Should Geely’s Massive Buyback and Tokenized Assets Strategy Require Action From Geely (SEHK:175) Investors?

- Earlier in December 2025, Geely Automobile Holdings Limited (SEHK:175) began a shareholder‑mandated buyback program allowing repurchases of up to 1,008,392,703 shares, equivalent to 10% of its issued share capital as of May 30, 2025, funded from legally available reserves and expected to enhance net asset value and earnings per share.

- At the same time, Geely’s plug‑in hybrid STARRAY EM-i SUV set a GUINNESS WORLD RECORDS™ fuel‑efficiency benchmark while its technology arm pursued tokenization of rare Huanghuali rosewood assets, underlining both product innovation and experimentation with new capital‑raising models.

- We’ll now examine how Geely’s record‑setting hybrid efficiency, alongside its real‑world asset tokenization ambitions, could influence its investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Geely Automobile Holdings Investment Narrative Recap

To own Geely Automobile Holdings, you need to believe it can convert its push into new energy vehicles, smart tech and exports into sustained, profitable growth despite intense competition. The new buyback program and record‑setting hybrid efficiency support the near term focus on earnings quality and NEV product appeal, but do not remove key risks around pricing pressure and execution in overseas markets, so the core narrative remains broadly intact.

The commencement of the shareholder‑mandated buyback, covering up to 10% of issued shares, ties directly into the current catalyst of improving earnings per share and capital efficiency. For investors watching Geely’s expansion in NEVs and exports, this capital return policy sits alongside its technology initiatives like the STARRAY EM-i and real world asset tokenization, adding another layer to how future earnings growth might be reflected on a per share basis.

Yet, while these developments are encouraging, investors should still be aware of how rising NEV competition could...

Read the full narrative on Geely Automobile Holdings (it's free!)

Geely Automobile Holdings' narrative projects CN¥463.1 billion revenue and CN¥22.5 billion earnings by 2028. This requires 19.5% yearly revenue growth and about CN¥7.4 billion earnings increase from CN¥15.1 billion today.

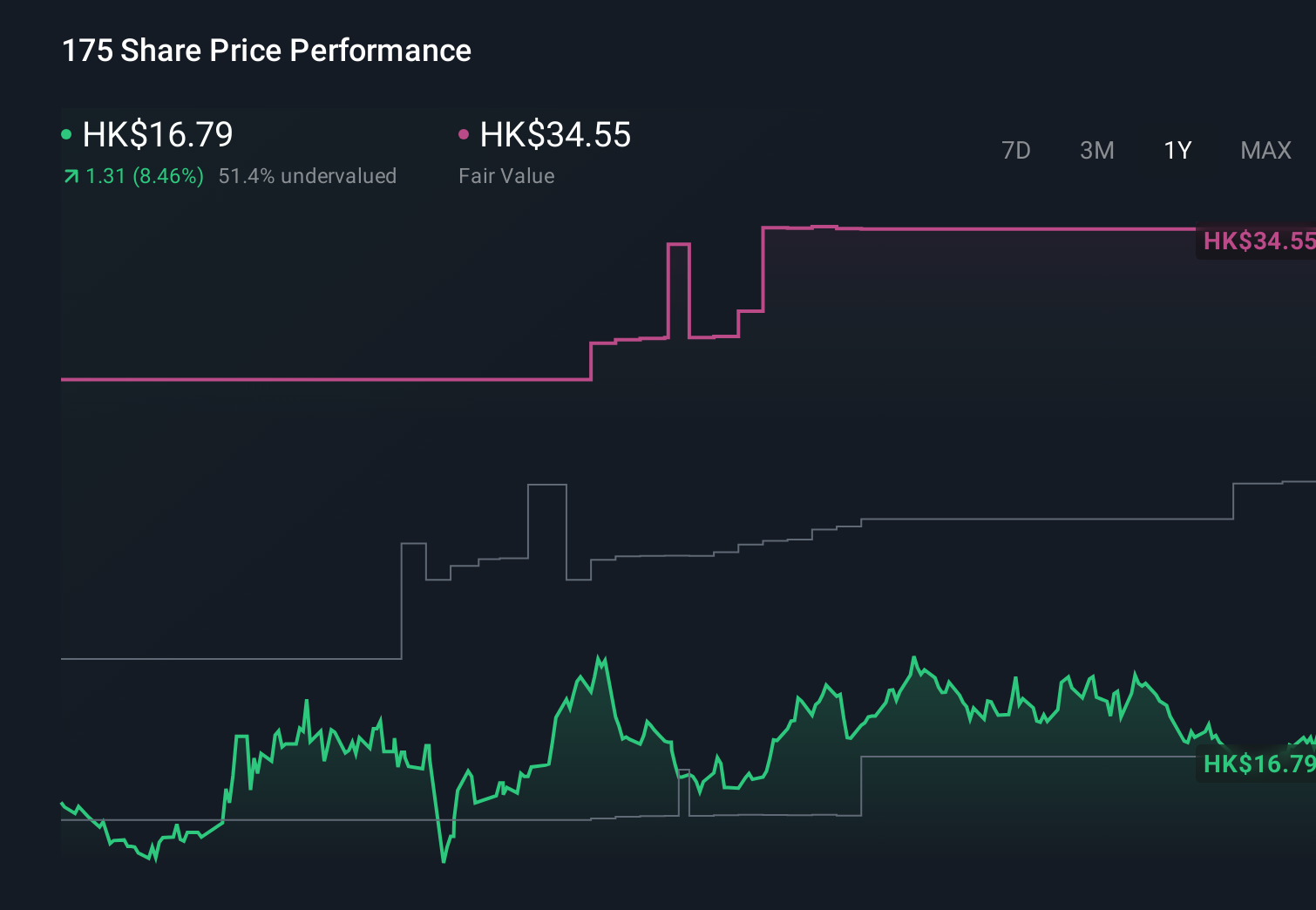

Uncover how Geely Automobile Holdings' forecasts yield a HK$26.38 fair value, a 57% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community currently see Geely’s fair value between HK$22.70 and HK$46.20, highlighting very different expectations. When you set these views against Geely’s heavy exposure to increasingly crowded NEV markets, it becomes even more important to weigh several perspectives on how competition could affect future performance.

Explore 6 other fair value estimates on Geely Automobile Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Geely Automobile Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Geely Automobile Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Geely Automobile Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Geely Automobile Holdings' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com