European Stocks Priced Below Estimated Intrinsic Value

As European markets navigate a mixed landscape with the pan-European STOXX Europe 600 Index ending slightly lower, investors are keenly observing economic indicators and central bank policies that could influence future growth. In this environment, identifying stocks priced below their estimated intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN129.00 | PLN257.76 | 50% |

| Truecaller (OM:TRUE B) | SEK18.60 | SEK36.55 | 49.1% |

| Straumann Holding (SWX:STMN) | CHF94.42 | CHF187.49 | 49.6% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.348 | €8.54 | 49.1% |

| Kitron (OB:KIT) | NOK68.05 | NOK135.42 | 49.7% |

| Jæren Sparebank (OB:JAREN) | NOK378.00 | NOK752.65 | 49.8% |

| Inission (OM:INISS B) | SEK48.90 | SEK97.00 | 49.6% |

| cyan (XTRA:CYR) | €2.28 | €4.51 | 49.5% |

| Circle (BIT:CIRC) | €8.00 | €15.74 | 49.2% |

| Allegro.eu (WSE:ALE) | PLN30.535 | PLN60.33 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

AKVA group (OB:AKVA)

Overview: AKVA group ASA designs, manufactures, and installs technology products for the aquaculture industry while also offering rental and consulting services, with a market cap of NOK3.25 billion.

Operations: The company's revenue is primarily derived from Sea Based Technology at NOK2.98 billion, followed by Land Based Technology at NOK966.05 million and Digital services at NOK133.51 million.

Estimated Discount To Fair Value: 31.8%

AKVA group appears undervalued, trading at NOK 89.4, significantly below its estimated fair value of NOK 131.03. Analysts expect revenue growth of 10.2% annually, outpacing the Norwegian market's 2.3%, with earnings projected to grow by 21% per year over the next three years. Despite a recent drop in quarterly net income to NOK 63.41 million from NOK 88.58 million last year, AKVA maintains strong future guidance and strategic contracts like the RAS project with Tytlandsvik Aqua AS bolster its prospects.

- Our comprehensive growth report raises the possibility that AKVA group is poised for substantial financial growth.

- Navigate through the intricacies of AKVA group with our comprehensive financial health report here.

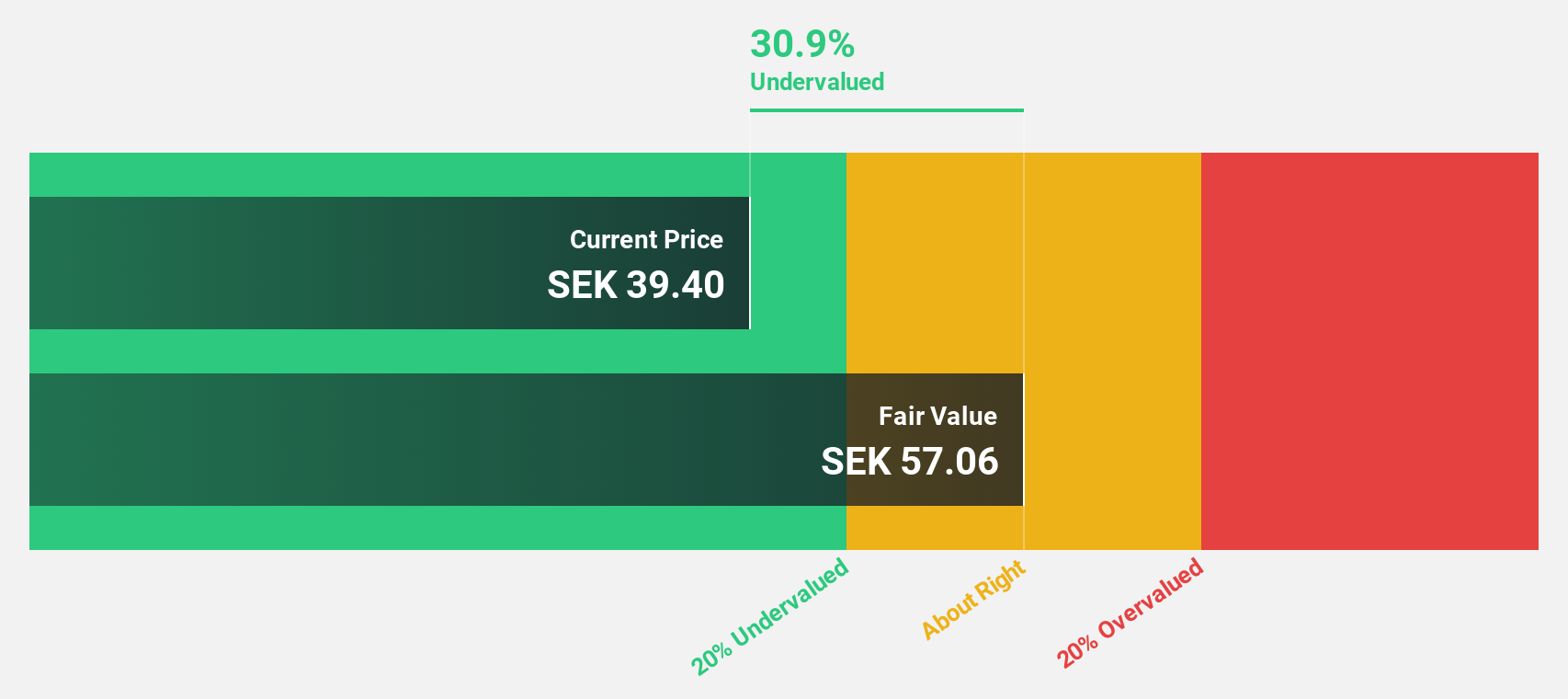

BHG Group (OM:BHG)

Overview: BHG Group AB (publ) is a consumer e-commerce company operating in Sweden, Finland, Denmark, Norway, and internationally with a market cap of SEK5.49 billion.

