Rolls-Royce (LSE:RR.) Valuation Check After Strong Recent Share Price Gains

Rolls-Royce Holdings (LSE:RR.) has quietly extended its strong run, with the share price gaining about 2% over the past day, 7% this week, and nearly 10% over the past month.

See our latest analysis for Rolls-Royce Holdings.

Those gains come on top of a powerful backdrop, with the share price delivering a roughly doubling year to date and a three year total shareholder return above 1,100%, signalling that momentum is very much still building as investors reassess Rolls Royce Holdings growth and risk profile.

If Rolls Royce Holdings has you rethinking the defence theme, this could be a good moment to scout other opportunities across aerospace and defense stocks.

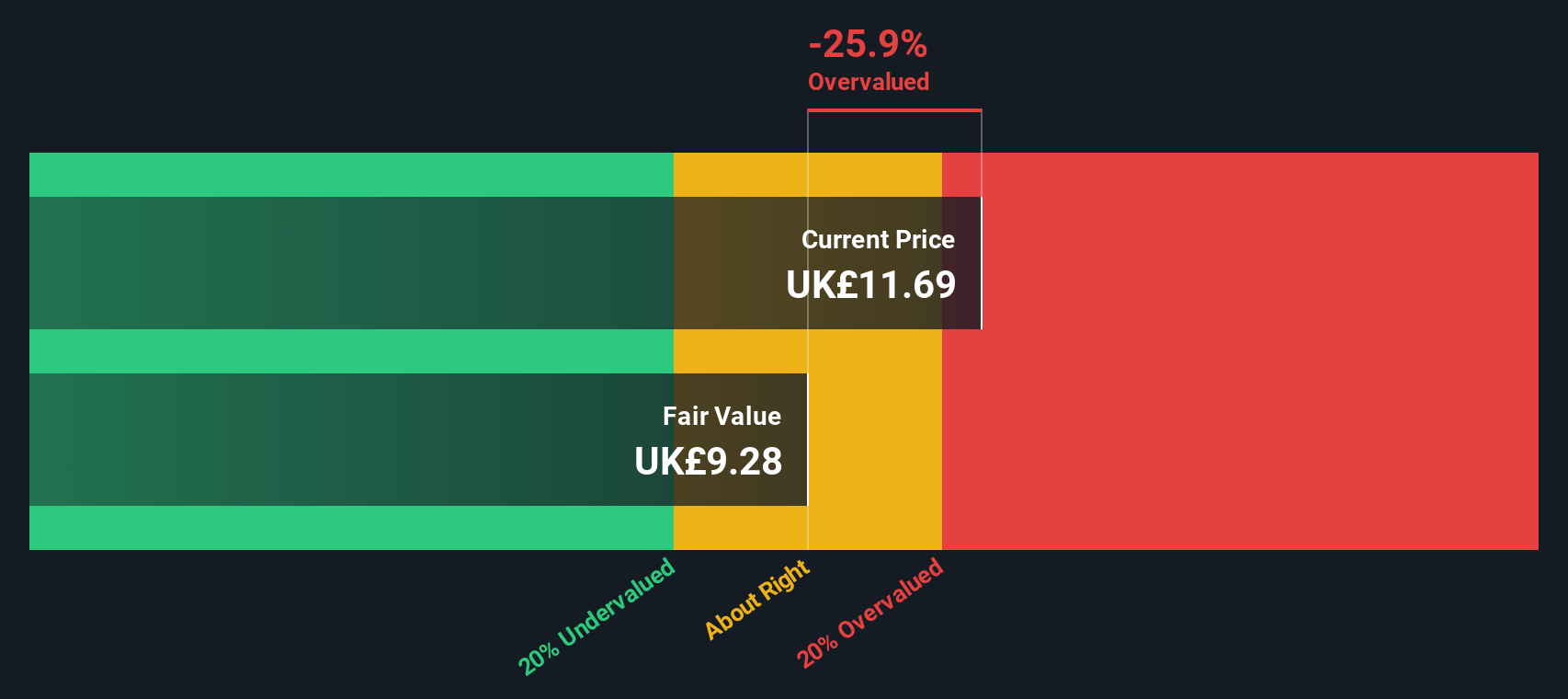

But after such a dramatic re-rating, with only a small discount to analyst targets and some metrics hinting at overvaluation, is Rolls Royce Holdings still a buying opportunity or is the market already pricing in years of future growth?

Most Popular Narrative: 2.3% Undervalued

With the most followed narrative placing fair value just above the £11.70 last close, the story hinges on how far current tailwinds can really stretch.

The exceptionally strong financial performance and raised guidance appear to heavily reflect surging demand from the civil aviation aftermarket (especially higher shop visits, aftermarket profitability, and improved contract terms), as well as record aftermarket order intake in Defence, both of which are influenced by a spike in global air traffic and backlogged demand post-pandemic. There is a risk this recovery pace will normalize, resulting in softer revenue and earnings growth than implied by current market optimism.

Want to see the engine behind that price tag? The narrative leans on brisk revenue growth, slimmer margins, and a rich future earnings multiple. Curious which assumptions really drive that fair value call?

Result: Fair Value of £11.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still a risk that data center demand cools or supply chain pressures return, which could slow margins and undermine the bullish narrative.

Find out about the key risks to this Rolls-Royce Holdings narrative.

Another Angle on Value

Our SWS DCF model paints a cooler picture, putting fair value nearer £10.01, which suggests Rolls Royce Holdings looks overvalued at £11.70. That gap hints the market may already be paying up for future growth. Are you comfortable buying into that optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rolls-Royce Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rolls-Royce Holdings Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a full narrative in minutes: Do it your way.

A great starting point for your Rolls-Royce Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities with the Simply Wall St screener, so potential winners do not pass you by.

- Capitalize on mispriced quality by targeting companies that look cheap on cash flow using these 918 undervalued stocks based on cash flows and sharpen your value hunting edge.

- Ride structural growth trends by focusing on innovators at the intersection of medicine and machine learning through these 29 healthcare AI stocks before the crowd catches on.

- Boost your income game by searching for dependable yield opportunities with these 13 dividend stocks with yields > 3%, aiming to strengthen long term cash returns from your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com