Applied Industrial Technologies (AIT): Evaluating Valuation After Automation Deals, Hydradyne Acquisition and Enhanced Shareholder Returns

Applied Industrial Technologies (AIT) just doubled down on its growth strategy by closing acquisitions of IRIS Factory Automation and Hydradyne, while also rolling out richer shareholder returns through higher dividends and a fresh share repurchase program.

See our latest analysis for Applied Industrial Technologies.

Those moves are landing against a solid backdrop, with the latest share price of $259.48 sitting on an 8.75 percent year to date share price return and an impressive 5 year total shareholder return of 249.57 percent, suggesting momentum is still very much on Applied Industrial Technologies side.

If acquisitions and buybacks have you thinking about what else could rerate higher, this might be a good time to explore fast growing stocks with high insider ownership.

With shares still below analyst targets but a long rally already behind them, is Applied Industrial Technologies quietly trading at a discount to its next leg of growth, or is the market already pricing in years of expansion?

Most Popular Narrative Narrative: 14.5% Undervalued

With Applied Industrial Technologies last closing at $259.48 versus a narrative fair value near $303, the story is anchored in steady compounding rather than explosive growth.

Analysts are assuming Applied Industrial Technologies's revenue will grow by 4.9% annually over the next 3 years.

Analysts assume that profit margins will increase from 8.6% today to 9.0% in 3 years time.

To see the math behind that upside, including the earnings climb, the margin lift, and the richer future multiple reflected in this target, read on.

Result: Fair Value of $303.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in legacy end markets, or slower than expected integration of acquisitions like Hydradyne, could quickly challenge this upbeat growth narrative.

Find out about the key risks to this Applied Industrial Technologies narrative.

Another Angle on Valuation

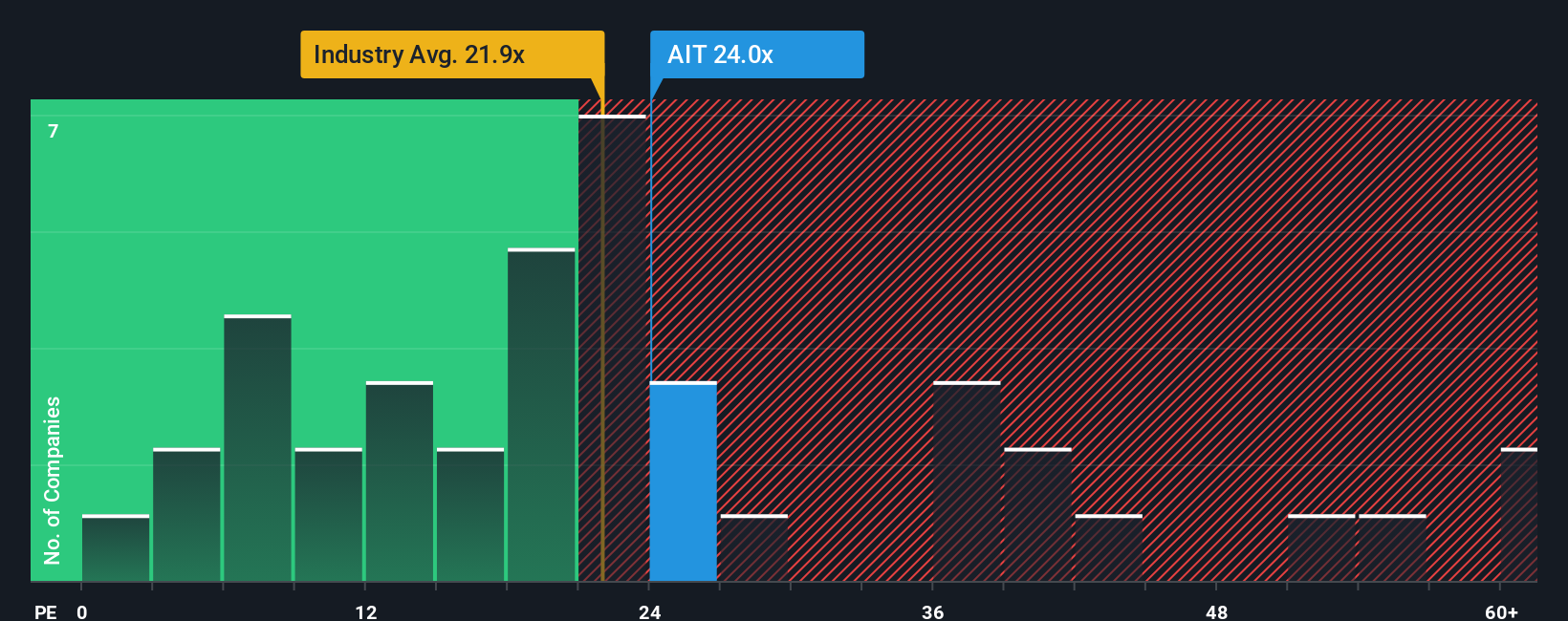

Viewed through its price to earnings ratio, Applied Industrial Technologies no longer screens as cheap. The stock trades at 24.4 times earnings compared to 20.1 times for the broader US Trade Distributors industry and a fair ratio near 21.7. This raises the risk of a sentiment led de rating if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Industrial Technologies Narrative

If you want to stress test this view or rely on your own research instead, you can build a custom narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Applied Industrial Technologies.

Looking for more investment ideas?

Before this rally moves on without you, use the Simply Wall St Screener to uncover fresh opportunities that match your strategy and sharpen your next move.

- Capture potential mispricings by targeting companies trading below their intrinsic value with these 917 undervalued stocks based on cash flows tailored to cash flow strength.

- Position your portfolio for the next wave of innovation by focusing on frontier technology opportunities through these 28 quantum computing stocks.

- Strengthen your income stream by pinpointing reliable payers using these 13 dividend stocks with yields > 3% to find yields that can support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com