IPO News | Fuxin Fortis Hong Kong Stock Exchange is one of China's leading providers of satellite spatio-temporal digital solutions

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 19, Fuxin Fortis Technology Co., Ltd. (hereinafter referred to as “Fuxin Fortis”) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CMB International is its sole sponsor. According to the prospectus, Fuxin Fortis is one of the leading providers of satellite space-time digital solutions in China.

Company profile

According to the prospectus, Fuxin Fortis has built a technical system of “one base, multiple capabilities, and multiple applications”, integrating hardware, software and data analysis capabilities, and relying on satellite communication, positioning, navigation and timing technology, the company provides satellite spatio-temporal digital solutions for various application fields. Fuxin Fortis's solutions support the integration and management of space, earth and sea information, enabling end users to obtain, analyze and apply data in real time, thus achieving intelligent and accurate operation management.

During the track record period, Fuxin Fortis's business covered 25 provinces, autonomous regions and municipalities directly under the Central Government in China. Major customers include central enterprises such as national telecom operators and other local state-owned enterprises. According to Frost & Sullivan, in terms of 2024 revenue, Fuxin Fortis is one of China's leading providers of satellite spatio-temporal digital solutions, and ranked second in the two major fields of digital transportation and digital ocean.

Fuxin Fortis's business is structured around two major revenue streams: the first is technology solution revenue: the company's revenue comes from (i) providing platform services based on communication, positioning, navigation and timing technology for various application areas, (ii) software licensing, (iii) customized technology development, and (iv) other services. Second, terminal equipment revenue: Fuxin Fortis's revenue mainly comes from sales of Beidou smart hardware products (including Beidou vehicle-mounted smart terminals, Beidou shipborne smart terminals, marine communication terminals, Beidou smart marine disaster prevention and mitigation terminals, and Beidou smart wearable products).

Fuxin Fortis's satellite spatio-temporal digital solutions mainly serve the four core application scenarios of digital transportation, digital ocean, digital cities, and digital low altitude. During the track record period, the company's revenue mainly came from the digital transportation and digital marine business, and the contribution of the digital city business was relatively small. However, the company did not record revenue from the digital low-altitude business. In May 2025, Fuxin Fortis signed a cooperation agreement to develop a low-altitude global big data center software platform. The platform is designed to provide real-time location services for drones. After the track record period and until the last practical date, Fuxin Fortis has collected advance payments in this area.

Fuxin Fortis's core technical advantages are mainly reflected in the following four pillars: edge intelligent terminal and multi-source sensor combined navigation technology, satellite+5G integrated communication technology, spatio-temporal data engine and AI analysis capabilities, and automated verification and optimization systems.

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the six months ended June 30, the company recorded revenue of RMB 419 million, RMB 521 million, RMB 597 million and RMB 241 million respectively.

Total profit and comprehensive revenue for the year/period

In 2022, 2023, 2024, and 2025 for the six months ended June 30, the company recorded total annual/period profit and overall revenue of RMB 74.884 million, RMB 91.844 million, RMB 112 million and RMB 49.11 million, respectively.

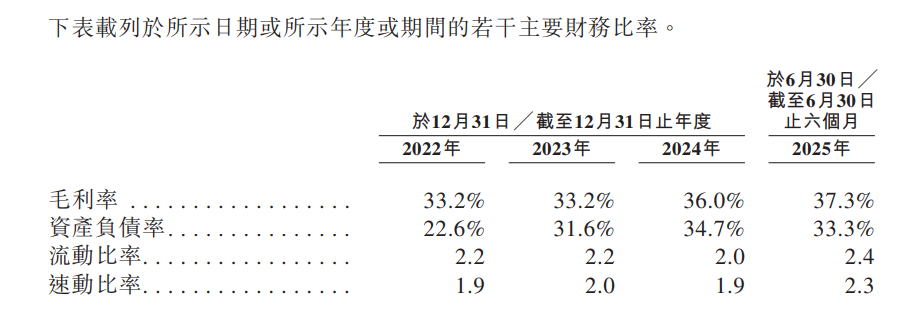

gross profit margin

For the six months ended June 30 in 2022, 2023, 2024, and 2025, the company's corresponding gross profit margins were 33.2%, 33.2%, 36%, and 37.3%.

Industry Overview

The overall market size of the global satellite spatio-temporal digital solutions industry is showing a steady growth trend. It increased from RMB 1,941.8 billion in 2020 to RMB 2,249.2 billion in 2024, with a compound annual growth rate of 3.7% during the period. The satellite spatio-temporal digital solutions industry is expected to continue to develop in the future, and the global satellite spatio-temporal digital solutions industry market size is expected to grow steadily from 2024 to 2029, with a compound annual growth rate of 9.2%.

