Block (SQ): Revisiting Valuation After Upbeat Analyst Calls and Expanded Square–Thrive Partnership

Block (NVDA) is back in the spotlight after a wave of upbeat analyst commentary and an expanded Square partnership with Thrive that tightens integration with Shopify, sharpening the company’s long term commerce platform strategy.

See our latest analysis for Block.

All this comes after a choppy stretch, with Block’s 1 year total shareholder return of around minus 28 percent and a 5 year total shareholder return near minus 72 percent, even as the 3 year total shareholder return remains slightly positive. The latest product wins and bullish institutional interest could be the start of rebuilding momentum from a depressed base.

If Block’s recent moves have your attention, it may be a good moment to explore other high growth tech and AI stocks that are shaping the next wave of digital finance and commerce.

With shares still down sharply over five years but trading at a roughly 30 percent discount to consensus targets, is Block a mispriced fintech compounder in recovery, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 23.4% Undervalued

With Block last closing at $64.39 against a narrative fair value near $84, the spread reflects a bullish long term earnings and margin reset story.

The scaling and innovation within Square for Businesses highlighted by the launch of new hardware like Square Handheld, adoption of omnichannel commerce tools, and growing field/telesales teams positions Block to further capture share from the global trend toward digitalization and consolidation of small business commerce, supporting topline growth and eventual margin expansion as the business scales internationally.

Curious how modest revenue growth, shifting profit margins, and a richer future earnings multiple can still justify upside from here? The narrative lays out the full playbook.

Result: Fair Value of $84.01 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained crypto volatility or weaker Cash App engagement could quickly undermine those margin and growth assumptions and could force investors to reassess Block’s upside narrative.

Find out about the key risks to this Block narrative.

Another View: Cash Flow Paints a Harsher Picture

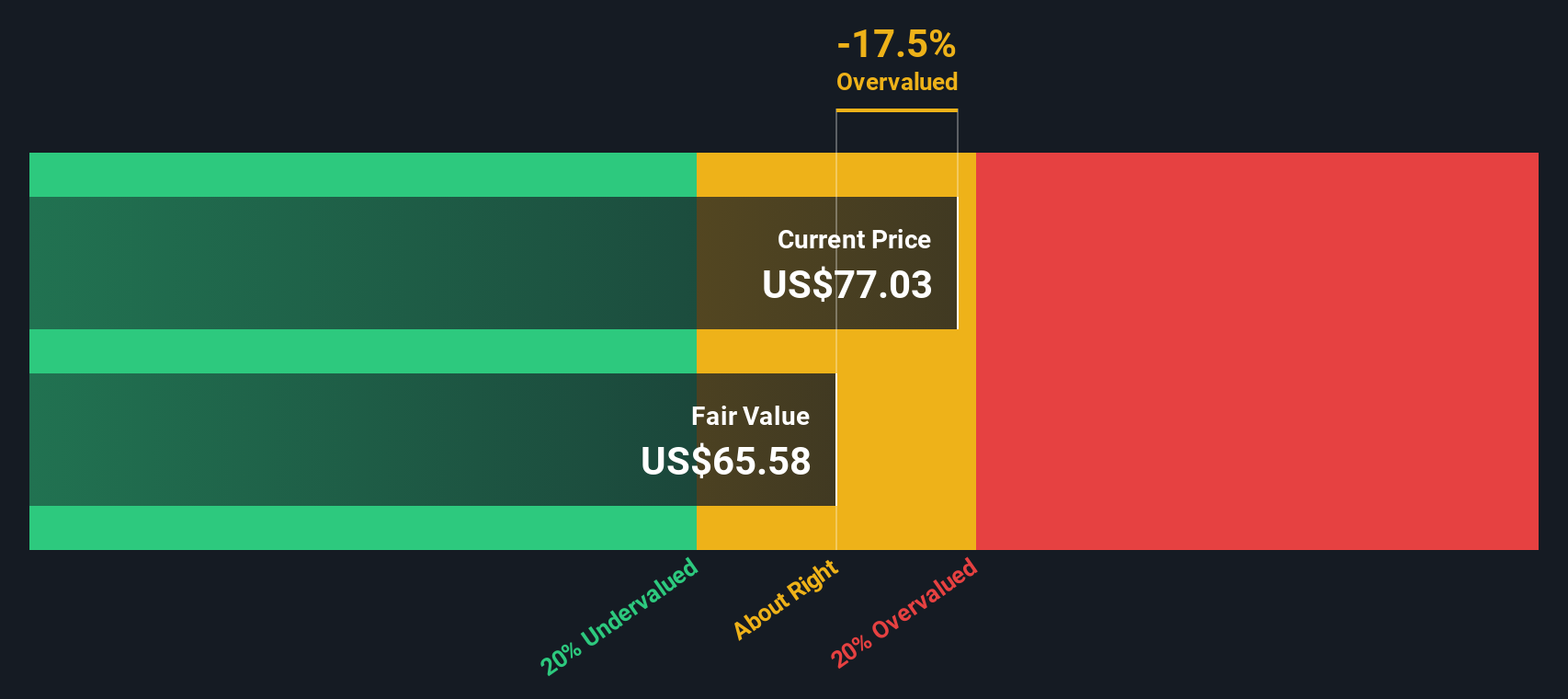

While earnings based metrics hint at upside, our DCF model suggests Block is trading above an intrinsic value near $56.81. This implies the shares may actually be overvalued on long term cash flows. Is the market overestimating durability of today’s growth and margins?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Block for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Block Narrative

If you are not convinced by these views or would rather dig into the numbers yourself, you can craft a personalized thesis in minutes: Do it your way.

A great starting point for your Block research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

If Block has you thinking bigger about your portfolio, do not stop here, use the Simply Wall St Screener to uncover tomorrow’s stand out opportunities today.

- Capture powerful income potential by targeting companies in these 13 dividend stocks with yields > 3% that aim to deliver reliable cash returns alongside capital growth.

- Position yourself early in transformative innovation by scanning these 28 quantum computing stocks for businesses pushing computing power to new frontiers.

- Strengthen your long term upside by zeroing in on these 916 undervalued stocks based on cash flows that markets may be mispricing based on their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com