Beam Therapeutics (BEAM): Reassessing Valuation After New BEACON risto-cel Data in Sickle Cell Disease

Beam Therapeutics (BEAM) just updated investors on new safety and efficacy results from its BEACON Phase 1/2 trial in sickle cell disease, and the stock is reacting to what this means for future commercialization.

See our latest analysis for Beam Therapeutics.

The latest BEACON update lands after a choppy year, with a 24.74% 1 month share price return but a 1 year total shareholder return of negative 9.79%. This suggests that near term momentum is improving even as longer term holders remain underwater.

If Beam's news has you watching cutting edge therapies more closely, it might be worth exploring other innovative healthcare stocks that could be riding similar sentiment shifts.

With shares still well below their long term highs yet trading up sharply on fresh BEACON data, is Beam quietly undervalued after years of pain, or are investors finally paying up for all that future growth?

Most Popular Narrative Narrative: 82.6% Undervalued

With Beam Therapeutics last closing at $26.17, the most widely followed narrative argues for a far higher intrinsic value, framing today’s rally as only a partial re-rating.

This sum-of-the-parts rNPV analysis of only the two lead assets (BEAM-101 and BEAM-302) derives a base-case intrinsic value of $65 per share.

This valuation is based on the following key assumptions from the report:

According to davidlsander, this price tag leans heavily on aggressive revenue ramp assumptions, rich margins and a premium future earnings multiple for a still unprofitable biotech. Want to see how those moving parts combine to justify more than double today’s share price?

Result: Fair Value of $65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors still face meaningful risk if BEAM-101 stumbles competitively or if safety signals emerge that undermine confidence in its base editing platform.

Find out about the key risks to this Beam Therapeutics narrative.

Another View: Rich Multiples, Very Different Story

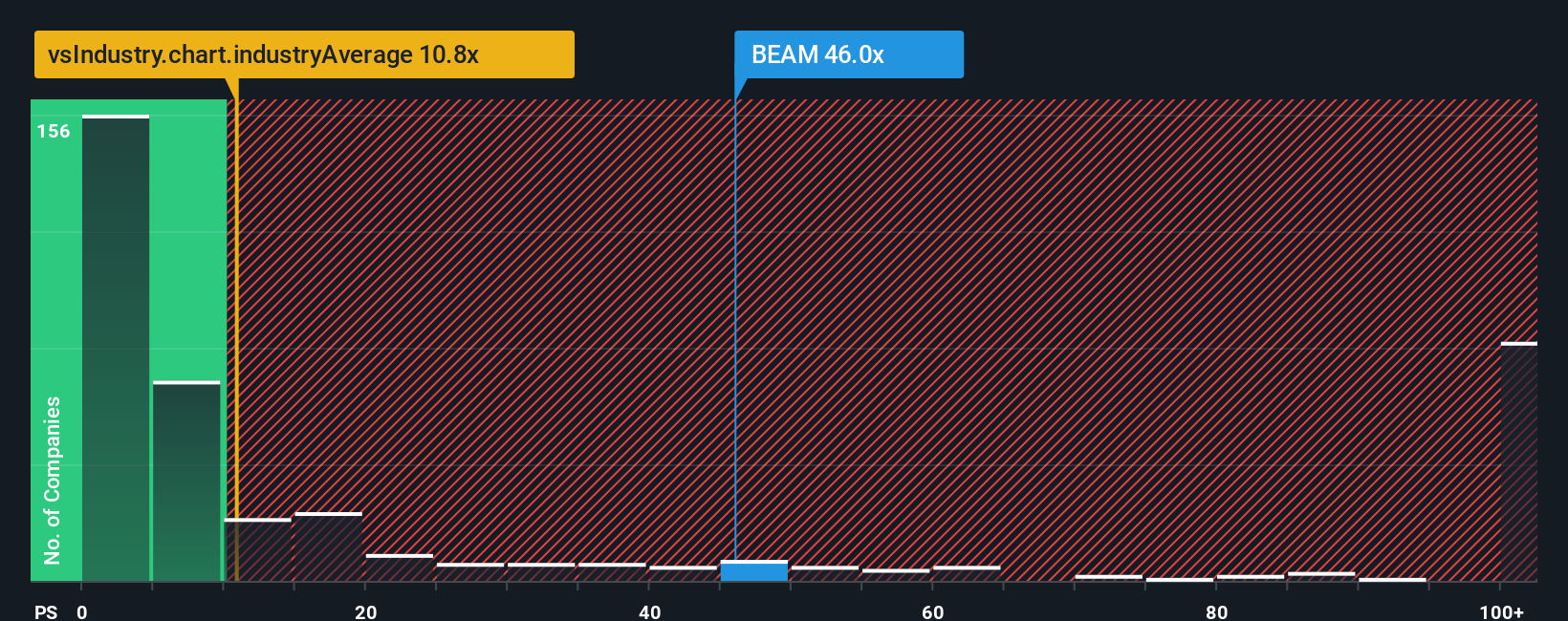

That $65 fair value sounds compelling, but the market is sending a mixed signal. On sales, Beam trades at about 46.4 times revenue, roughly four times the US biotech average of 11.8 and more than double peers at 21.1, far above a fair ratio the market could move toward.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beam Therapeutics Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more high conviction investment ideas?

Before Beam’s story moves on without you, quickly scan fresh opportunities on Simply Wall Street’s Screener and position yourself where future gains could emerge next.

- Capture early momentum by scanning these 3628 penny stocks with strong financials that already back their potential with solid balance sheets and improving fundamentals.

- Capitalize on the next wave of innovation by targeting these 24 AI penny stocks that blend breakthrough technology with scalable business models.

- Lock in potential mispricings by focusing on these 917 undervalued stocks based on cash flows that trade below what their cash flows could justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com