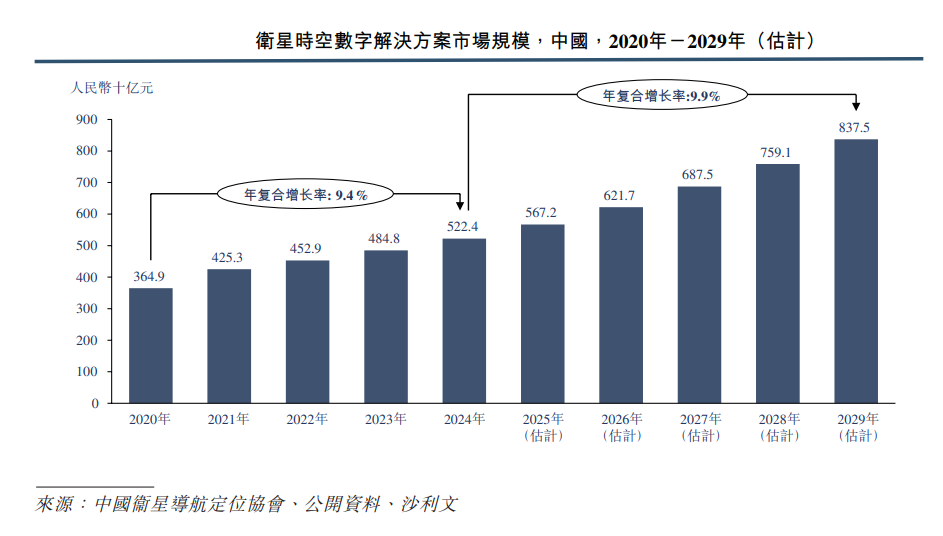

The market size of China's satellite spatio-temporal digital solutions industry continues to grow rapidly, and the market potential is huge. Benefiting from digital strategies, large-scale applications of Beidou satellite navigation systems, and the deep integration of next-generation information technology (such as AI and Internet of Things), the market size has steadily risen from RMB 364.9 billion in 2020 to RMB 522.4 billion in 2024, with a compound annual growth rate of 9.4% during the period. Looking ahead, as downstream application scenarios continue to expand, the market size of the industry is expected to continue to grow at a compound annual growth rate of 9.9% between 2024 and 2029.

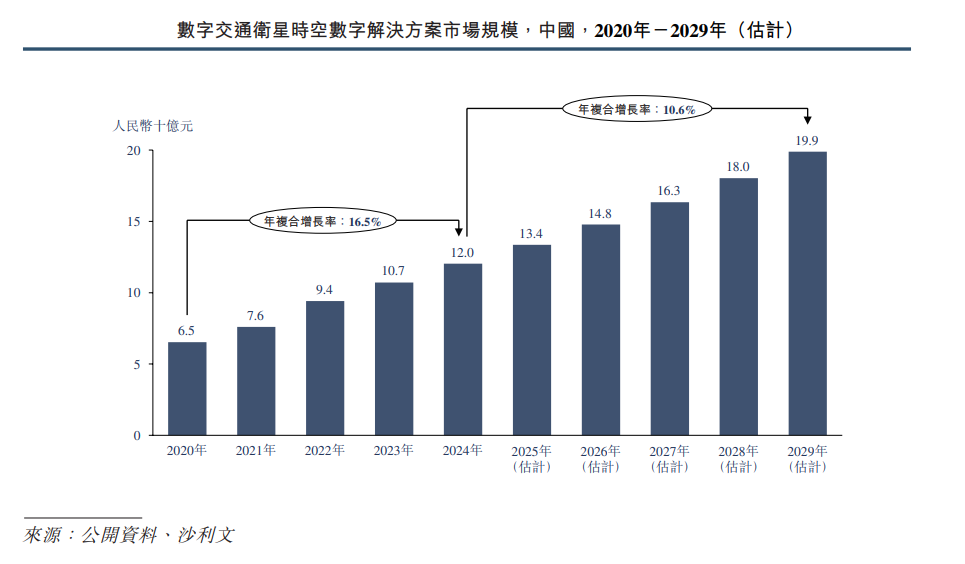

The overall market size of digital space-time digital solutions for digital transportation satellites in China is showing a steady growth trend. It increased from RMB 6.5 billion in 2020 to RMB 12 billion in 2024, with a compound annual growth rate of 16.5% during the period. It is expected that in the future, with the continuous growth of the digital transportation industry, China's digital transportation satellite spatio-temporal digital solutions market size is expected to grow steadily from 2024 to 2029, with a compound annual growth rate of 10.6% during the period.

