European Dividend Stocks To Consider For December 2025

As the European market experiences mixed movements, with indices such as Germany's DAX gaining while others like France's CAC 40 see declines, investors are keeping a close eye on potential policy shifts from the European Central Bank. In this environment of economic resilience and cautious optimism, dividend stocks can offer stability and income, making them an attractive consideration for those looking to navigate these uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.16% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.64% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.05% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.88% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.10% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.90% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.26% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.27% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.44% | ★★★★★☆ |

Click here to see the full list of 202 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

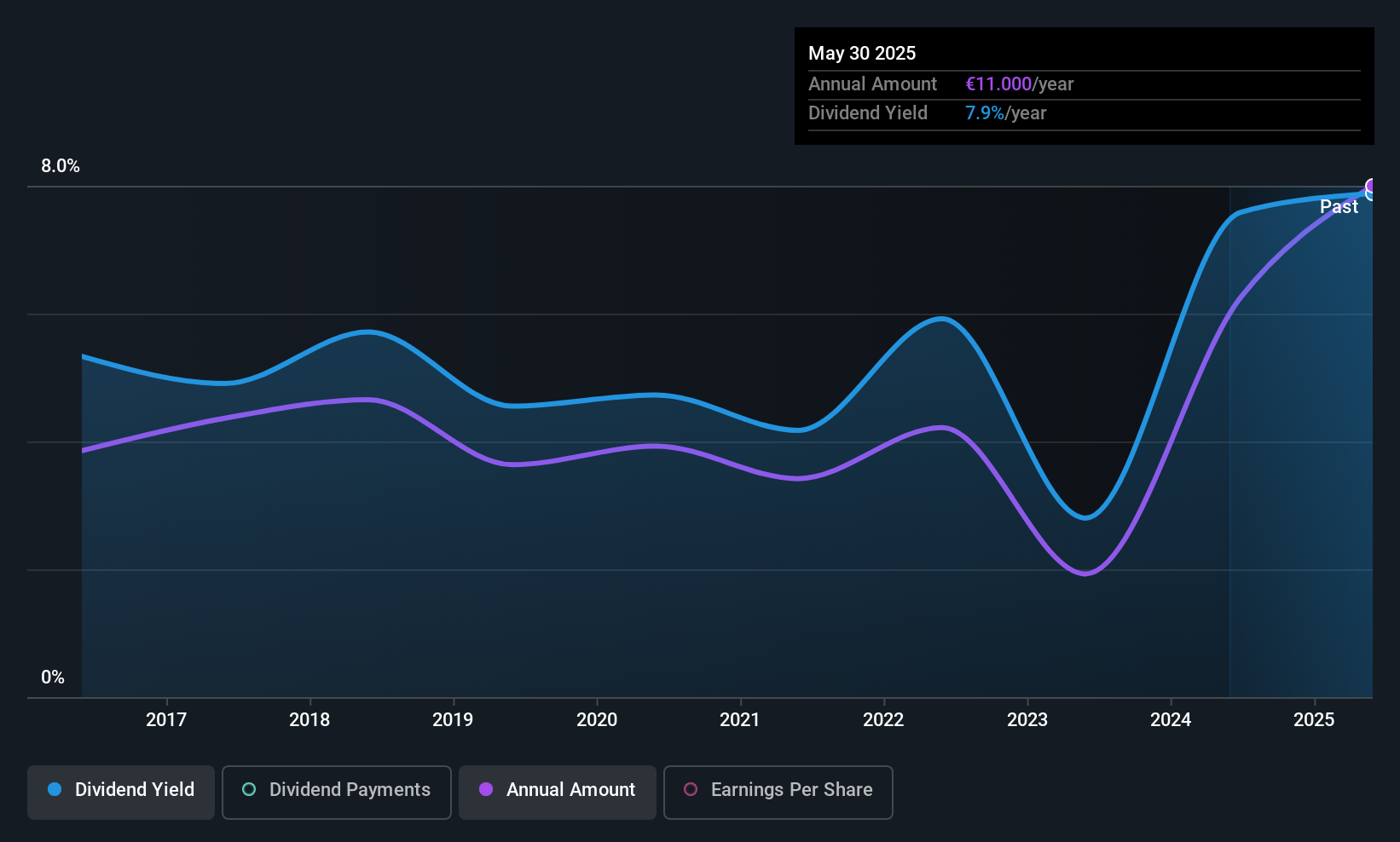

Banco di Desio e della Brianza (BIT:BDB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco di Desio e della Brianza S.p.A. offers banking products and services to individuals and businesses in Italy, with a market cap of €1.23 billion.

Operations: Banco di Desio e della Brianza S.p.A. generates revenue through its provision of financial products and services tailored to both individual clients and corporate entities within the Italian market.

Dividend Yield: 4.9%

Banco di Desio e della Brianza offers a dividend yield of 4.88%, placing it in the top 25% of Italian dividend payers, supported by a reasonable payout ratio of 51.6%. However, its dividend history is marked by volatility and unreliability over the past decade. The bank's price-to-earnings ratio of 10.7x suggests good value compared to the Italian market average. Despite this, challenges include high bad loans at 2.3% and low allowance for these loans at 77%.

- Delve into the full analysis dividend report here for a deeper understanding of Banco di Desio e della Brianza.

- In light of our recent valuation report, it seems possible that Banco di Desio e della Brianza is trading beyond its estimated value.

