Reassessing Westamerica Bancorporation (WABC) Valuation After Recent Share Price Rebound

Westamerica Bancorporation (WABC) has quietly outperformed many regional peers recently, with the stock up around 9% over the past month even as annual revenue and net income both slipped.

See our latest analysis for Westamerica Bancorporation.

That recent 1 month share price return of 9.3% looks more like a sentiment reset than a one day blip. This is especially the case given the year to date share price return is still slightly negative and the 3 year total shareholder return sits just below zero, suggesting momentum is rebuilding from a low base rather than peaking late in the cycle.

If Westamerica’s move has you thinking about what else might be setting up for a sentiment shift, it could be a good moment to explore fast growing stocks with high insider ownership.

With earnings drifting lower even as the valuation still implies upside to analyst targets and a hefty intrinsic discount, investors face a key question: is WABC quietly undervalued or already reflecting its future growth prospects?

Price-to-Earnings of 10.6x: Is it justified?

On a headline basis, Westamerica Bancorporation’s 10.6x price to earnings multiple looks modest next to peers, but it also screens as expensive versus its own fair ratio.

The price to earnings ratio compares today’s share price to the bank’s per share earnings. This gives a quick snapshot of how much investors are willing to pay for each dollar of profit.

For WABC, that 10.6x multiple is described as good value against both the peer average of 14.8x and the wider US Banks industry at 12x. This suggests the market is not attaching a premium to its earnings stream despite high quality past profits and a long run of growth.

However, relative to the estimated fair price to earnings ratio of 7.6x, the current multiple looks stretched. This implies investors are paying noticeably more than the level our fair ratio work suggests the stock could drift toward if expectations reset.

Explore the SWS fair ratio for Westamerica Bancorporation

Result: Price-to-Earnings of 10.6x (OVERVALUED)

However, ongoing declines in revenue and net income, combined with a valuation premium to fair value, could quickly reverse sentiment if earnings disappoint again.

Find out about the key risks to this Westamerica Bancorporation narrative.

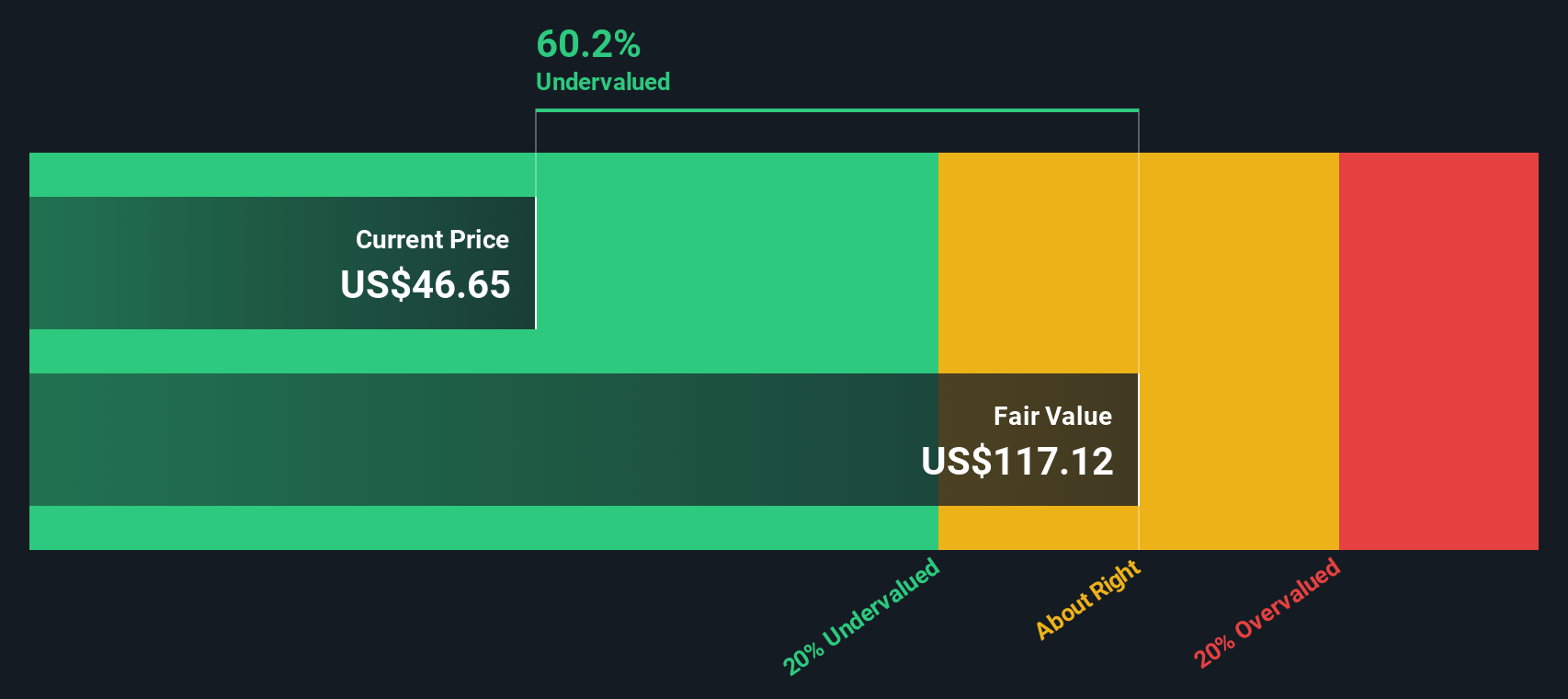

Another View: DCF Points the Other Way

While the 10.6x earnings multiple screens as rich against a 7.6x fair ratio, our DCF model indicates something very different. It suggests Westamerica is worth about $115.68 per share, versus the current $50.88 price. If that gap persists, is the risk in the downside, or in not owning it?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Westamerica Bancorporation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Westamerica Bancorporation Narrative

If you have a different view or would rather dig into the numbers yourself, you can build a tailored narrative in just a few minutes: Do it your way.

A great starting point for your Westamerica Bancorporation research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before markets shift again, lock in a shortlist of fresh opportunities using the Simply Wall Street Screener so you are not chasing yesterday’s winners.

- Capitalize on deep value by targeting underpriced cash flow machines using these 918 undervalued stocks based on cash flows that could re rate as sentiment turns.

- Ride powerful secular trends by scanning these 24 AI penny stocks for companies reshaping industries with intelligent automation and data driven products.

- Boost your income potential by zeroing in on these 13 dividend stocks with yields > 3% that can enhance returns while markets remain unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com