Operations: The company generates revenue through three primary segments: Value Home (SEK2.66 billion), Premium Living (SEK2.52 billion), and Home Improvement (SEK5.28 billion).

Estimated Discount To Fair Value: 35.2%

BHG Group is trading at SEK 30.62, significantly below its estimated fair value of SEK 47.27, suggesting it is undervalued based on discounted cash flow analysis. Despite a forecasted revenue growth of 6.5% per year, which surpasses the Swedish market's average, BHG's return on equity remains low at a projected 6.1%. Recent earnings reports show improved performance with net income reaching SEK 11.2 million in Q3 2025 compared to a loss last year, indicating positive momentum towards profitability over the next three years.

- Our growth report here indicates BHG Group may be poised for an improving outlook.

- Click here to discover the nuances of BHG Group with our detailed financial health report.

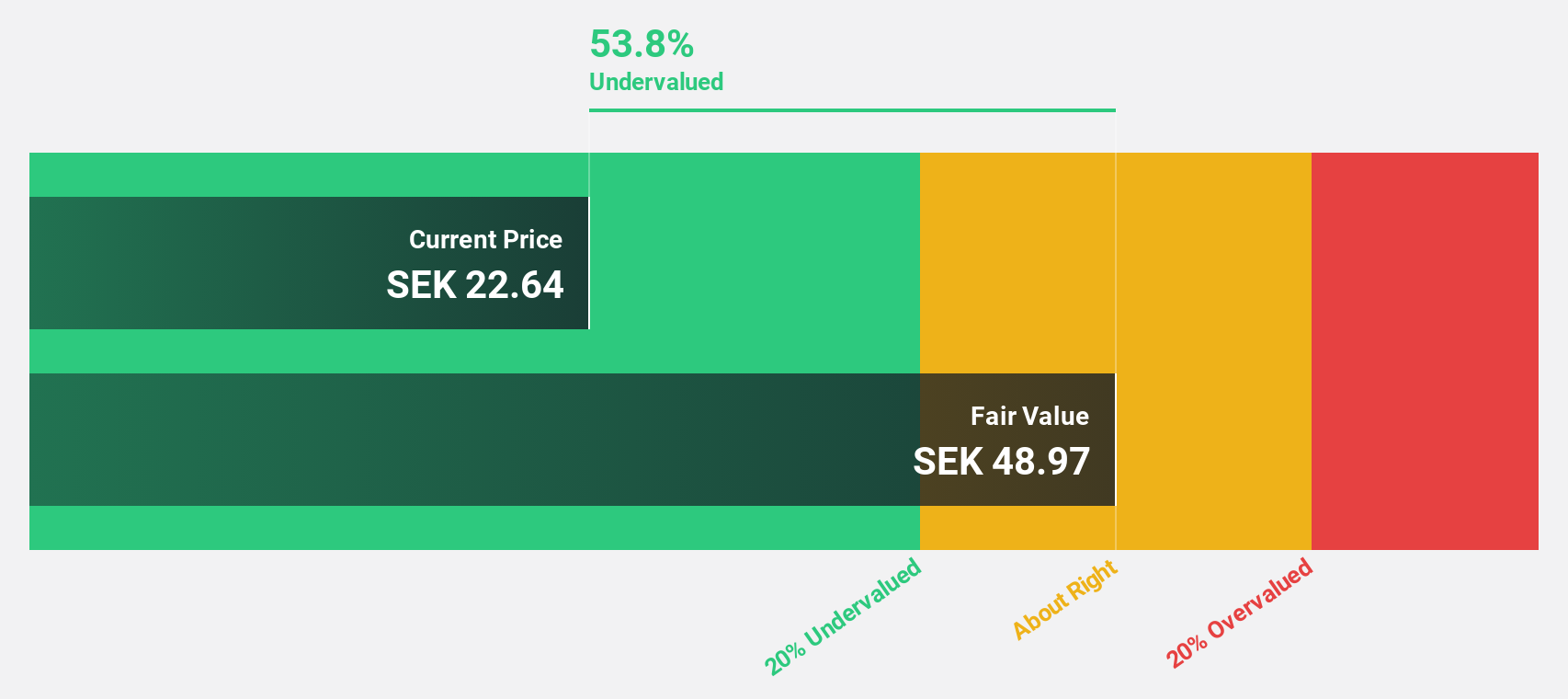

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market capitalization of SEK15.26 billion.

Operations: The company generates revenue from four main segments: Medtech (€153.80 million), Diagnostics (€22.70 million), Specialty Pharma (€181.60 million), and Veterinary Services (€63.10 million).

Estimated Discount To Fair Value: 10.4%

Vimian Group, trading at SEK 28.86, is undervalued relative to its estimated fair value of SEK 32.2 based on discounted cash flow analysis. The company reported strong financial results with Q3 sales reaching EUR 104.3 million and net income of EUR 6.5 million, reversing a loss from the previous year. Despite a modest forecasted revenue growth rate of 8.9% annually, earnings are expected to grow significantly at 39.1% per year, outpacing the Swedish market average growth rate.

- Our expertly prepared growth report on Vimian Group implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Vimian Group here with our thorough financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 193 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com