintech players and global banks, reinforcing its role at the center of cashless spending. At the same time, scrutiny around regulation and fees continues to bubble in the background and shape how investors think about its future growth runway.

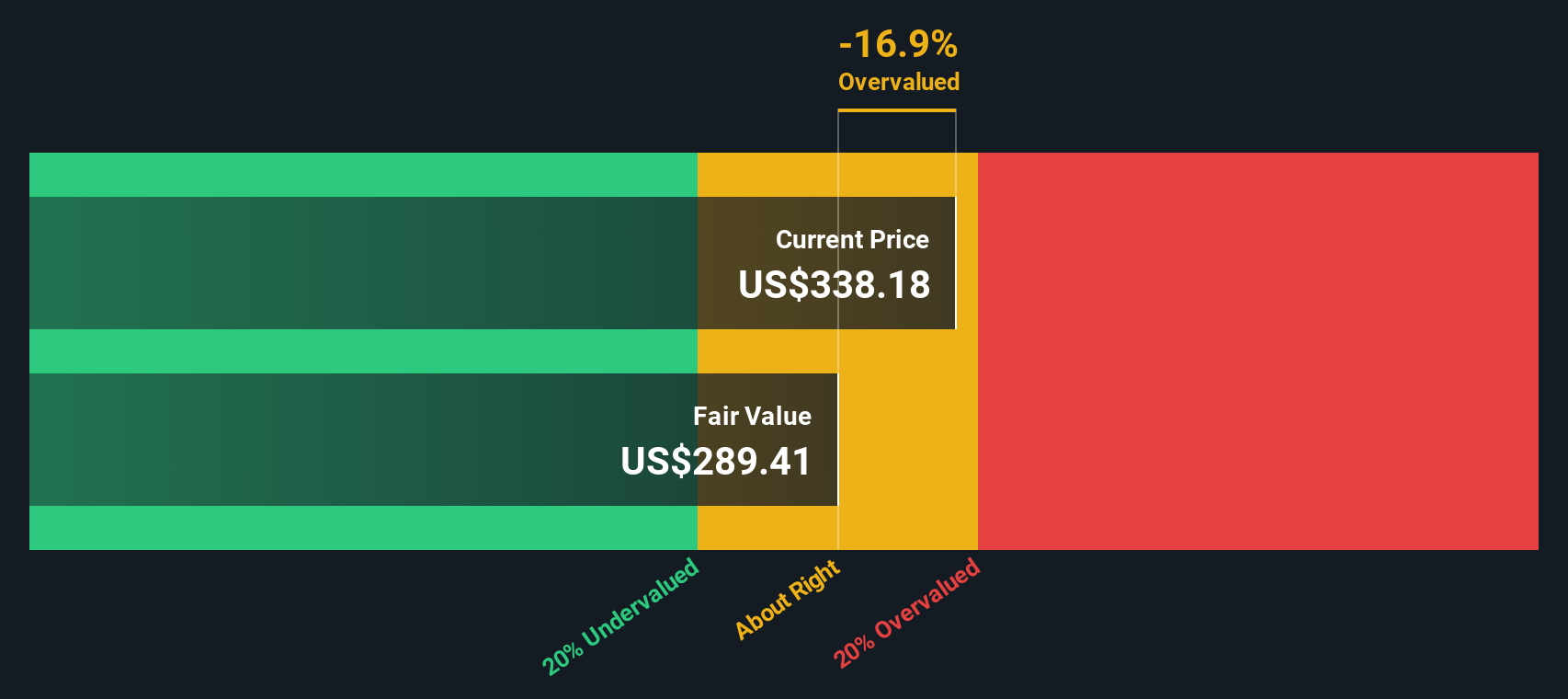

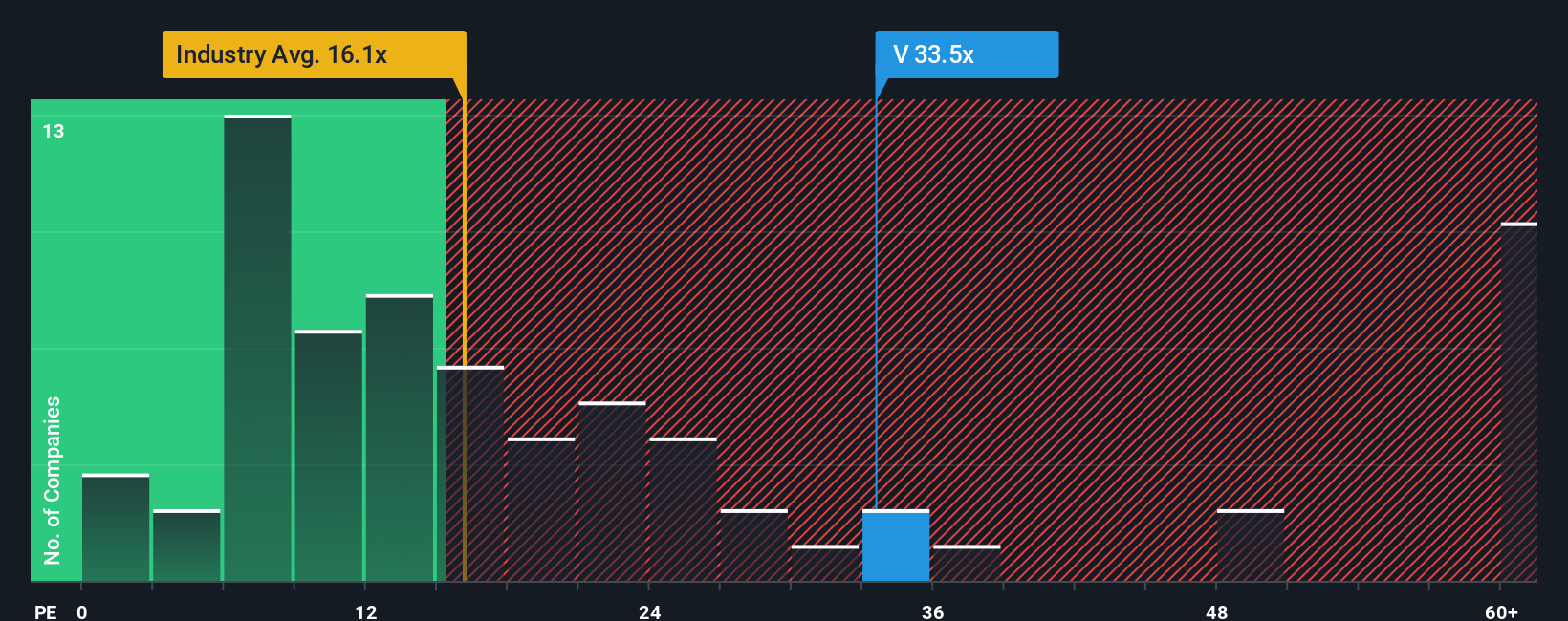

- Even with that backdrop, Visa only scores 1/6 on our undervaluation checks, which might surprise investors who see it as a must own compounder. Next, we will unpack how different valuation methods judge the stock today and then finish with a more nuanced way to think about what Visa is really worth.

Visa scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Visa Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the minimum return that shareholders require, and then capitalizes those surplus profits into a fair value per share.

For Visa, the model starts with a Book Value of $19.38 per share and a Stable EPS of $15.99 per share, based on weighted future return on equity estimates from 13 analysts. With a Cost of Equity of $1.68 per share, Visa is expected to generate an Excess Return of $14.31 per share, implying it can consistently earn far more than investors demand on its equity base.

This is reinforced by an exceptionally high Average Return on Equity of 70.54% and a projected Stable Book Value of $22.67 per share, sourced from nine analysts. Folding these inputs into the Excess Returns framework yields an intrinsic value of about $368.57 per share, suggesting the stock is roughly 6.1% below fair value at current prices.

Taken together, Visa looks slightly cheap rather than stretched on this model.

Result: ABOUT RIGHT

Visa is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Visa Price vs Earnings

For a profitable, mature business like Visa, the price to earnings ratio is a useful shorthand for how much investors are willing to pay for each dollar of current profits. It naturally bakes in expectations about future growth and the risk that those earnings might disappoint, so faster growing and more resilient businesses usually command higher PE multiples.

