Hanwha’s Expanded Stake and State Street’s Exit Could Be A Game Changer For Austal (ASX:ASB)

- Austal Limited recently confirmed that State Street Global Advisors Europe Limited ceased to be a substantial holder on 12 December 2025, while Australia approved Hanwha’s move to lift its stake to 19.9% under strict security and data-access conditions.

- This rapid reshaping of Austal’s shareholder base could influence future voting outcomes, capital allocation choices, and the company’s longer-term corporate direction.

- We’ll now explore how Hanwha’s expanded role as a major shareholder could influence Austal’s investment narrative and risk-reward profile.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Austal Investment Narrative Recap

To own Austal today, you need to believe its large defense-focused order book and expanding U.S. and Australian yards will convert into sustained, profitable work despite contract and budget risks. The recent shift in the register, with State Street stepping back and Hanwha lifting its stake toward 19.9% under security conditions, does not materially alter the near term earnings catalyst, but it could gradually shape governance and how Austal balances growth, capital allocation, and national security sensitivities.

One of the more relevant recent developments is Austal’s equity raising of about A$200,000,000 in March 2025, alongside Hanwha’s initial 9.91% entry. That fresh capital supports capacity expansion and program execution at a time when the order book and guidance upgrades have put the focus on delivering contracted work at acceptable margins, even as investors weigh valuation, governance changes, and increased regulatory scrutiny on foreign ownership in defense assets.

Yet while order visibility looks strong, investors should be aware of the risk that Austal’s dependence on large government defense contracts...

Read the full narrative on Austal (it's free!)

Austal's narrative projects A$2.7 billion revenue and A$129.1 million earnings by 2028. This requires 14.6% yearly revenue growth and about A$39.4 million earnings increase from A$89.7 million today.

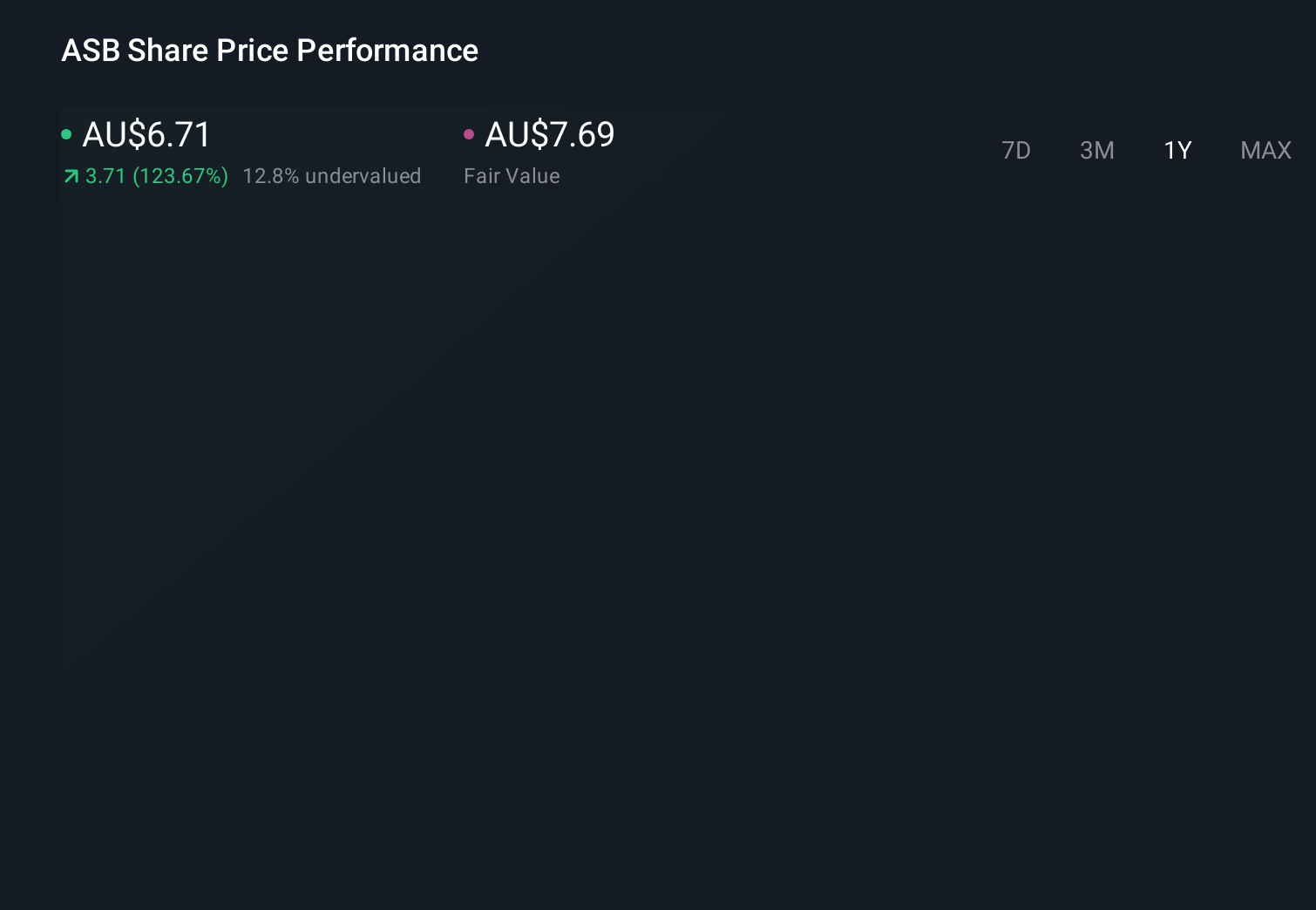

Uncover how Austal's forecasts yield a A$7.69 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community value Austal between A$5.58 and A$20.34, showing how far apart individual views can be. Against that backdrop, Austal’s reliance on major government defense contracts means any policy or budget shift could materially affect how those valuations play out over time, so it is worth comparing several perspectives before deciding where you stand.

Explore 4 other fair value estimates on Austal - why the stock might be worth over 3x more than the current price!

Build Your Own Austal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Austal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Austal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Austal's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com