Reinsurance Group of America (RGA): Is the Recent 9% Move Signalling an Undervalued Opportunity?

Reinsurance Group of America (RGA) has quietly climbed about 9% over the past month, even though the stock is still roughly flat over the past year. This invites a closer look at what might be shifting under the surface.

See our latest analysis for Reinsurance Group of America.

That recent 1 month share price return of about 8 percent looks more like a catch up move than a speculative spike, especially when set against a roughly flat 1 year total shareholder return and a strong multi year track record.

If RGA's shift is making you rethink where momentum might build next, it could be worth scanning fast growing stocks with high insider ownership for other under the radar compounders with aligned insiders.

With earnings still growing faster than the share price and the stock trading at a sizeable discount to analyst targets and some intrinsic value estimates, is RGA quietly undervalued, or is the market already discounting that future growth?

Most Popular Narrative: 14% Undervalued

With Reinsurance Group of America closing at $203.78 against a narrative fair value near $236.89, the implied upside puts its long term growth path under the spotlight.

RGA is capitalizing on growing insurance demand in Asia and other international markets, as evidenced by robust new business in Hong Kong, Taiwan, Korea, and a record number of asset intensive transactions across five countries and three continents. This global expansion drives sustained premium growth and strengthens revenue diversification.

Curious how global expansion, rising margins and faster earnings growth all feed into that upside case? Want to see the exact trajectory they are betting on?

Result: Fair Value of $236.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent claims volatility and rising medical costs could squeeze margins, challenge capital deployment plans, and quickly cool enthusiasm around the bullish growth case.

Find out about the key risks to this Reinsurance Group of America narrative.

Another Lens on Value

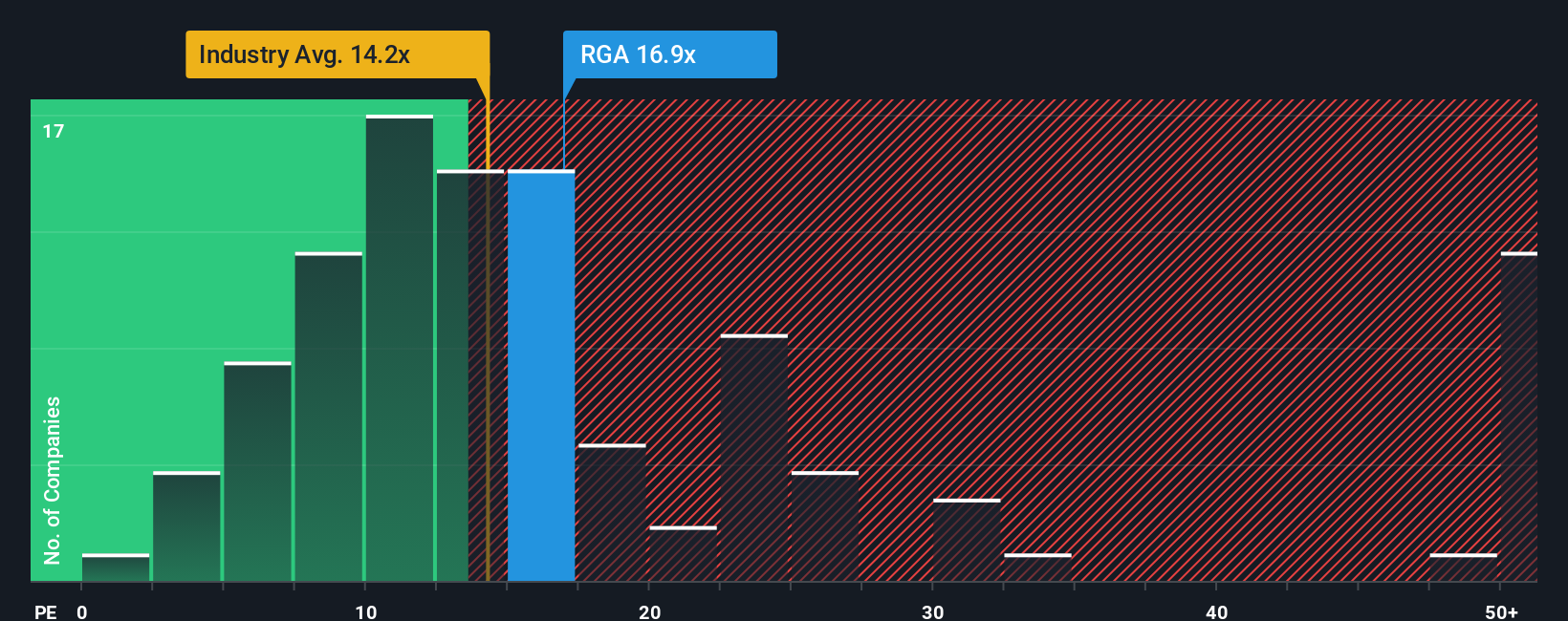

On earnings, RGA looks less obviously cheap. It trades on a 15.4x price to earnings ratio, above the US insurance industry at 13.5x but below peers at 17.6x and a fair ratio of 19.6x. That leaves potential upside, but also less of a clear bargain. Which signal do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reinsurance Group of America Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can quickly build a personalized view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Reinsurance Group of America.

Looking for more investment ideas?

Keep your edge sharp by running a quick scan across fresh opportunities on Simply Wall Street's Screener so you are not left chasing yesterday's winners.

- Capture mispriced quality by checking out these 918 undervalued stocks based on cash flows that combine strong fundamentals with appealing valuations before the broader market catches on.

- Ride powerful technology trends by focusing on these 24 AI penny stocks where innovation and scalable business models could turn early positions into meaningful long term positions.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that can help anchor your portfolio with cash returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com