Mueller Water Products (MWA): Assessing Valuation After a Strong Multi‑Year Shareholder Return Run

Recent performance and context

Mueller Water Products (MWA) has been quietly grinding higher this year, and the stock’s recent move reflects investors warming up to steady water infrastructure demand and the company’s improving profitability.

See our latest analysis for Mueller Water Products.

At around $24.88, Mueller’s modest recent pullback comes after a solid year to date share price return. The standout three year total shareholder return above 140 percent suggests momentum is still broadly on the side of long term holders.

If steady water infrastructure demand has you thinking about where else durable growth might be hiding, it is worth exploring fast growing stocks with high insider ownership as a next step.

With earnings still growing faster than revenue and the share price sitting just below analyst targets, is Mueller Water Products quietly undervalued, or is the market already pricing in the next leg of its growth?

Most Popular Narrative Narrative: 10.1% Undervalued

With the narrative fair value near $27.67 against the $24.88 last close, the valuation case leans on steady growth and expanding profitability assumptions.

Operational efficiency initiatives including legacy foundry closures and modernization of iron foundries are expected to further lower production costs and enable scalable capacity, resulting in sustainable improvements to net margins and increased free cash flow generation over the coming years.

Curious how moderate revenue growth, sharply higher margins, and a deliberately lower future earnings multiple can still justify upside from here? The full narrative unpacks that puzzle.

Result: Fair Value of $27.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly high interest rates or delays in federal infrastructure funding could choke off demand and derail the margin and earnings expansion story.

Find out about the key risks to this Mueller Water Products narrative.

Another Angle on Valuation

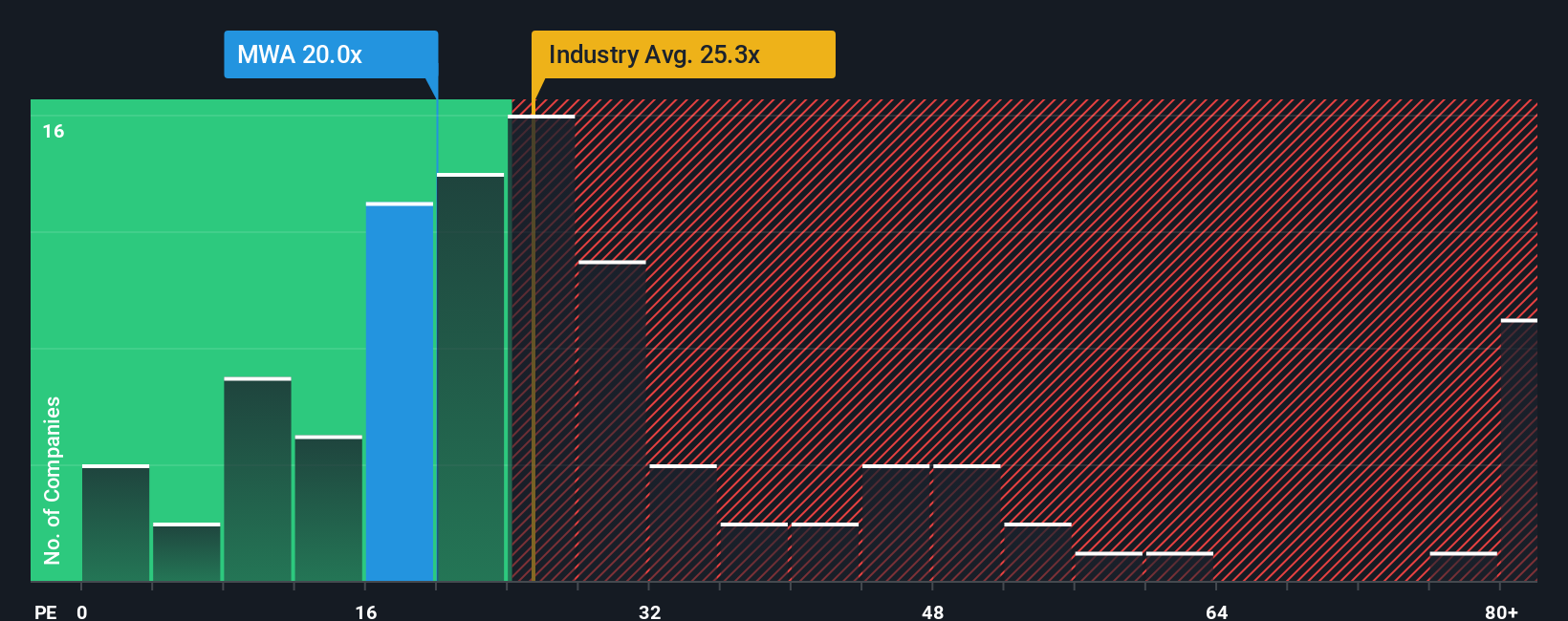

On a simple earnings lens, Mueller trades on about 20.3 times earnings versus 25.4 times for the US Machinery industry and 37.8 times for close peers, while our fair ratio sits nearer 21.4 times. That discount hints at opportunity, but is the gap really mispricing or just slower growth expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mueller Water Products for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mueller Water Products Narrative

If you see the numbers differently or simply prefer to dig into the data yourself, you can build a complete narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mueller Water Products.

Looking for more investment ideas?

Before the market moves on without you, use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy and keep your edge sharp.

- Target powerful compounding potential with these 13 dividend stocks with yields > 3% that can strengthen total returns and provide reliable income through changing market cycles.

- Capitalize on structural growth by scanning these 29 healthcare AI stocks where innovation, data, and medicine intersect to reshape the future of patient care.

- Position yourself ahead of the next digital shift by evaluating these 80 cryptocurrency and blockchain stocks tied to real businesses building blockchain and decentralized finance infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com