How Morgan Stanley’s Downgrade and Insider Selling Will Impact Southern Copper (SCCO) Investors

- Morgan Stanley analyst Carlos De Alba recently downgraded Southern Copper to a Sell rating, while broader analyst opinions now sit at a Moderate Sell consensus accompanied by increasingly negative corporate insider sentiment over the past quarter.

- The combination of a bearish stance from a major Wall Street firm and rising insider share sales raises fresh questions about how confident key stakeholders are in Southern Copper’s current outlook.

- We’ll now examine how Morgan Stanley’s downgrade, alongside rising insider selling, could influence Southern Copper’s existing investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Southern Copper Investment Narrative Recap

To own Southern Copper, you need to believe in sustained global demand for copper and the company’s ability to translate its large asset base into durable earnings. Morgan Stanley’s Sell rating and rising insider selling both sharpen attention on valuation and near term sentiment, but do not directly change the most important short term catalyst, which remains operational execution against cost pressures, nor the key risk around trade tensions affecting copper demand.

The most relevant recent update here is the Q3 2025 earnings release, which showed higher sales and net income compared with the prior year despite slightly lower copper production. Against the backdrop of a higher price to earnings multiple than peers and fresh analyst caution, those results give investors concrete numbers to weigh against concerns over tariffs, cost inflation and the company’s sizeable long term capital spending pipeline.

Yet, investors should be aware that if a 25% U.S. import tariff were implemented on copper products, it could...

Read the full narrative on Southern Copper (it's free!)

Southern Copper’s narrative projects $13.0 billion revenue and $4.3 billion earnings by 2028. This requires 3.1% yearly revenue growth and about a $0.7 billion earnings increase from $3.6 billion today.

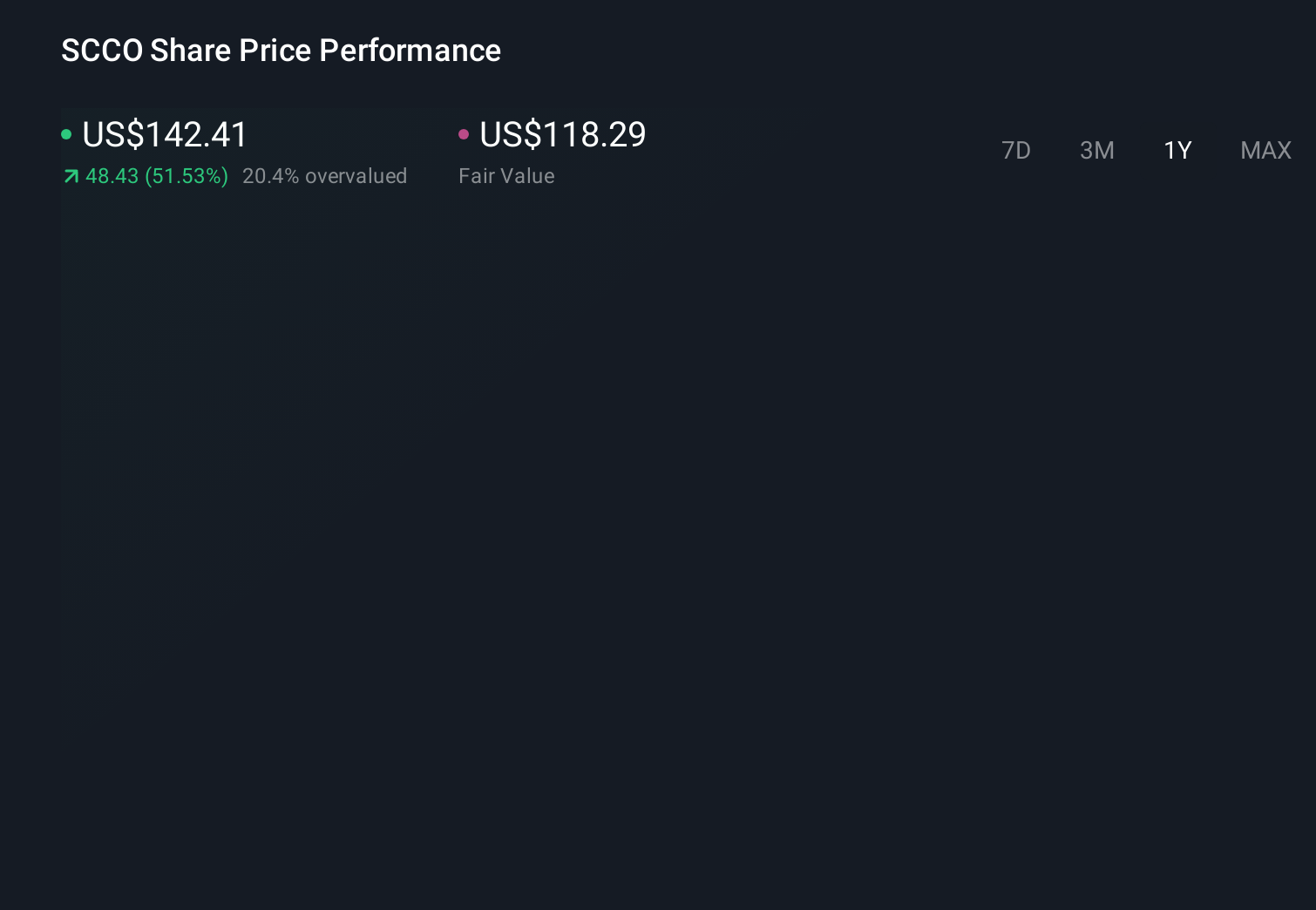

Uncover how Southern Copper's forecasts yield a $118.29 fair value, a 17% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span about US$100 to roughly US$172 per share, underlining how far apart individual views can be. You can set those wide expectations against the risk that an intense U.S. China commercial conflict could curb copper demand and influence Southern Copper’s future performance.

Explore 4 other fair value estimates on Southern Copper - why the stock might be worth 30% less than the current price!

Build Your Own Southern Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Copper's overall financial health at a glance.

No Opportunity In Southern Copper?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com