Is It Too Late To Consider Cal-Maine Foods After Volatile Egg Prices And Regulatory Shifts?

- If you are wondering whether Cal-Maine Foods at around $86 a share is still a smart buy or if the easy money has already been made, you are not the only one trying to figure out what the current price really bakes in.

- The stock is down about 0.9% over the last week, 1.8% over the past month, and 18.5% year to date, even though it is still up roughly 65% over 3 years and nearly 194% over 5 years.

- Those mixed returns come against a backdrop of ongoing headlines about volatile egg prices, shifting consumer demand, and the impact of biosecurity concerns on supply chains. At the same time, investors are watching regulatory developments around animal welfare standards that could affect Cal-Maine's costs and capacity decisions.

- Right now, Cal-Maine scores a 5/6 valuation check score, suggesting the market may be underestimating the business. Next, we will break down what those checks actually say, then circle back at the end to an additional way to think about valuation in the real world.

Find out why Cal-Maine Foods's -8.6% return over the last year is lagging behind its peers.

Approach 1: Cal-Maine Foods Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, DCF, model projects a company’s future cash flows and then discounts them back to today to estimate what the entire business might be worth now. For Cal-Maine Foods, the model uses a 2 stage Free Cash Flow to Equity approach based on cash flows reported and projected in $.

The latest twelve month free cash flow is about $1.18 billion, a very strong starting point for a cyclical food producer. Analyst and extrapolated estimates then project annual free cash flows in the mid to high $500 million range over the next decade, with 2035 free cash flow estimated at roughly $655.9 million. These future amounts are discounted to reflect risk and the time value of money, then summed.

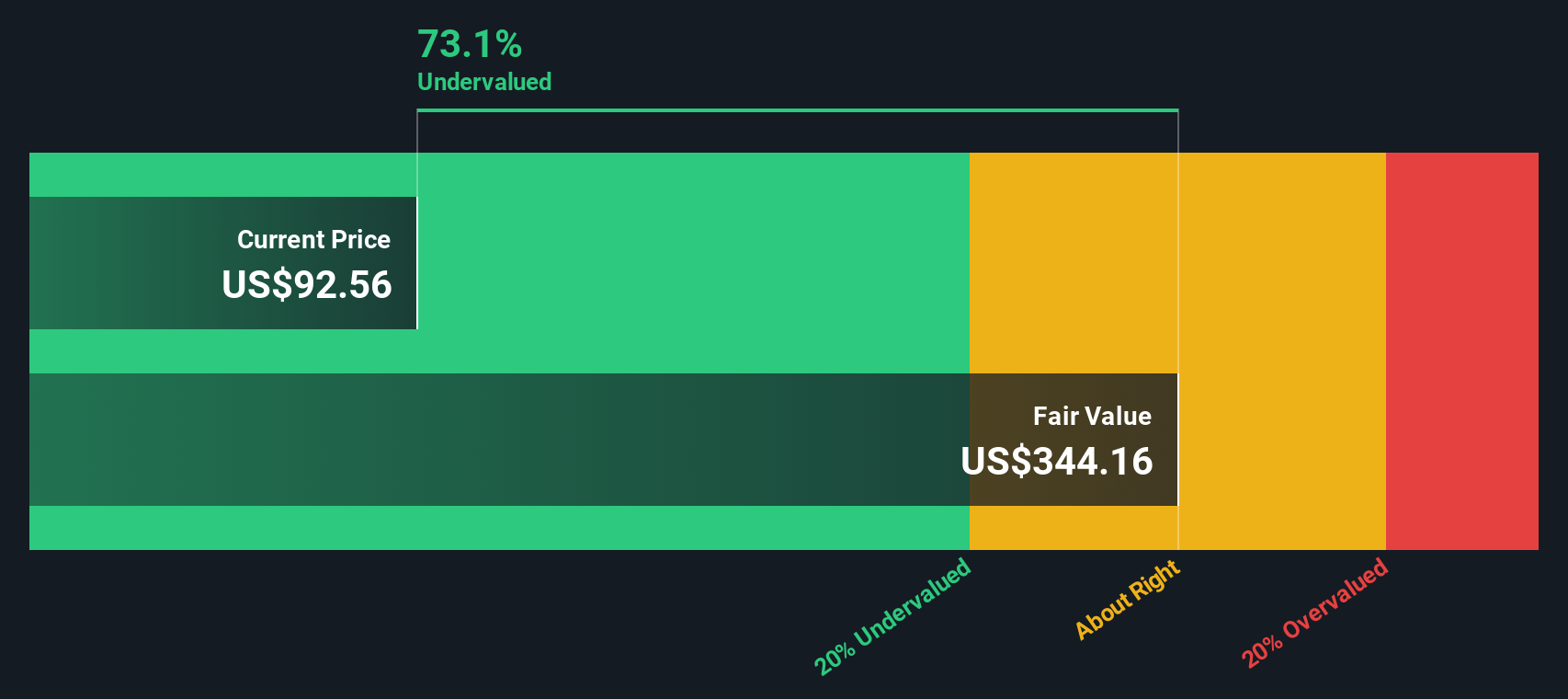

On this basis, the DCF suggests an intrinsic value of about $277.36 per share, implying the stock is roughly 69.0% undervalued versus a market price around $86. In other words, the cash flow outlook currently presents Cal-Maine as materially cheaper than its long term earning power might justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cal-Maine Foods is undervalued by 69.0%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Cal-Maine Foods Price vs Earnings