The overall market size of China's digital marine satellite spatio-temporal digital solutions is showing a steady growth trend. It increased from RMB 381.1 million in 2020 to RMB 689.1 million in 2024, with a compound annual growth rate of 16.0% during the period. It is expected that as the digital ocean industry continues to grow in the future, the market size is expected to grow steadily from 2024 to 2029, with a compound annual growth rate of 13.3% during the period.

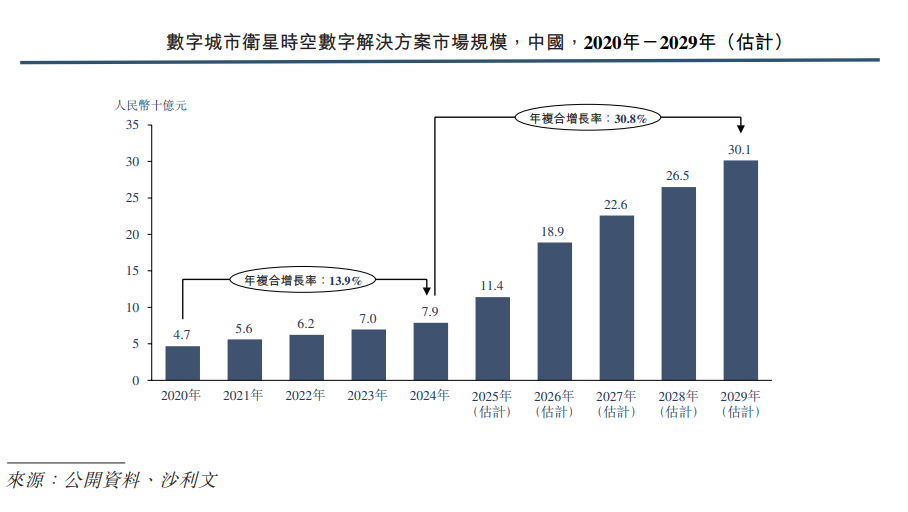

From 2020 to 2024, China's digital city satellite spatio-temporal digital solutions market grew from RMB 4.7 billion to RMB 7.9 billion, with a compound annual growth rate of 13.9% during the period. According to the “Electric Bicycle Safety Technical Specification” which came into effect on September 1, 2025, all newly produced electric bicycles should be designed with a Beidou module, while commercial or commercial electric bicycles must be equipped with a Beidou module. In this context, China's digital city satellite spatio-temporal digital solutions market size is expected to grow rapidly, reaching RMB 30.1 billion by 2029, and the predicted compound annual growth rate between 2024 and 2029 is 30.8%.

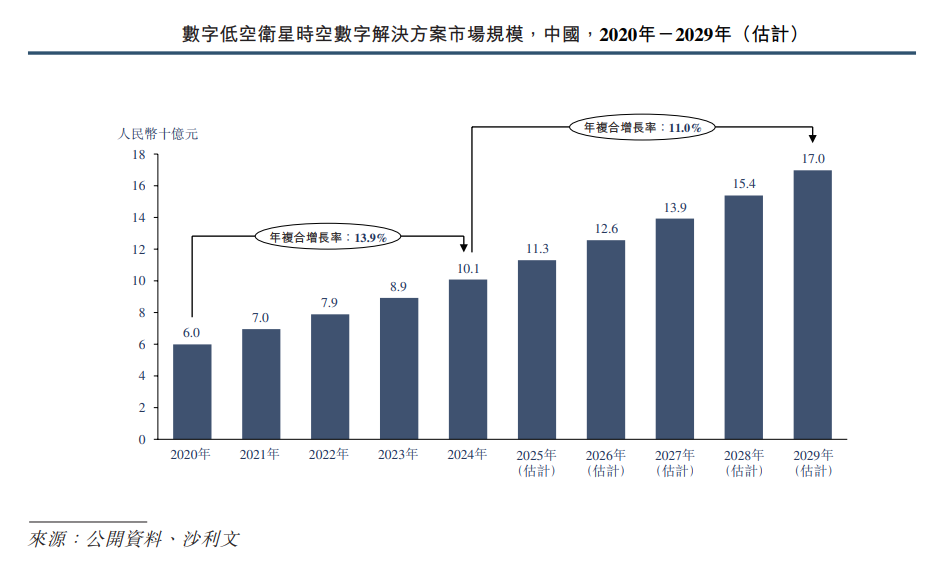

The overall size of China's digital low-altitude satellite spatio-temporal digital solutions market is showing a steady growth trend. It increased from RMB 6 billion in 2020 to RMB 10.1 billion in 2024, with a compound annual growth rate of 13.9% during the period. It is expected that in the future, as the digital low-altitude industry continues to grow, the market size of China's digital low-altitude satellite spatio-temporal digital solutions market is expected to grow steadily from 2024 to 2029, with a compound annual growth rate of 11.0% during the period.

