Yanbu National Petrochemical Company's (TADAWUL:2290) Popularity With Investors Is Under Threat From Overpricing

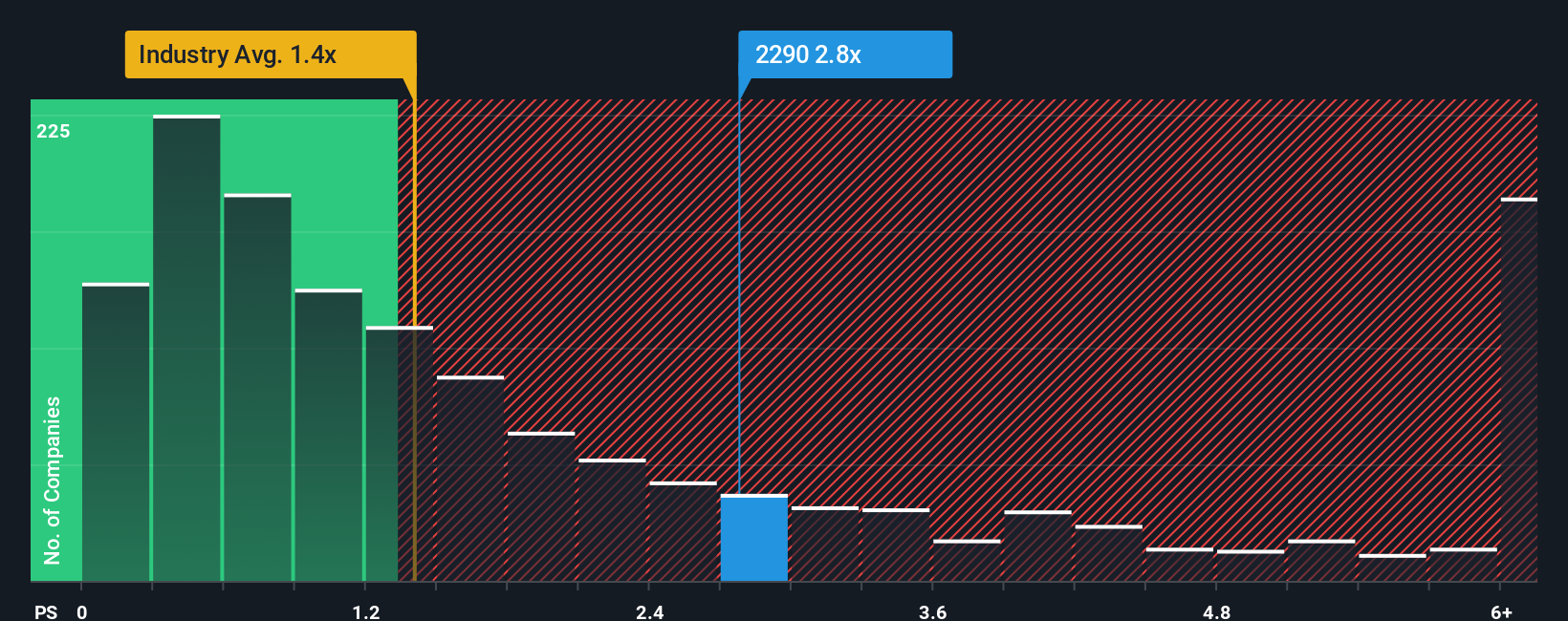

When you see that almost half of the companies in the Chemicals industry in Saudi Arabia have price-to-sales ratios (or "P/S") below 1.5x, Yanbu National Petrochemical Company (TADAWUL:2290) looks to be giving off some sell signals with its 2.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Yanbu National Petrochemical

How Yanbu National Petrochemical Has Been Performing

Yanbu National Petrochemical hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Yanbu National Petrochemical.How Is Yanbu National Petrochemical's Revenue Growth Trending?

In order to justify its P/S ratio, Yanbu National Petrochemical would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 6.7% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 25% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.3% per annum during the coming three years according to the six analysts following the company. That's shaping up to be similar to the 2.7% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Yanbu National Petrochemical's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Yanbu National Petrochemical currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Yanbu National Petrochemical (1 is potentially serious!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.