Global Market Insights On 3 Stocks That Might Be Priced Below Intrinsic Value

As global markets navigate a landscape marked by interest rate adjustments and mixed economic signals, investors are keenly observing shifts in stock valuations. In this context, identifying stocks that may be priced below their intrinsic value can provide opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN129.00 | PLN257.76 | 50% |

| Straumann Holding (SWX:STMN) | CHF94.42 | CHF187.49 | 49.6% |

| KIYO LearningLtd (TSE:7353) | ¥689.00 | ¥1374.94 | 49.9% |

| Kitron (OB:KIT) | NOK68.05 | NOK135.42 | 49.7% |

| Jæren Sparebank (OB:JAREN) | NOK378.00 | NOK752.65 | 49.8% |

| Inission (OM:INISS B) | SEK48.90 | SEK97.00 | 49.6% |

| H.U. Group Holdings (TSE:4544) | ¥3300.00 | ¥6592.59 | 49.9% |

| Global Security Experts (TSE:4417) | ¥2882.00 | ¥5725.97 | 49.7% |

| cyan (XTRA:CYR) | €2.28 | €4.51 | 49.5% |

| Andes Technology (TWSE:6533) | NT$244.50 | NT$484.69 | 49.6% |

Let's uncover some gems from our specialized screener.

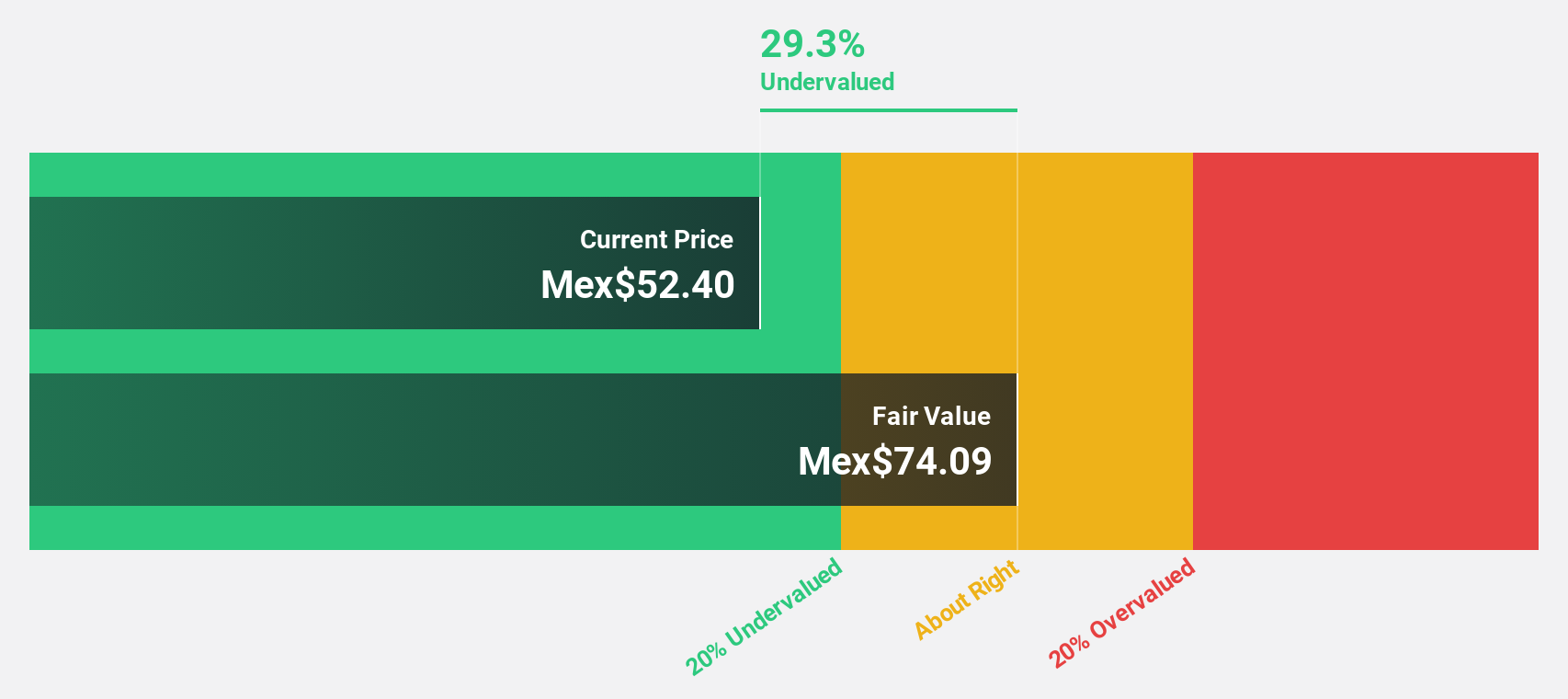

Alsea. de (BMV:ALSEA *)

Overview: Alsea, S.A.B. de C.V. operates restaurants across Latin America and Europe with a market capitalization of MX$42.03 billion.