Visa currently trades at about 33.3x earnings, which is far richer than the Diversified Financial industry average of roughly 13.7x and also well above the peer average of 17.4x. At first glance, that kind of premium might look stretched, but simple comparisons like these can miss important context.

That is where Simply Wall St’s Fair Ratio comes in. This proprietary metric estimates what a reasonable PE multiple should be after accounting for factors like Visa’s earnings growth outlook, strong profit margins, scale, industry dynamics and risk profile. For Visa, the Fair Ratio is 20.0x, which is meaningfully below the current 33.3x and implies the market is paying a sizable extra premium beyond what these fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Visa Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you write the story you believe about a company, link that story to a set of forecasts for revenue, earnings and margins, and then translate those forecasts into a Fair Value you can compare to today’s price. On Simply Wall St’s Community page, Narratives are an easy, guided tool used by millions of investors to connect a company’s business drivers to a financial model that updates dynamically as new news, earnings releases or guidance come through, so your view on when to buy or sell can evolve with the facts. With Visa, for example, one investor might build a bullish Narrative around stablecoin expansion, cross border growth and rising value added services, arriving at a Fair Value near $430, while another focuses on regulation, real time payments and competition risks and lands closer to $305, and Narratives make those different perspectives, and what needs to happen for them to be right, completely transparent.

Do you think there's more to the story for Visa? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com