Did Southwest’s Turkish Airlines Partnership Just Rewire Its Global Ambitions and Investment Narrative (LUV)?

- Southwest Airlines Co. recently announced a partnership with Turkish Airlines, set to begin in early 2026, enabling one-ticket journeys between the United States and Istanbul with onward access to Turkish Airlines’ more than 350 destinations in 132 countries via shared U.S. gateway airports.

- This agreement, combined with Southwest’s broader push into international partnerships and cabin upgrades such as assigned and extra-legroom seating, marks a significant shift from its traditional domestic-focused model toward a more globally connected offering.

- We’ll now examine how this new Turkish Airlines link, which extends Southwest’s reach well beyond its own fleet, could influence its investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Southwest Airlines Investment Narrative Recap

To own Southwest, you generally need to believe its shift from a purely domestic, one-class carrier toward a more connected, higher-yield offering can translate into sustainable earnings, despite macro uncertainty and leisure booking softness. The Turkish Airlines partnership and broader international tie ups could support revenue mix and brand relevance, but do not directly resolve nearer term concerns around profitability, valuation, and potential pressure if demand cools after the current travel season.

Among recent updates, the planned Austin crew base, opening in March 2026, is particularly relevant because it underlines Southwest’s commitment to operational scale and efficiency at a fast growing hub. As partnerships funnel more international traffic into its network, the added crew capacity and training capability in Austin may help support tighter turn times and reliability, both of which matter for keeping costs in check and protecting margins if demand or pricing conditions become more challenging.

Yet while these growth moves grab attention, investors should also be aware of the risk that softened leisure demand could collide with rising competition and...

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines' narrative projects $32.6 billion revenue and $1.9 billion earnings by 2028. This requires 5.9% yearly revenue growth and about a $1.5 billion earnings increase from $392.0 million today.

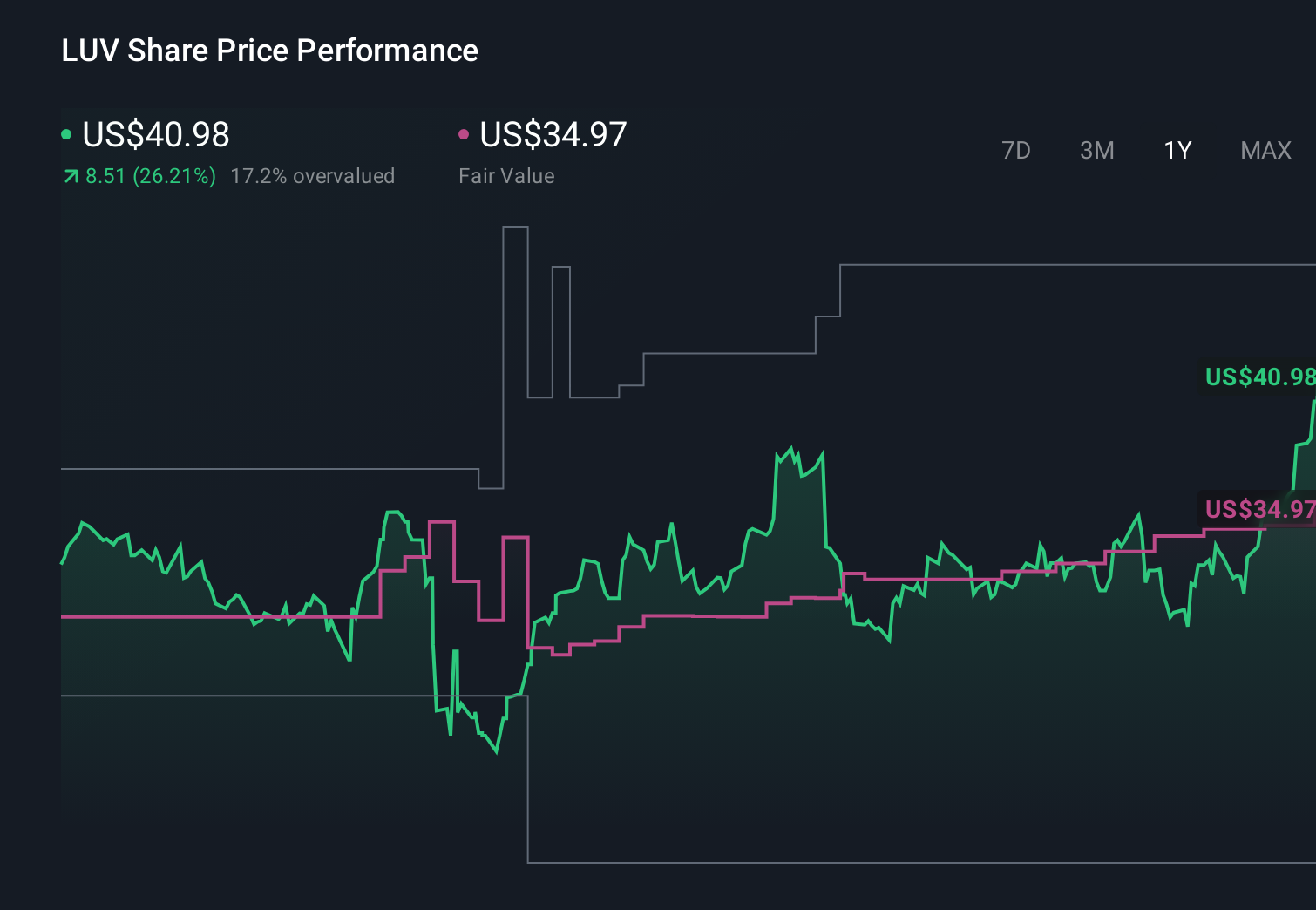

Uncover how Southwest Airlines' forecasts yield a $34.97 fair value, a 14% downside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community see fair value anywhere between about US$26.72 and US$205.69, reflecting very different expectations. You can weigh those views against the current concern that weaker leisure bookings and macro uncertainty could still pressure Southwest’s revenues and near term earnings performance.

Explore 7 other fair value estimates on Southwest Airlines - why the stock might be worth 34% less than the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com