How Investors May Respond To Academy Sports (ASO) Earnings Beat, Raised Dividend And Faster Store Expansion

- Academy Sports and Outdoors, Inc. recently reported past third-quarter 2025 results, with sales rising to US$1,383.7 million and diluted EPS from continuing operations increasing to US$1.05, while also affirming a quarterly dividend of US$0.13 per share.

- The company paired this earnings release with slightly narrowed full-year guidance and an acceleration of its store rollout to 317 locations across 21 states, highlighting its focus on physical expansion alongside steady profitability.

- Next, we’ll examine how Academy’s modestly higher quarterly earnings alongside expanded store openings influence the existing investment narrative for the company.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Academy Sports and Outdoors Investment Narrative Recap

To own Academy Sports and Outdoors, you need to believe it can keep leveraging store expansion and omnichannel investments while managing cost pressures and a more promotional retail backdrop. The latest quarter showed slightly higher sales and EPS and a modestly tightened full year outlook, which does not materially change the near term focus on new store productivity as a key catalyst or the risk that rising tariffs, labor, and shipping costs continue to squeeze margins.

The most relevant update here is the acceleration of store openings, with 24 locations added in fiscal 2025 and the network reaching 317 stores across 21 states. This expansion sits right at the heart of the current thesis, since it can support higher revenue and operating leverage over time, but it also increases exposure to regional economic swings and promotional intensity if demand softens.

Yet behind the solid store growth, investors should be aware that persistent cost inflation and a tougher promotional backdrop could...

Read the full narrative on Academy Sports and Outdoors (it's free!)

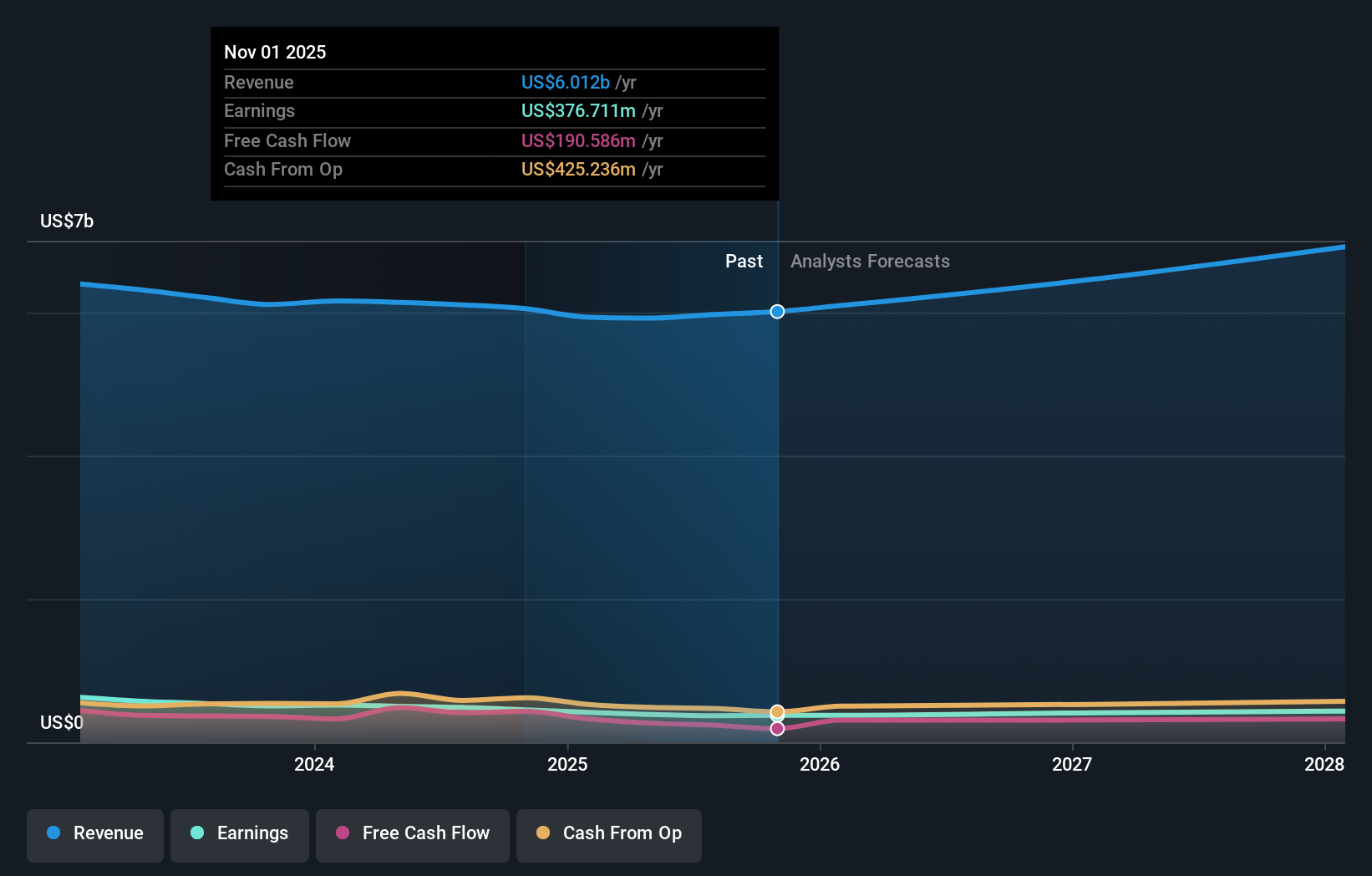

Academy Sports and Outdoors' narrative projects $7.2 billion revenue and $460.3 million earnings by 2028. This requires 6.6% yearly revenue growth and a roughly $89 million earnings increase from $370.9 million.

Uncover how Academy Sports and Outdoors' forecasts yield a $59.10 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$24 to US$86 per share, showing how far apart individual views can be. Against that wide range, the current focus on store rollout as the main growth driver, and margin pressure as a key risk, gives important context for how Academy’s performance could evolve and why it is worth weighing several viewpoints.

Explore 4 other fair value estimates on Academy Sports and Outdoors - why the stock might be worth less than half the current price!

Build Your Own Academy Sports and Outdoors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Academy Sports and Outdoors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Academy Sports and Outdoors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Academy Sports and Outdoors' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com