Yorkton Equity Group Inc. (CVE:YEG) Stock Catapults 26% Though Its Price And Business Still Lag The Market

Yorkton Equity Group Inc. (CVE:YEG) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.9% over the last year.

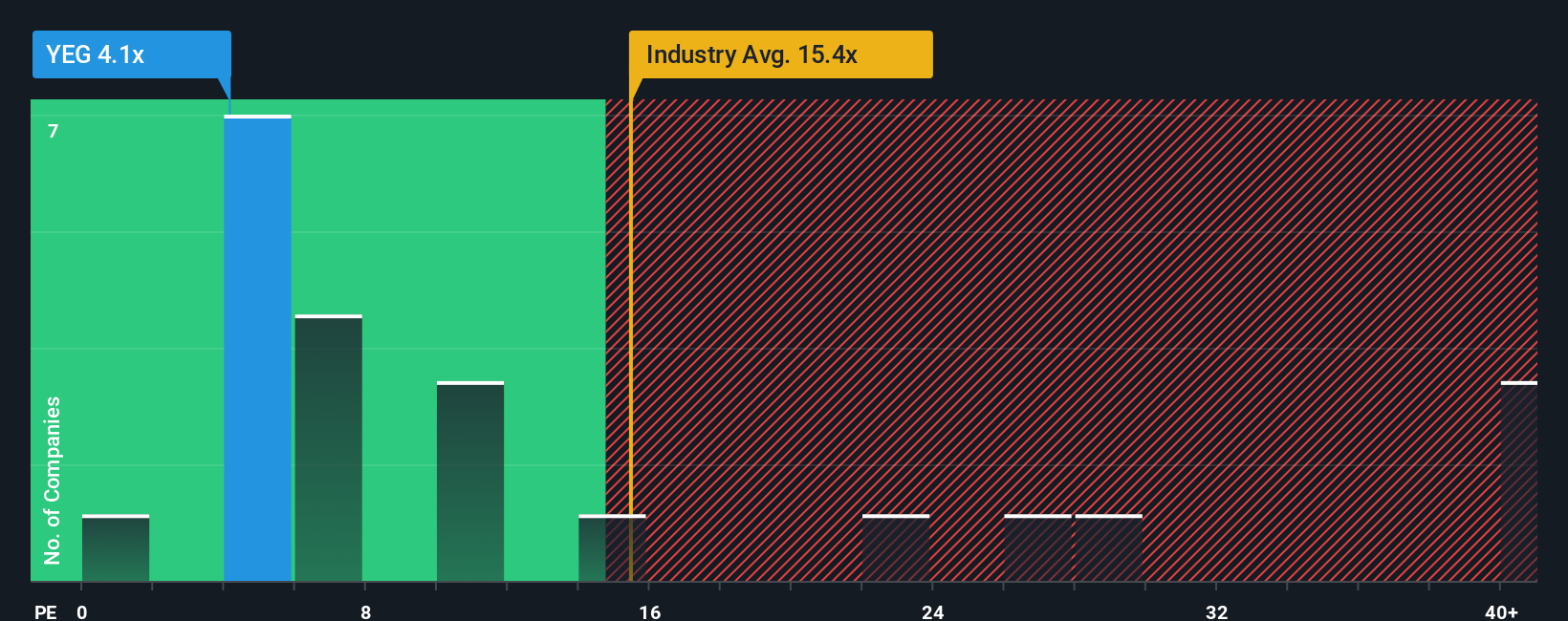

In spite of the firm bounce in price, Yorkton Equity Group may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.1x, since almost half of all companies in Canada have P/E ratios greater than 17x and even P/E's higher than 30x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Yorkton Equity Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Yorkton Equity Group

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Yorkton Equity Group's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.4%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings growth is heading into negative territory, declining 9.9% over the next year. Meanwhile, the broader market is forecast to expand by 23%, which paints a poor picture.

In light of this, it's understandable that Yorkton Equity Group's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Even after such a strong price move, Yorkton Equity Group's P/E still trails the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Yorkton Equity Group's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 6 warning signs for Yorkton Equity Group (2 make us uncomfortable!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.