Is Lincoln Electric (LECO) Still Undervalued After Its Recent Share Price Strength?

Lincoln Electric Holdings (LECO) has quietly outperformed the broader market this year, and with the stock near 243 dollars after a strong month, investors are asking whether this steady climb still has room to run.

See our latest analysis for Lincoln Electric Holdings.

That move has been backed by solid execution in the core welding and automation business, with a 9.9 percent 1 month share price return feeding into a robust multi year total shareholder return profile. This suggests that momentum is still very much intact.

If Lincoln Electric’s run has you rethinking your watchlist, this could be a good moment to explore aerospace and defense stocks for other industrial names riding similar long term themes.

Yet with shares trading near record highs and only a modest gap to analyst targets, the key question now is whether Lincoln Electric is still undervalued or if the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 7.7% Undervalued

With Lincoln Electric closing at 243.69 dollars against a narrative fair value of 263.90 dollars, the valuation case hinges on how durable its growth trajectory really is.

Product mix shift towards higher value automation, robotics, and proprietary wear plate solutions (including through acquisitions like Alloy Steel) will raise exposure to premium product categories, supporting margin improvement and long term earnings growth.

Growth in digital platforms and IoT connected solutions is strengthening customer loyalty and recurring revenue streams, increasing earnings stability and net margin potential as both services and aftermarket businesses expand alongside core product sales.

Curious how steady mid single digit revenue growth, fatter margins, and a slightly lower future earnings multiple can still point to upside from here? The narrative lays out a tightly modeled path for earnings, buybacks, and discount rates that turns incremental improvements into meaningful valuation headroom. The real surprise is which assumptions do most of the heavy lifting.

Result: Fair Value of $263.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on demand holding up, because weaker industrial cycles or prolonged reliance on price increases over volume could quickly compress that valuation headroom.

Find out about the key risks to this Lincoln Electric Holdings narrative.

Another Angle on Valuation

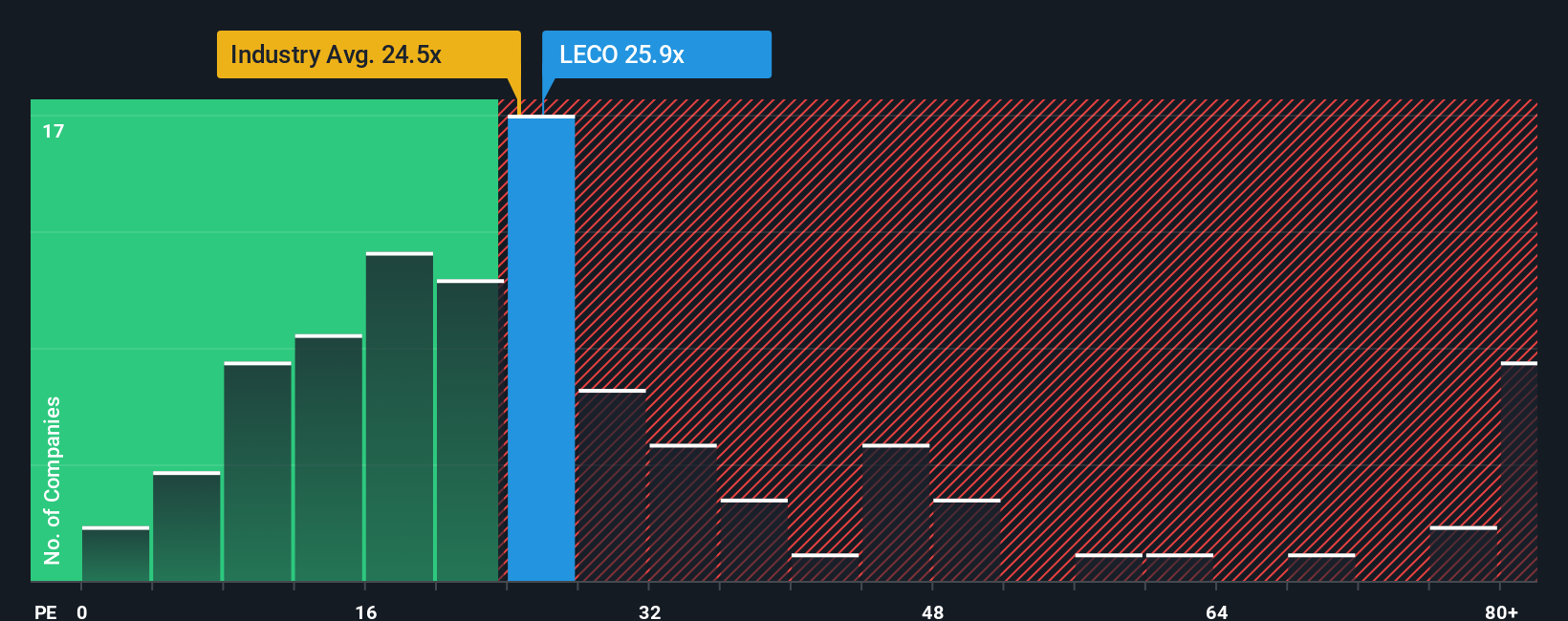

Strip away the narrative model and Lincoln Electric looks fully valued on traditional earnings terms. Its 25.5 times price to earnings is above our 24.2 times fair ratio and slightly ahead of the US machinery average, which suggests less margin for error if growth stumbles from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lincoln Electric Holdings Narrative

If you would rather follow your own process and interpret the numbers directly, you can quickly build a personalized view in minutes, starting with Do it your way.

A great starting point for your Lincoln Electric Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing move?

If Lincoln Electric is on your radar, do not stop there. Use the Simply Wall Street Screener to uncover fresh opportunities before the crowd catches on.

- Capture tomorrow’s growth stories early by scanning these 3628 penny stocks with strong financials that already back their potential with solid financial foundations.

- Position your portfolio at the heart of the AI revolution by targeting these 24 AI penny stocks with powerful technology tailwinds.

- Lock in value opportunities others overlook by focusing on these 917 undervalued stocks based on cash flows where cash flows suggest the market is still playing catch up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com