Operations: Alsea generates revenue from its restaurant operations in Latin America and Europe.

Estimated Discount To Fair Value: 29.3%

Alsea, S.A.B. de C.V. is trading at MX$52.49, significantly below its estimated fair value of MX$73.89, suggesting undervaluation based on cash flows. Analysts forecast a robust annual earnings growth of 23.4%, outpacing the Mexican market's 11.7%. Despite slower revenue growth at 8.2% annually, recent financial results show substantial improvement with third-quarter net income rising to MX$367 million from last year's MX$11.87 million, highlighting strengthened profitability metrics amidst valuation concerns.

- Our earnings growth report unveils the potential for significant increases in Alsea. de's future results.

- Click to explore a detailed breakdown of our findings in Alsea. de's balance sheet health report.

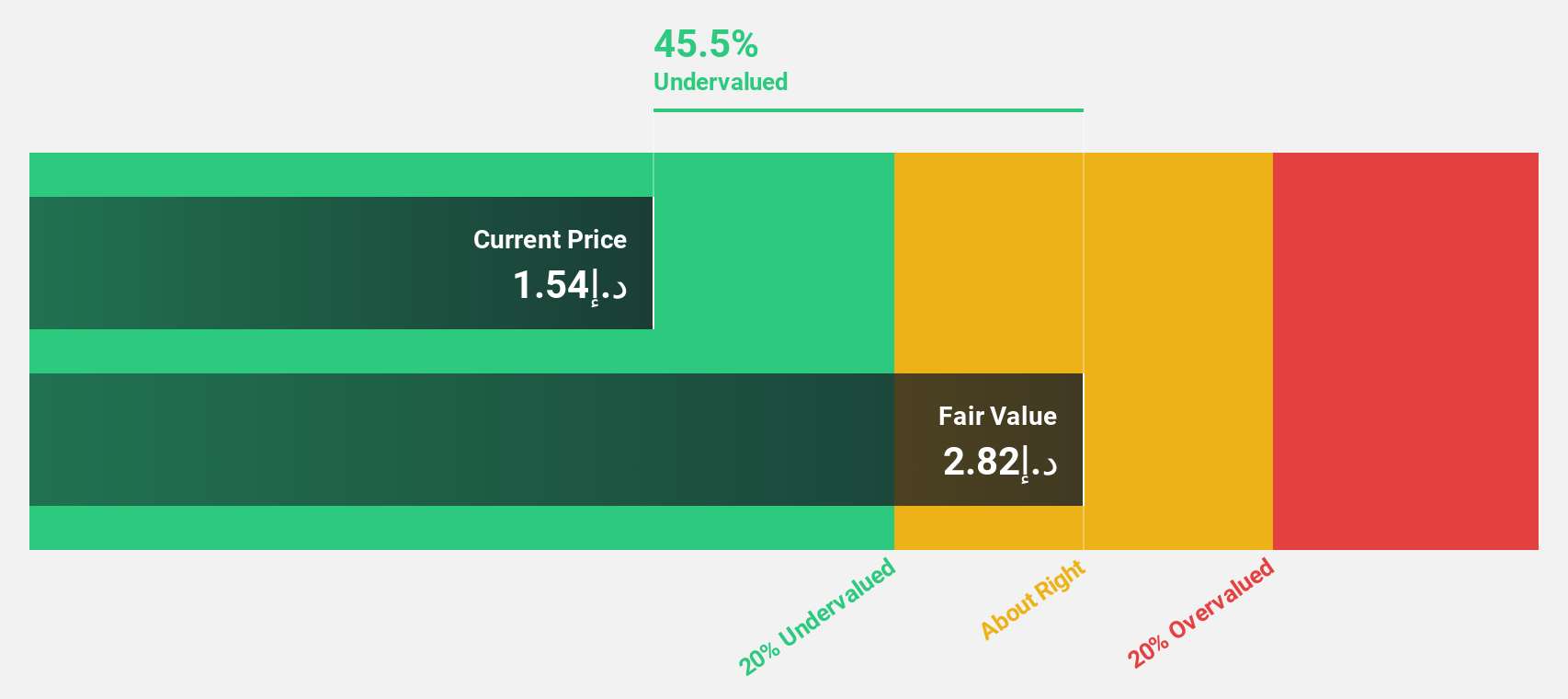

ALEC Holdings PJSC (DFM:ALEC)

Overview: ALEC Holdings PJSC specializes in engineering and constructing building projects, airport infrastructure, industrial, energy, and commercial flagship projects, with a market cap of AED7.60 billion.

Operations: The company's revenue segments include AED4.20 billion from Energy, AED2.62 billion from Related Businesses, and AED6.17 billion from Building and Infrastructure Construction Services.

