Assessing Mind Medicine (MNMD)’s Valuation After a Strong Recent Share Price Rally

Mind Medicine (MindMed) (MNMD) has quietly turned into one of the more interesting brain health names this year, with the stock up roughly 66% year to date and nearly 39% over the past 3 months.

See our latest analysis for Mind Medicine (MindMed).

That kind of move, including a roughly 38.7% 3 month share price return on top of a 75.1% one year total shareholder return, signals momentum building as investors warm to its brain health pipeline and clinical milestones.

If MindMed has caught your eye, it could be worth seeing what else is moving in brain health and beyond with our curated set of healthcare stocks.

But with shares still trading at a steep discount to analyst targets even after such a strong run, are investors looking at an underappreciated growth story or a market that has already priced in MindMed’s next leg higher?

Price to Book of 9.5 times, Is it justified?

MindMed trades at a rich price to book ratio of 9.5 times, well above peers, which signals the market is paying up for its future potential rather than current fundamentals.

The price to book multiple compares a company’s market value to its net assets and is often used for early stage or asset light biopharma names where earnings are not yet meaningful.

In MindMed’s case, that 9.5 times multiple stands sharply above both its peer group at 2.4 times and the broader US pharmaceuticals industry at 2.5 times. This implies investors are assigning a premium valuation multiple that reflects substantial pipeline success and future commercialization despite the company still being unprofitable and making less than 1 million dollars in revenue.

Compared with other US pharmaceuticals companies, this elevated price to book ratio makes MindMed look materially more expensive on an asset basis. This highlights how much more optimism is embedded in its share price than in the typical sector name.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 9.5 times (OVERVALUED)

However, investors should note that clinical setbacks or delays in MM120 and MM402 trials, along with ongoing losses and negligible revenue, could quickly undermine today’s optimism.

Find out about the key risks to this Mind Medicine (MindMed) narrative.

Another View: Our DCF Lens

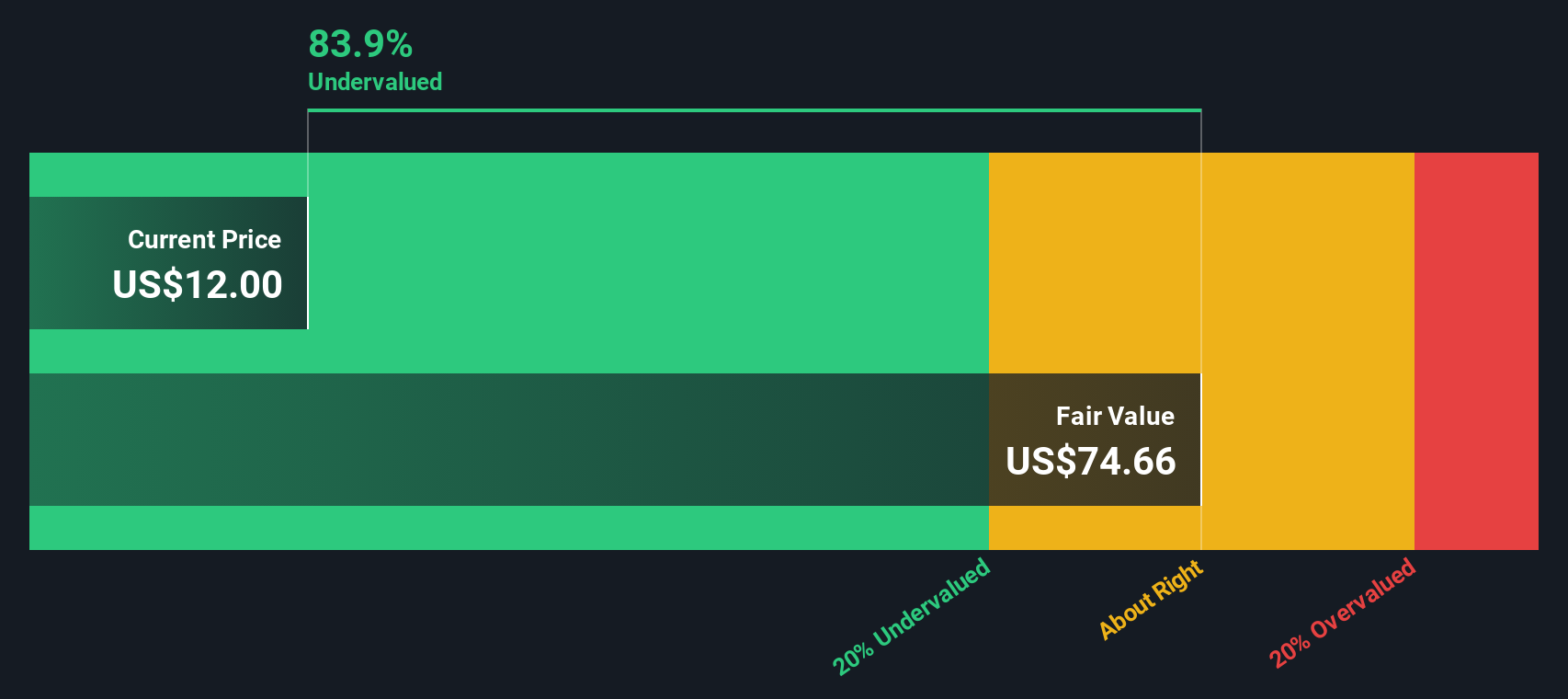

Price to book paints MindMed as expensive, but our DCF model suggests a different story, with fair value at 21.49 dollars versus a 12.54 dollars share price, implying the stock trades about 41.6 percent below that estimate. Is the market underestimating long term brain health optionality here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mind Medicine (MindMed) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mind Medicine (MindMed) Narrative

If you see the story differently or want to dig into the numbers yourself, you can design a complete view in minutes: Do it your way.

A great starting point for your Mind Medicine (MindMed) research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you log off, give yourself an edge by scanning fresh opportunities on Simply Wall St’s Screener, so you never leave high conviction ideas on the table.

- Capture potential market mispricing by reviewing these 918 undervalued stocks based on cash flows that strong cash flow analysis suggests could be trading below their intrinsic worth.

- Ride structural growth trends by evaluating these 25 AI penny stocks positioned at the center of the AI adoption wave reshaping entire industries.

- Lock in reliable income streams by analysing these 13 dividend stocks with yields > 3% that may offer attractive yields alongside sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com