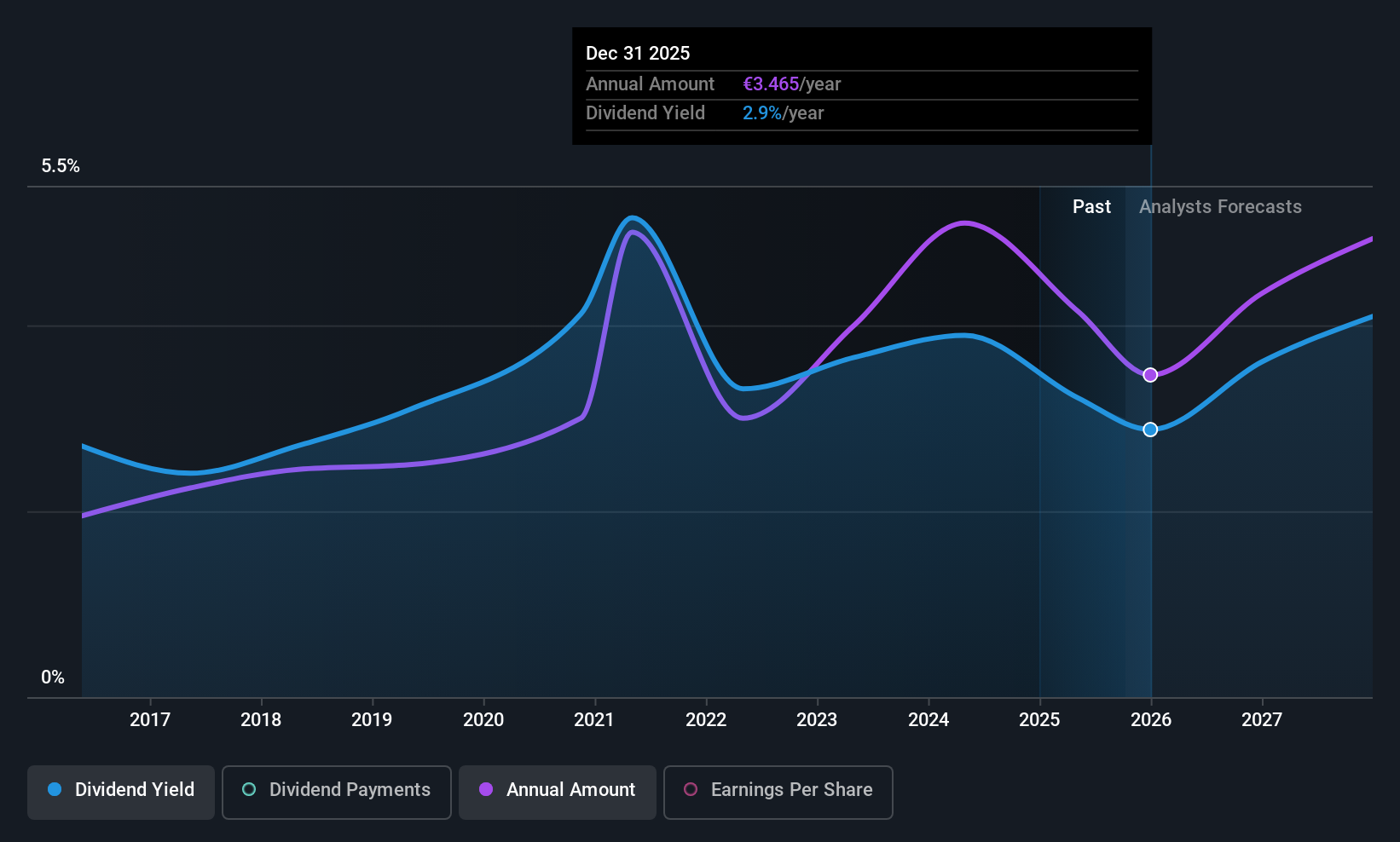

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €1.29 billion.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from its electricity and gas distribution segment, which accounts for €329.54 million, and the production and marketing of electricity and gas segment, contributing €1.02 billion.

Dividend Yield: 6.1%

Électricite de Strasbourg Société Anonyme offers a dividend yield of 6.09%, ranking it among the top 25% in the French market. Despite this attractive yield, its dividend payments have been volatile and unreliable over the past decade. The company's dividends are covered by earnings and cash flows, with payout ratios of 50.7% and 61.7%, respectively, indicating sustainability despite past instability. Recent earnings growth of 10.4% further supports its capacity to maintain dividends amidst fluctuating sales figures (€676.70 million) compared to last year (€762.92 million).

- Unlock comprehensive insights into our analysis of Électricite de Strasbourg Société Anonyme stock in this dividend report.

- Our expertly prepared valuation report Électricite de Strasbourg Société Anonyme implies its share price may be lower than expected.

STEF (ENXTPA:STF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: STEF SA specializes in temperature-controlled road transport and logistics services for the agri-food industry and out-of-home food services, with a market cap of €1.59 billion.

Operations: STEF SA's revenue is primarily derived from its operations in France (€2.47 billion) and international markets (€1.92 billion).

Dividend Yield: 3.3%

STEF's dividend yield of 3.27% is lower than the top tier in the French market, and while its dividends are covered by earnings (payout ratio: 53.9%) and cash flows (cash payout ratio: 67.6%), they have been volatile over the past decade, experiencing significant drops at times. Despite an unstable track record, recent growth forecasts suggest potential for future stability. However, a high debt level could pose risks to sustaining dividend payments long-term.

- Click here and access our complete dividend analysis report to understand the dynamics of STEF.

- In light of our recent valuation report, it seems possible that STEF is trading behind its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 202 Top European Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com