Is VanEck Rare Earth and Strategic Metals ETF the Smartest Investment You Can Make Today?

Key Points

VanEck's rare earth metals ETF invests in businesses that are vital to the modern world.

With 30 investments, it offers a quick and diversified way to invest in rare-earth metals.

A lot of uncertainty surrounds this sector, and the ETF's long-term performance is mixed.

When Washington, D.C. started imposing tariffs on other nations, there were different responses. China's response included the threat of limiting access to rare-earth metals. The move quickly highlighted the importance of these metals to the world and made the VanEck Rare Earth and Strategic Metals ETF (NYSEMKT: REMX) a hot commodity on Wall Street.

So is this exchange-traded fund (ETF) a smart buy today?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

What does the VanEck Rare Earth and Strategic Metals ETF do?

The VanEck Rare Earth and Strategic Metals ETF's stated objective is to track the MVIS Global Rare Earth/Strategic Metals index. That index's objective is to "track the overall performance of companies involved in producing, refining, and recycling of rare-earth and strategic metals and minerals." The list of metals includes things like lithium, used in high-tech batteries, and lanthanum, used in magnets and lasers.

Image source: Getty Images.

These metals are important for industries ranging from consumer electronics to defense. They are vital for modern technology, but reliable access isn't just a nicety; it is a priority for nations as they consider their military strategies. The rare-earth space got a shot in the arm when the U.S. government made a material investment in MP Materials (NYSE: MP) earlier in 2025.

That investment was a statement about how important these metals are to the U.S., let alone the world. The move was largely driven by China's willingness to use rare-earth metals as a bargaining chip during tariff negotiations. You could play this space by buying a single rare-earth stock, like MP Materials, but that approach comes with material idiosyncratic risks. As the chart below highlights, MP Materials' stock price has been a bit volatile of late.

A diversified approach could be a better call

Spreading your bets across a diversified portfolio of rare-earth and strategic metals is probably a better choice for most investors. This is the purpose of the VanEck Rare Earth and Strategic Metals ETF. Although it is highly focused on a specific investment niche, it has a fairly attractive structure.

For starters, all investments must have a market cap of at least $150 million and be sufficiently liquid, allowing them to be traded relatively easily. For a company to be considered, it must also generate at least 50% of its revenues from rare-earth and strategic metals, or at least 50% of its resources must be related to these materials. According to the ETF's sponsor, "The index includes refiners, recyclers, and producers of rare-earth and strategic metals and minerals." The portfolio consists of 30 stocks.

That's a good start, as it focuses the ETF on the niche in a fairly broad manner, but the real diversification benefit comes from the weighting methodology. A market cap weighting is used, so the largest companies have the greatest effect on performance. However, the max weighting for any one holding is 8%. That's the limit at each rebalancing period; a stock can rise above that between rebalancing. That limit, however, ensures that the portfolio isn't overly dependent on the performance of any single stock, an issue that many sector-specific ETFs face.

If you are looking for a way to quickly get diversified exposure to rare-earth and strategic metals, the VanEck Rare Earth and Strategic Metals ETF is a solid choice. That said, it has an expense ratio of 0.58%, so it is a fairly expensive way to get this exposure relative to other ETFs.

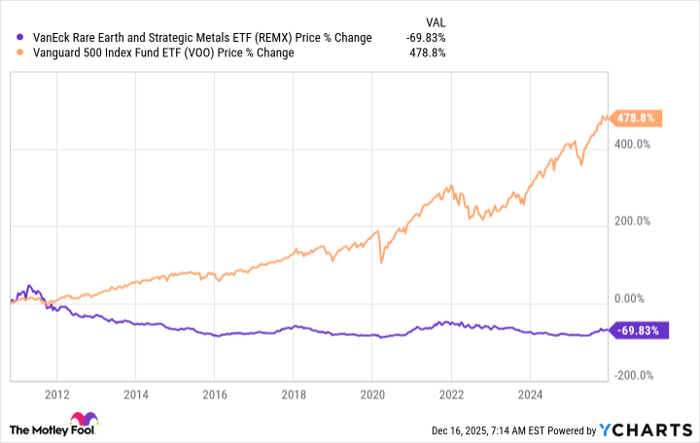

There's just one problem. Rare-earth and strategic metals are commodities, so there is a fair amount of price volatility. That can have a material effect on the stocks in this index. Given the news-driven nature of many of these metals, this is not a low-risk investment choice. As the chart above shows, the VanEck Rare Earth and Strategic Metals ETF has been a fairly poor performer since its inception.

Fit for purpose, but tread carefully

If you believe very strongly in the rare-earth and strategic metals story, the VanEck Rare Earth and Strategic Metals ETF could be a smart choice. It quickly provides diversified exposure to a relatively narrow niche of Wall Street. However, most investors will likely be better off considering the bigger picture.

Is the risk-reward profile here better than what you'd get by simply buying an S&P 500 index ETF? Historically speaking, the answer has been no. That could change, but for long-term investors, keeping a simple portfolio is likely a smarter choice than trying to invest in highly specialized market niches.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends MP Materials. The Motley Fool has a disclosure policy.