Assessing Avadel Pharmaceuticals (AVDL) Valuation After a Strong 1-Year Share Price Rally

Avadel Pharmaceuticals (AVDL) has quietly turned into one of those under the radar movers, with the stock nearly doubling this year even after a recent pullback over the past month.

See our latest analysis for Avadel Pharmaceuticals.

With the share price now at $21.42, Avadel’s roughly 32% 3 month share price return and 107.76% 1 year total shareholder return suggest momentum is still building as investors reassess its growth runway and risk profile.

If Avadel’s run has you rethinking your healthcare exposure, this is a good moment to scout other potential winners across healthcare stocks.

Yet with the stock already near analyst targets but still trading at an estimated intrinsic discount, investors face a pivotal question: Is Avadel still a mispriced growth story, or is the market already baking in the next leg higher?

Most Popular Narrative Narrative: 2.3% Overvalued

Compared with the narrative fair value of roughly $20.94 per share, Avadel’s $21.42 last close leaves little room for error on execution and deal timing.

The analysts have a consensus price target of $19.0 for Avadel Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $16.0.

Want to see the math behind this tight valuation band? The narrative leans on aggressive earnings scaling, richer margins, and a future multiple usually reserved for sector leaders. Curious which assumptions really carry the fair value, and how sensitive they are to even modest growth disappointments? The full breakdown reveals the levers and the pressure points in black and white.

Result: Fair Value of $20.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated reliance on LUMRYZ and uncertainty around litigation outcomes could quickly undermine growth assumptions and compress the premium baked into today’s price.

Find out about the key risks to this Avadel Pharmaceuticals narrative.

Another Lens on Value

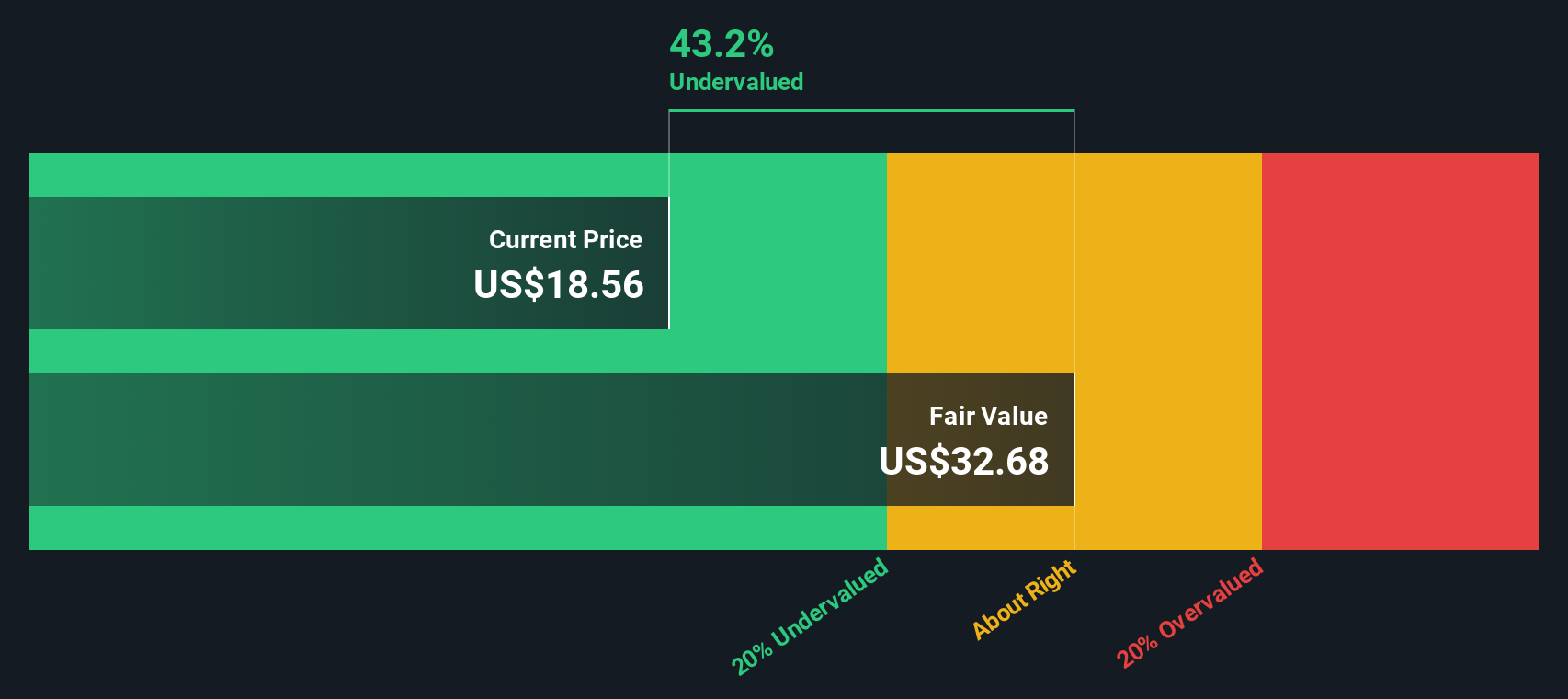

While the narrative model sees Avadel as slightly overvalued, our DCF model paints a different picture, with fair value closer to $32.31 per share, implying the stock is trading at roughly a one third discount. Is the market underestimating long term cash flows, or is the DCF too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avadel Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avadel Pharmaceuticals Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a complete narrative in just minutes: Do it your way.

A great starting point for your Avadel Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next strong idea?

Before the market moves on without you, put Simply Wall St’s powerful screener to work and shortlist high conviction opportunities that truly fit your strategy.

- Capture mispriced potential by scanning these 917 undervalued stocks based on cash flows that offer compelling upside based on robust cash flow fundamentals and attractive entry points.

- Ride powerful secular shifts by targeting these 24 AI penny stocks positioned at the forefront of artificial intelligence innovation and real world adoption.

- Lock in reliable income streams by focusing on these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s yield without sacrificing quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com