Is It Too Late to Consider Global Ship Lease After Its 2024 Surge in Share Price?

- If you are wondering whether Global Ship Lease is still a bargain after its big run, or if you have already missed the boat, this article will walk through what the current price is really baking in and where value focused investors may want to look next.

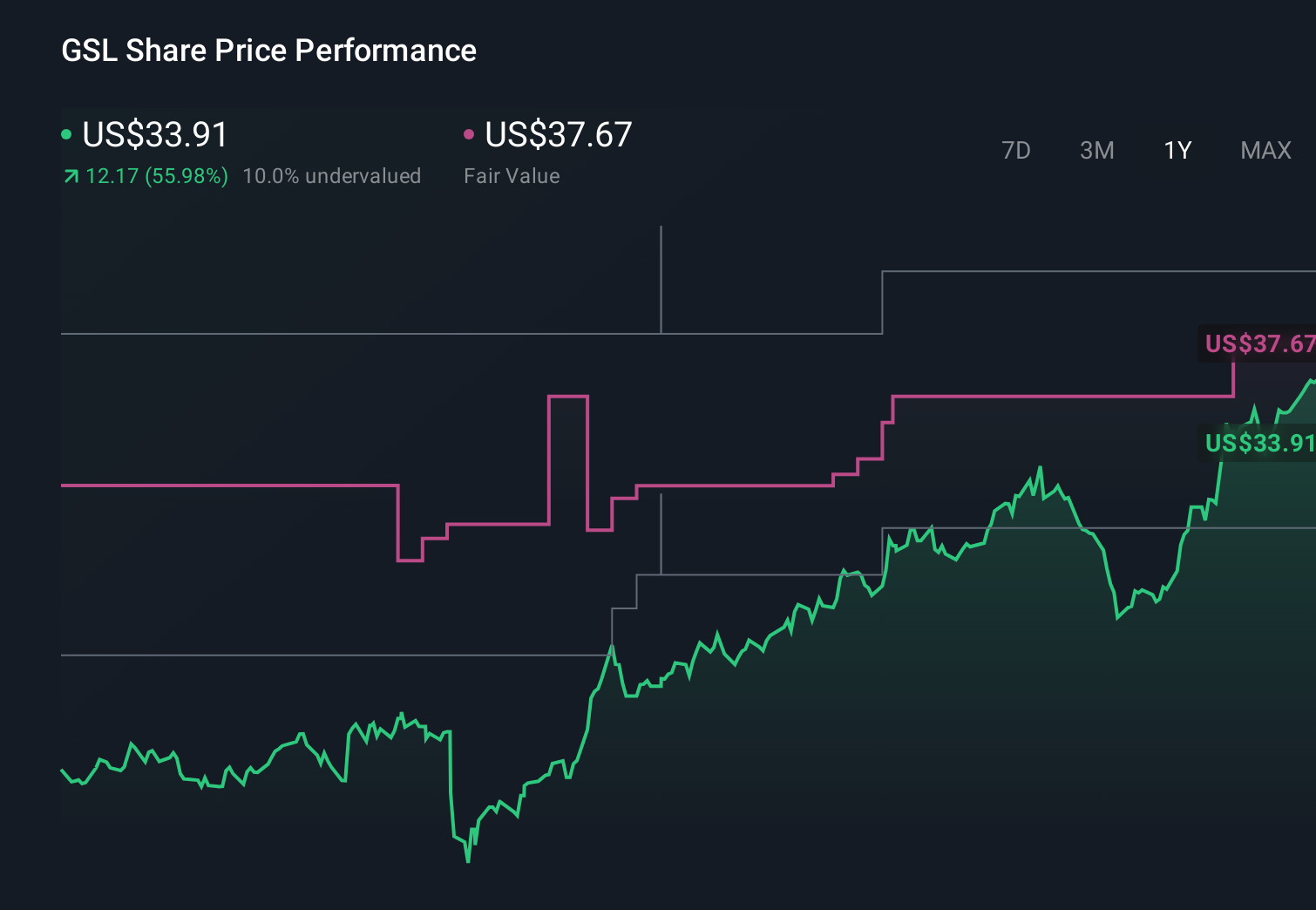

- Despite a recent pullback of 1.4% over the last week and 3.4% over the last month, the stock is still up 49.8% year to date and 73.2% over the past year, with longer term gains of 155.1% over three years and 314.8% over five years that highlight a powerful underlying rerating story.

- Recent moves have been shaped by a mix of sector wide sentiment and company specific developments, including charter market dynamics for container ships and evolving expectations for global trade lanes. At the same time, investors have been evaluating fresh commentary on fleet expansion, contract coverage, and capital allocation decisions that frame how durable today’s cash flows might be.

