ATI (ATI) Valuation Check After Strong Buy Rating, Momentum Score and Upgraded Earnings Estimates

ATI (ATI) is riding a wave of positive sentiment after earning a top tier momentum rating and fresh earnings estimate upgrades, prompting investors to revisit whether the recent rally still has room to run.

See our latest analysis for ATI.

Those upgraded estimates are landing on a stock that has already been strong, with a near term share price move of 35.96 percent over 90 days and a powerful 3 year total shareholder return of 262.36 percent, suggesting momentum is still building rather than fading.

If ATI’s surge has you thinking about what else could be setting up for the next leg higher, it might be worth exploring aerospace and defense stocks as your next hunting ground.

Yet with ATI now trading just below analyst targets and sporting a modest value score, investors face a key question: Is there still upside left to capture here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 7.2% Undervalued

With ATI closing at $109.76 versus a most-followed fair value of $118.25, the narrative is leaning toward more upside driven by structural margin gains.

Discrete investments in advanced alloys production, process automation, and supply chain partnerships are already yielding step-changes in manufacturing efficiency and output, evidenced by expanding High Performance Materials & Components margins (to >24%) and stronger incremental margin capture, accelerating EBITDA and free cash flow conversion.

Want to see how margin expansion, disciplined capacity investments, and a premium future earnings multiple all tie together into that higher fair value? The full narrative reveals the detailed growth runway, the profitability inflection, and the specific return hurdles this valuation assumes. Curious which long term cash flow path justifies paying up from here? Dive in before the market fully prices it.

Result: Fair Value of $118.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution is not risk free, with heavy capital expenditure needs and concentrated aerospace customers leaving ATI exposed if demand, pricing, or project timelines slip.

Find out about the key risks to this ATI narrative.

Another Lens on Valuation

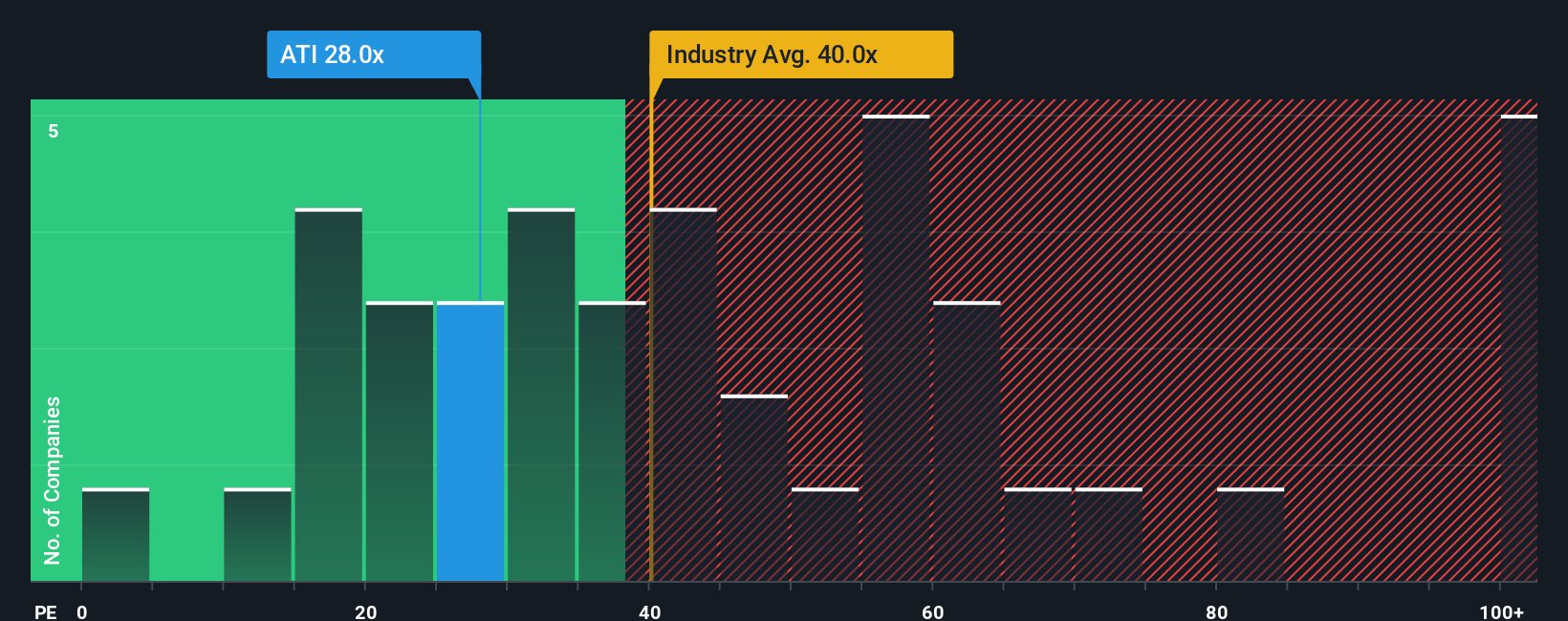

While the fair value narrative points to upside, ATI’s 33.5x earnings multiple is slightly richer than its 32.1x fair ratio and even edges above close peers, despite sitting below the broader US aerospace and defense average of 36.5x. That leaves less margin for error if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ATI Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a custom ATI view in minutes using Do it your way.

A great starting point for your ATI research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before momentum shifts elsewhere, put Simply Wall Street’s Screener to work and line up your next potential winners instead of waiting for opportunities to pass you by.

- Capture powerful growth trends by scanning these 24 AI penny stocks that are reshaping entire industries with intelligent automation and data driven products.

- Lock in potential income by targeting these 13 dividend stocks with yields > 3% offering reliable cash returns that can support your portfolio through changing market cycles.

- Position ahead of the crowd by tracking these 80 cryptocurrency and blockchain stocks riding the ongoing shift toward digital assets and blockchain enabled business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com