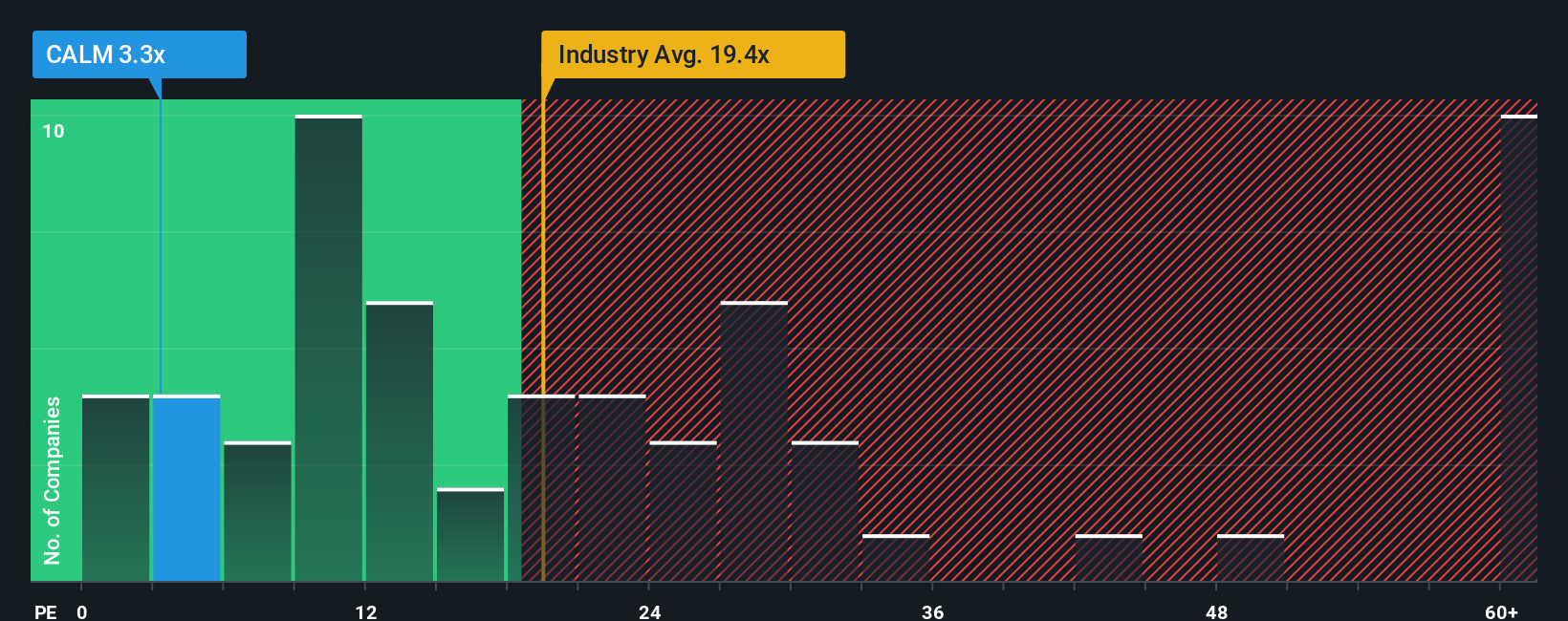

For consistently profitable businesses like Cal-Maine, the price to earnings (PE) ratio is a practical way to gauge how much investors are paying for each dollar of current earnings. The higher the expected growth and the lower the perceived risk, the more investors are usually willing to pay, which pushes a normal or fair PE ratio higher.

Cal-Maine currently trades at about 3.29x earnings, far below the Food industry average of roughly 20.17x and a peer average near 20.09x. On the surface, that gap suggests the market is pricing Cal-Maine much more conservatively than its sector. However, simple comparisons like this do not fully account for the company’s specific growth profile, margins, size, and risk factors.

This is where Simply Wall St’s Fair Ratio comes in. It is a proprietary estimate of what Cal-Maine’s PE should be, given its earnings growth outlook, profitability, risks, industry, and market cap. For Cal-Maine, the Fair Ratio is 3.40x, only slightly above the current 3.29x. That small difference implies the shares are trading very close to the level justified by company specific fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cal-Maine Foods Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about Cal-Maine Foods to the numbers by setting your assumptions for fair value, future revenue, earnings, and margins. A Narrative links what you believe about a company’s business drivers, such as egg demand, regulation, and costs, to a financial forecast and then to an explicit fair value estimate. On Simply Wall St, millions of investors build and share these Narratives on the Community page, making it an easy and accessible tool rather than something only professionals can use. Each Narrative compares its Fair Value to the current market Price, helping you evaluate whether Cal-Maine looks like a buy, a hold, or a sell based on your own thesis. As earnings releases, news, or guidance changes come in, the Narrative’s forecasts and fair value can update dynamically, so your view stays current instead of static. For example, one Cal-Maine Narrative might assume robust demand and higher margins that justify a much higher fair value, while another assumes mean reverting egg prices and tighter margins that point to a much lower fair value.

Do you think there's more to the story for Cal-Maine Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com