- On our valuation checklist, Global Ship Lease scores a strong 5 out of 6 for being undervalued, which sets up a deeper dive into multiples, cash flows, and peer comparisons. Later in the article, we will look at an even more intuitive way to tie all those valuation signals together.

Approach 1: Global Ship Lease Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to a present value.

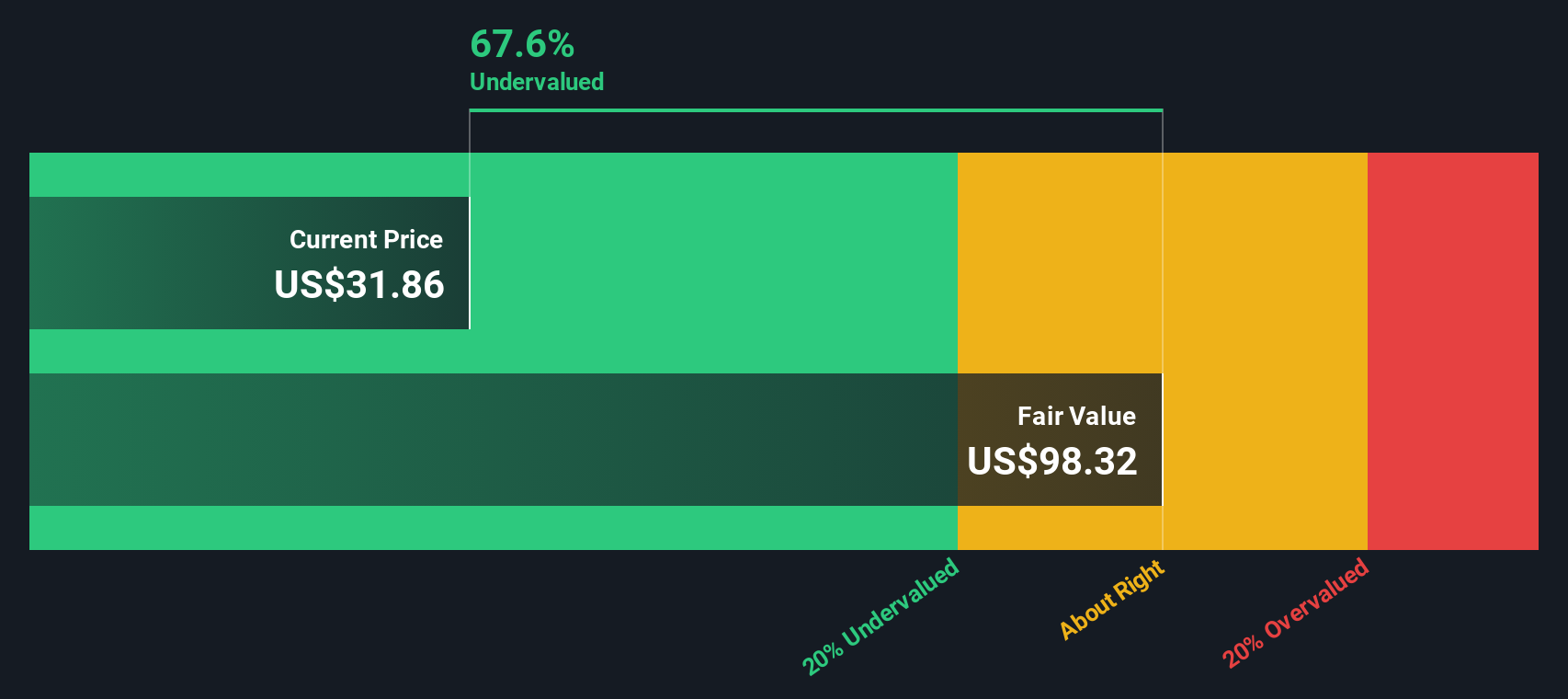

For Global Ship Lease, the model starts with last twelve month Free Cash Flow of about $271.3 million and uses analyst forecasts and extrapolations to project how this could evolve. Cash flows are expected to rise to around $457 million in 2026 and $387 million in 2027, before gradually normalizing, with extrapolated projections in the mid $300 million range by 2035. These figures are all converted into today’s dollars using a required return, creating a total equity value that is then divided by shares outstanding to get a per share intrinsic value.

