Kennedy-Wilson (KW): Assessing Valuation After $306 Million Harborside 8 Multifamily Loan Commitment

Kennedy Wilson (KW) is drawing fresh attention after providing a $306 million senior non recourse construction loan for the Harborside 8 multifamily tower in Jersey City, a sizable bet on high demand rental housing.

See our latest analysis for Kennedy-Wilson Holdings.

That push into high demand multifamily lending comes as Kennedy-Wilson Holdings’ share price has quietly delivered a 14.27% 90 day share price return, while its 1 year total shareholder return of 3.86% masks a still weak 3 year total shareholder return.

If this kind of real estate lending story has your attention, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other potential compounders early.

Yet with revenue rising, earnings under pressure and the share price sitting within a whisker of analyst targets, investors have to ask: Is Kennedy-Wilson still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 10.5% Undervalued

With the narrative fair value set at $11 against a last close of $9.85, the story leans toward upside if ambitious growth targets materialise.

The company is rapidly expanding its rental housing portfolio in both the US and Europe, moving from 65% to a projected 80% of assets under management. This is positioning Kennedy-Wilson to benefit from persistent housing shortages and growing rental demand, which should drive future revenue growth and higher occupancy.

Curious how aggressive revenue expansion, margin lift and a richer future earnings multiple all combine to support that higher value? This narrative spells out the full playbook, including the bold growth and profitability swing it assumes over the next few years.

Result: Fair Value of $11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on resilient rental demand and smooth asset sales, and a tougher credit or property market could quickly undermine both.

Find out about the key risks to this Kennedy-Wilson Holdings narrative.

Another View: Cash Flows Point the Other Way

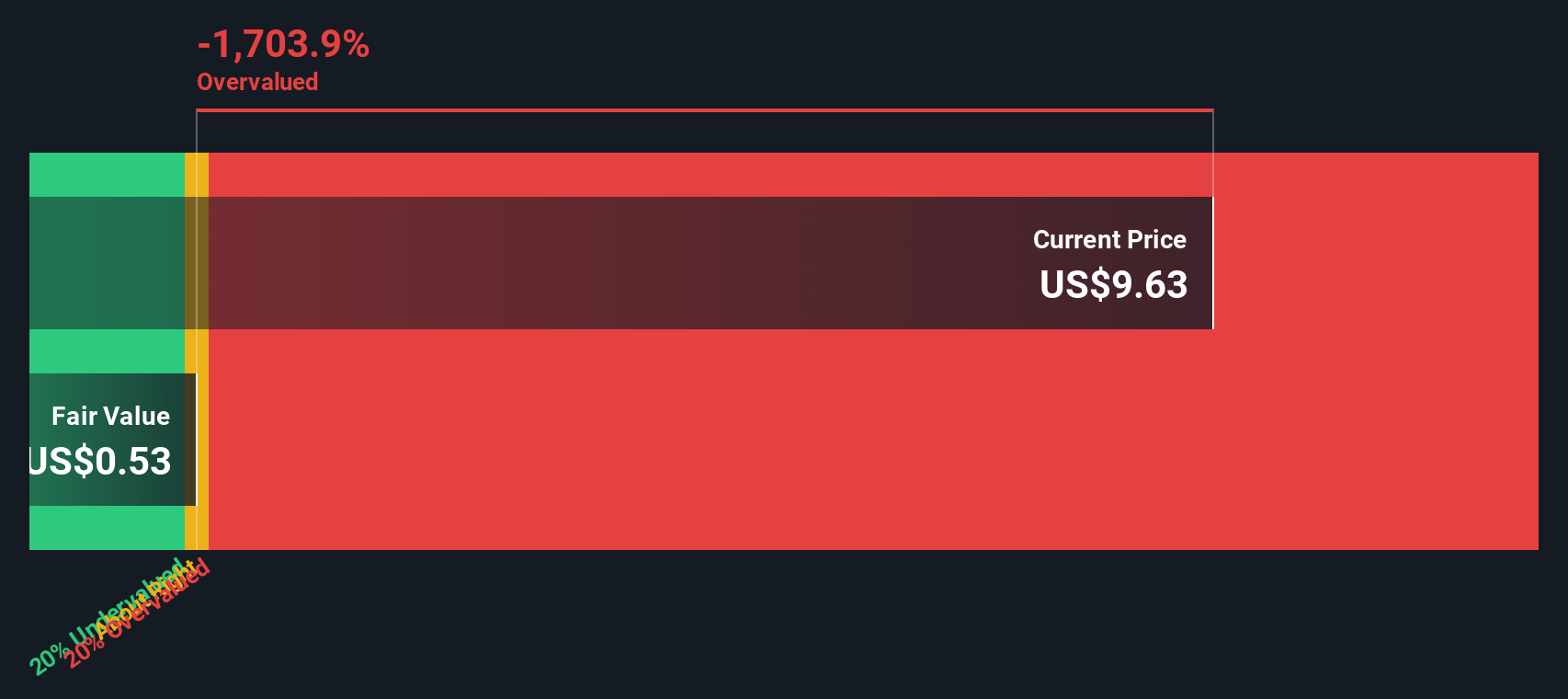

Our DCF model paints a far less upbeat picture, with KW trading well above its estimated fair value of just $0.53 per share. On this view, the stock screens as meaningfully overvalued and raises the question: are investors leaning too hard on the growth narrative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kennedy-Wilson Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kennedy-Wilson Holdings Narrative

If you are not fully convinced by this storyline or would rather dig into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your Kennedy-Wilson Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover fresh ideas that match your strategy before the market fully catches on.

- Capture early momentum by using these 3628 penny stocks with strong financials that combine smaller size with stronger financial foundations than typical speculative names.

- Position for structural growth in medicine and automation with these 29 healthcare AI stocks targeting companies at the intersection of data, diagnostics, and treatment.

- Strengthen your income stream through these 13 dividend stocks with yields > 3% that aim to balance attractive yields with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com