Insider-Owned Growth Companies To Watch In Global December 2025

As global markets navigate a landscape marked by interest rate cuts from the Federal Reserve and mixed performances across major indices, investors are keenly observing how these shifts impact growth companies with substantial insider ownership. In such a climate, stocks that demonstrate robust insider confidence can be particularly appealing, suggesting alignment between management and shareholder interests amidst economic uncertainties.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's review some notable picks from our screened stocks.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that develops long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of approximately ₩23.05 trillion.

Operations: The company's revenue primarily comes from its biotechnology segment, amounting to approximately ₩202.18 million.

Insider Ownership: 25.8%

Revenue Growth Forecast: 56.6% p.a.

ALTEOGEN is poised for substantial growth, with earnings expected to increase 68.7% annually, outpacing the Korean market's 30.4%. Revenue is also forecast to grow significantly at 56.6% per year, surpassing the market average of 10.6%. The company has recently turned profitable and boasts a high future return on equity of 56.5%. No significant insider trading activity was reported in the last three months, indicating stable insider sentiment.

- Unlock comprehensive insights into our analysis of ALTEOGEN stock in this growth report.

- The analysis detailed in our ALTEOGEN valuation report hints at an inflated share price compared to its estimated value.

Ningbo Jifeng Auto Parts (SHSE:603997)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Jifeng Auto Parts Co., Ltd. manufactures automotive interior parts for both the Chinese and international markets, with a market cap of CN¥17.30 billion.

Operations: Ningbo Jifeng Auto Parts Co., Ltd. generates its revenue through the production and sale of automotive interior components both domestically and abroad.

Insider Ownership: 23.7%

Revenue Growth Forecast: 16.6% p.a.

Ningbo Jifeng Auto Parts has recently become profitable, reporting a net income of CNY 251.11 million for the first nine months of 2025, reversing a loss from the previous year. Earnings are projected to grow significantly at 61.5% annually, well above the Chinese market average of 27.1%. Despite trading at a substantial discount to estimated fair value, revenue growth is expected to be moderate at 16.6% per year with no recent insider trading activity reported.

- Click to explore a detailed breakdown of our findings in Ningbo Jifeng Auto Parts' earnings growth report.

- Our comprehensive valuation report raises the possibility that Ningbo Jifeng Auto Parts is priced higher than what may be justified by its financials.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