On this basis, the DCF suggests a fair value of roughly $100.18 per share, implying the stock trades at about a 66.1% discount to its estimated intrinsic value, which some investors may view as a substantial margin of safety.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Global Ship Lease is undervalued by 66.1%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Global Ship Lease Price vs Earnings

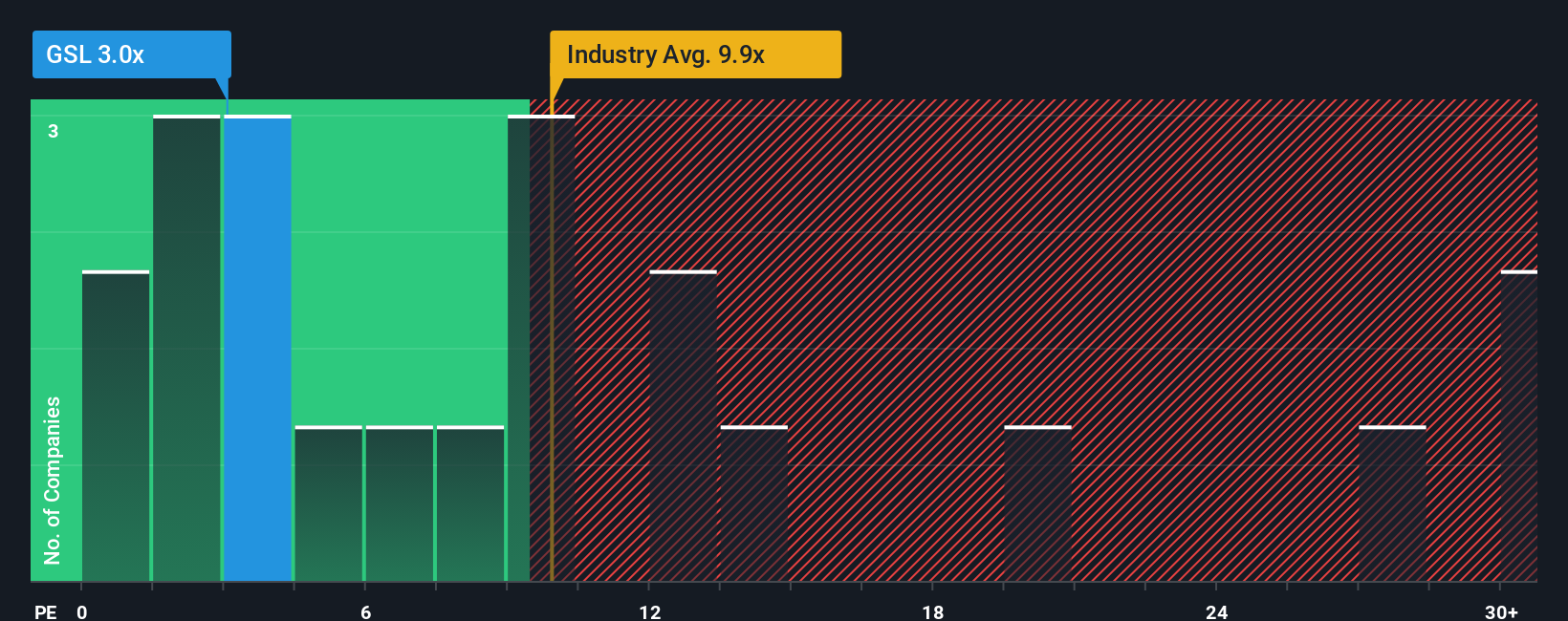

For a company like Global Ship Lease that is clearly profitable, the price to earnings ratio is a practical way to gauge how much investors are paying for each dollar of current earnings. In general, higher expected growth and lower perceived risk justify a higher PE, while slower growth or elevated risk usually call for a lower, more conservative multiple.

Global Ship Lease currently trades on a PE of about 3.1x, which is well below both the Shipping industry average of around 9.8x and the peer group average of roughly 5.9x. To move beyond these broad comparisons, Simply Wall St uses a Fair Ratio, a proprietary estimate of what the PE should be after accounting for factors like earnings growth, profit margins, risk profile, industry characteristics and market capitalization. Because it blends these company specific drivers, the Fair Ratio is a more tailored benchmark than simply lining Global Ship Lease up against sector or index averages.

For Global Ship Lease, the Fair Ratio is calculated at about 6.9x, noticeably above the current 3.1x multiple, which points to the shares trading below what would be expected on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Global Ship Lease Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives. This is an approach on Simply Wall St’s Community page where you connect your view of a company’s story with your own forecast for revenue, earnings and margins. These forecasts then flow through to a Fair Value that you can compare with today’s share price to decide whether to buy, hold or sell. That Fair Value automatically updates as new news or earnings arrive. For example, one investor might build a bullish Global Ship Lease Narrative around resilient midsize containership demand, disciplined buybacks and dividend support that, in their view, justifies a Fair Value closer to the $42.00 end of the analyst range. A more cautious investor might instead focus on declining revenue forecasts, regulatory and trade risks, and dilution from follow on offerings to anchor their Narrative nearer the $32.00 downside, all using the same numbers but very different stories.

Do you think there's more to the story for Global Ship Lease? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com