Estimated Discount To Fair Value: 46.3%

ALEC Holdings PJSC, trading at AED1.52, is significantly below its estimated fair value of AED2.83, indicating undervaluation based on cash flows. With forecasted earnings growth of 17.1% annually, surpassing the AE market's 5.5%, and a very high projected return on equity of 54.1%, ALEC shows strong potential despite slower revenue growth at 12.6%. Recent results reveal substantial improvement with Q3 sales reaching AED3.54 billion from AED1.94 billion last year, enhancing profitability metrics amidst valuation concerns.

- Our growth report here indicates ALEC Holdings PJSC may be poised for an improving outlook.

- Take a closer look at ALEC Holdings PJSC's balance sheet health here in our report.

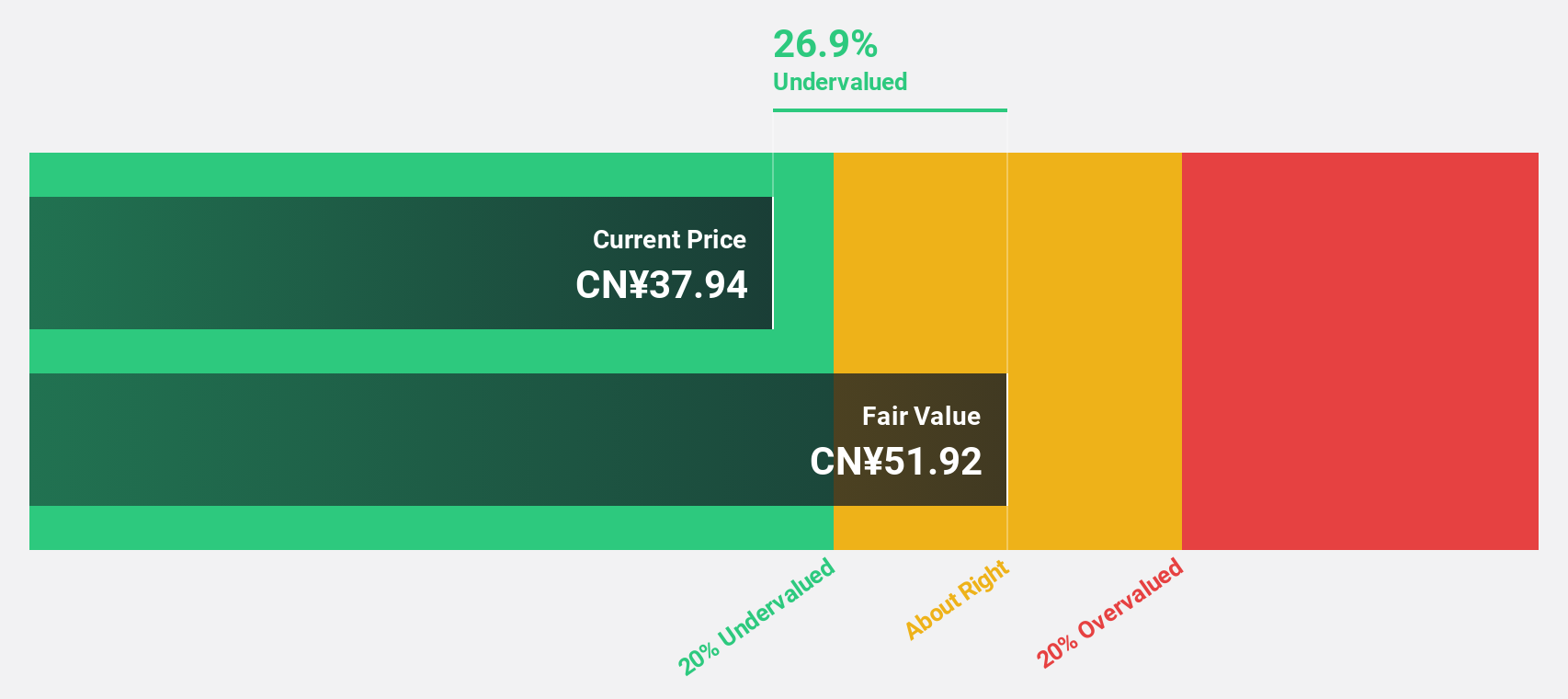

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co., Ltd. operates in China, producing and selling architectural coatings, waterproof materials, floor materials, thermal insulation materials and thermal insulation integration with a market cap of CN¥33.33 billion.

Operations: The company's revenue is derived from the production and sale of architectural coatings, waterproof materials, floor materials, thermal insulation materials, and thermal insulation integration in China.

Estimated Discount To Fair Value: 16.3%

SKSHU Paint Ltd., trading at CN¥45.75, is undervalued relative to its fair value estimate of CN¥54.69, with earnings expected to grow significantly at 27.17% annually over the next three years. Despite a high debt level and slower revenue growth forecasted at 9.5%, recent results show improved profitability, with net income rising to CN¥743.61 million from CN¥410.34 million year-on-year, reflecting strong cash flow potential despite valuation concerns and an unstable dividend history.

- The analysis detailed in our SKSHU PaintLtd growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of SKSHU PaintLtd stock in this financial health report.

Taking Advantage

- Investigate our full lineup of 495 Undervalued Global Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com