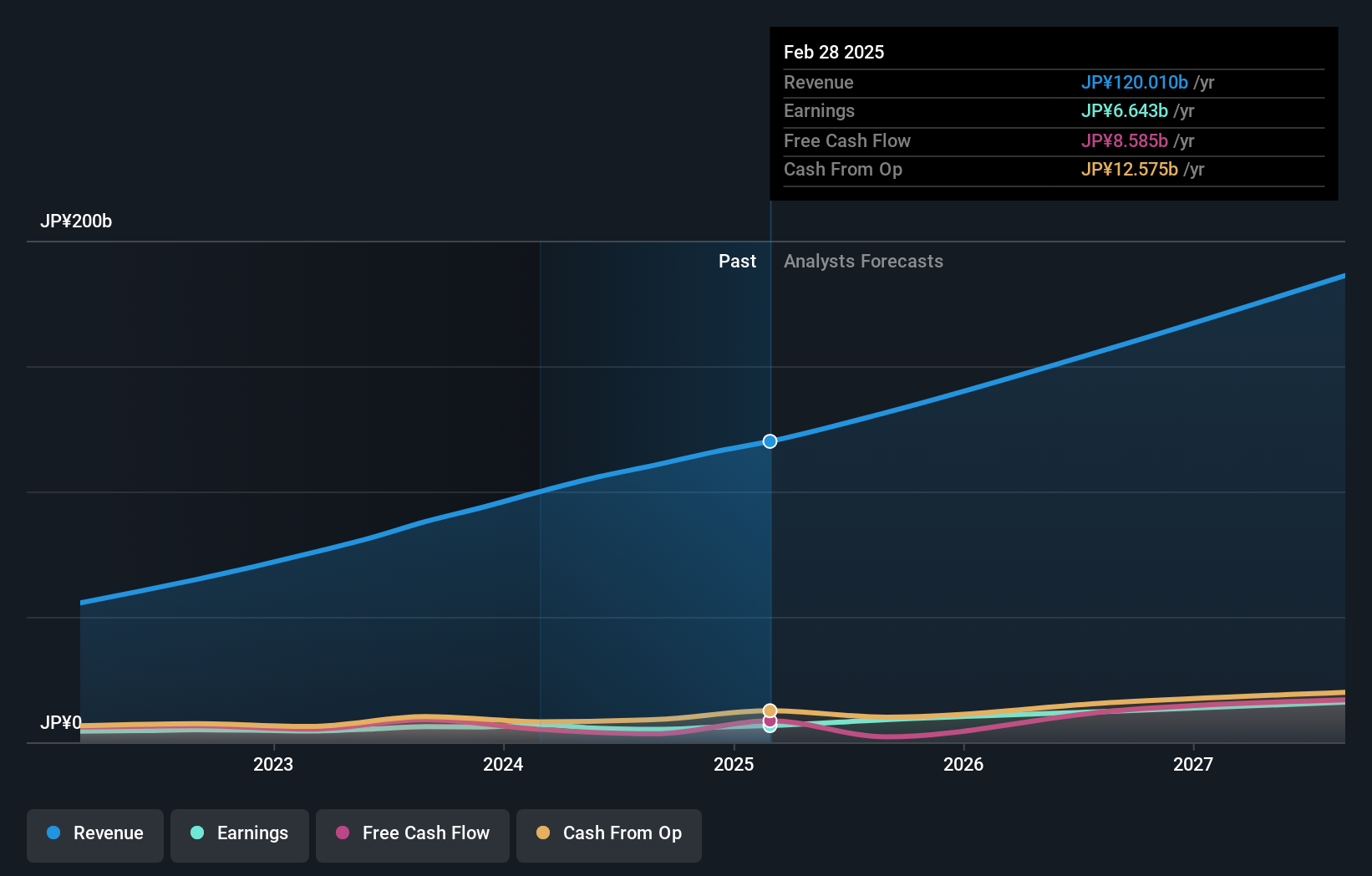

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market cap of ¥252.75 billion.

Operations: SHIFT Inc.'s revenue is primarily derived from Software Testing Related Services, which contribute ¥84.30 billion, and Software Development Related Services, which add ¥40.13 billion.

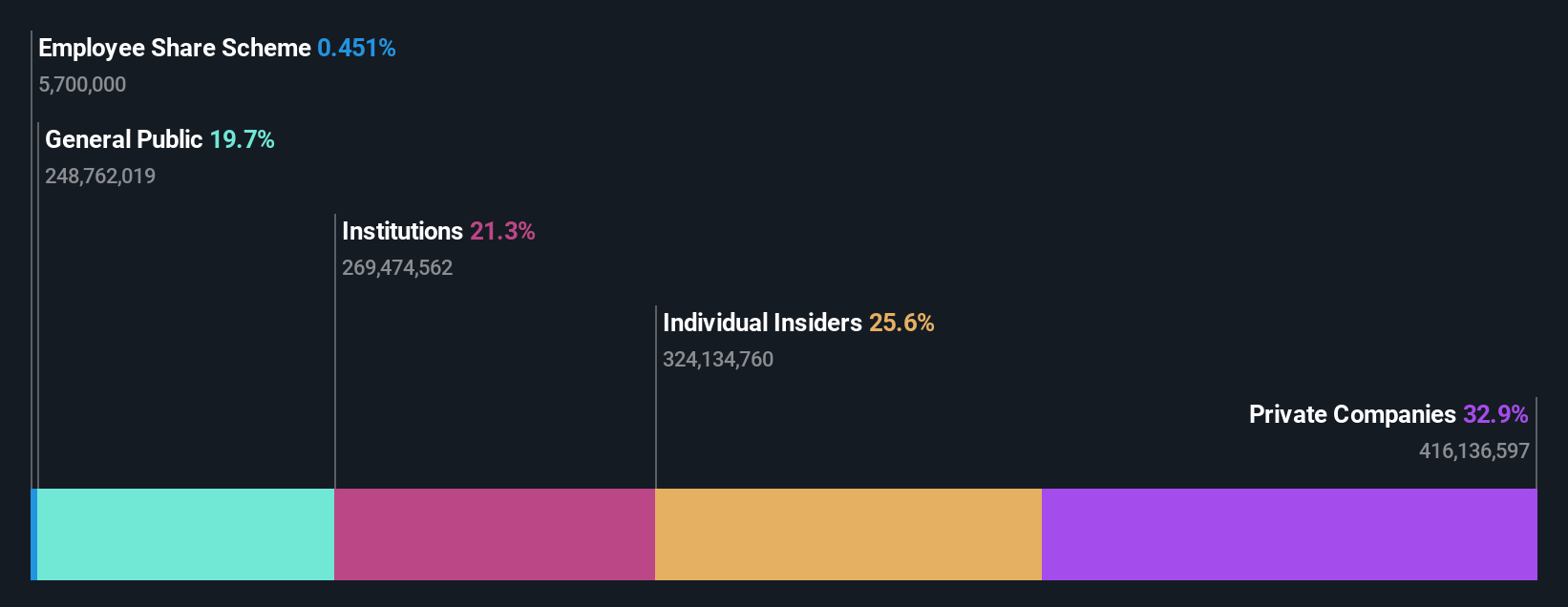

Insider Ownership: 32%

Revenue Growth Forecast: 16.3% p.a.

SHIFT Inc. is experiencing robust growth, with earnings projected to increase significantly at 22% annually, surpassing the Japanese market average of 8.5%. Despite its highly volatile share price, the stock trades at a notable discount to estimated fair value and analysts expect a substantial price rise. Recent strategic moves include an organizational restructuring aimed at enhancing synergies and expanding into the Middle Eastern market through SHIFT Arabia W.L.L., potentially bolstering future revenue streams.

- Click here and access our complete growth analysis report to understand the dynamics of SHIFT.

- The analysis detailed in our SHIFT valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Unlock more gems! Our Fast Growing Global Companies With High Insider Ownership screener has unearthed 858 more companies for you to explore.Click here to unveil our expertly curated list of 861 Fast Growing Global Companies With High Insider Ownership.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com