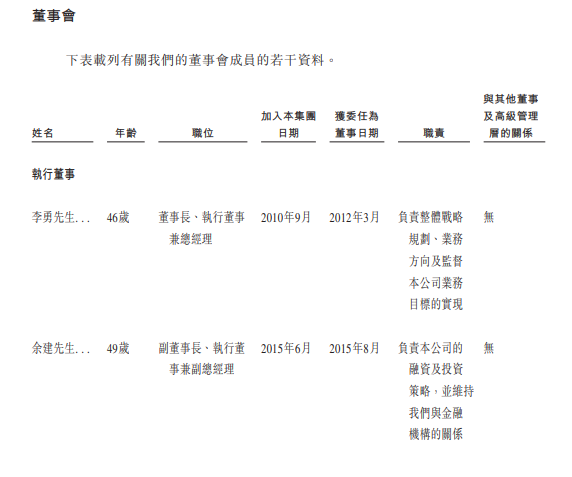

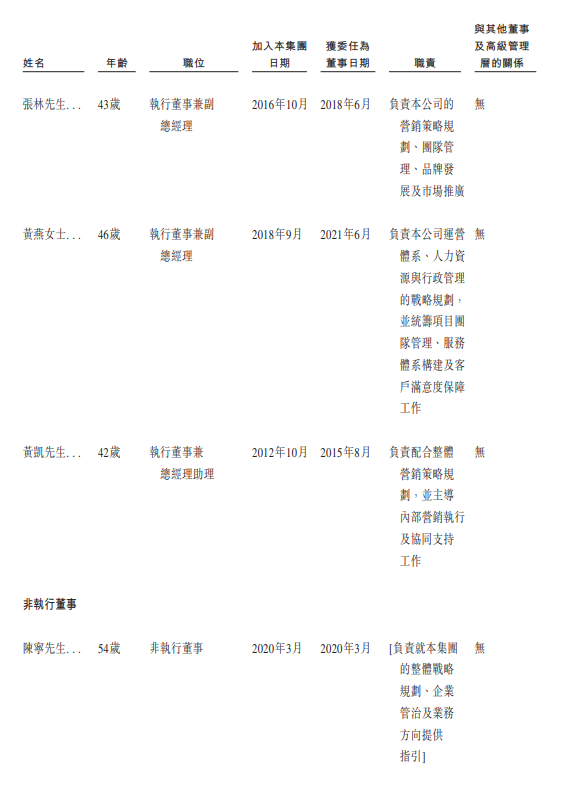

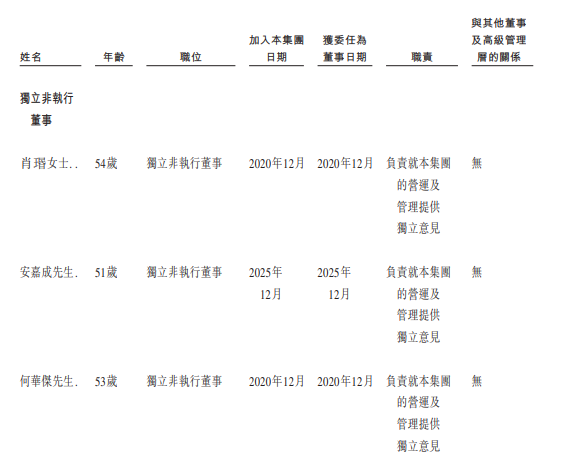

Board Information

The board of directors will be composed of nine directors, including five executive directors, one non-executive director and three independent non-executive directors. The Board of Directors is responsible for and has general powers to manage and operate the Company. Directors serve for three years and are eligible for re-election at the end of their term.

Shareholding structure

At the last practical date, Mr. Li Yong, along with his executive partners Smart Cloud, Fuxin Investment, and Sino-Singapore Fuxin, were the company's single largest shareholder group and controlled about 28.48% of the voting rights at the company's shareholders' meeting.

Intermediary team

Sole sponsor: CMB International Finance Co., Ltd.

Company Legal Advisors: King & Wood Mallesons, Shanghai AllBright (Shenzhen) Law Firm, Beijing Haiwen Law Firm Shanghai Branch, Katten Muchin Rosenman LLP

Sole sponsor legal adviser: A recent law firm, Beijing Jingtian Gongcheng Law Firm

Reporting Accountant: Grant Thornton (Hong Kong) Certified Public Accountants Limited

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch