Is It Too Late To Consider Federated Hermes After Its Strong 32.8% Share Price Climb?

- If you are wondering whether Federated Hermes remains attractively valued after its recent run up, or if that value is already fully reflected in the price, this piece will walk you through what the current share price is really implying.

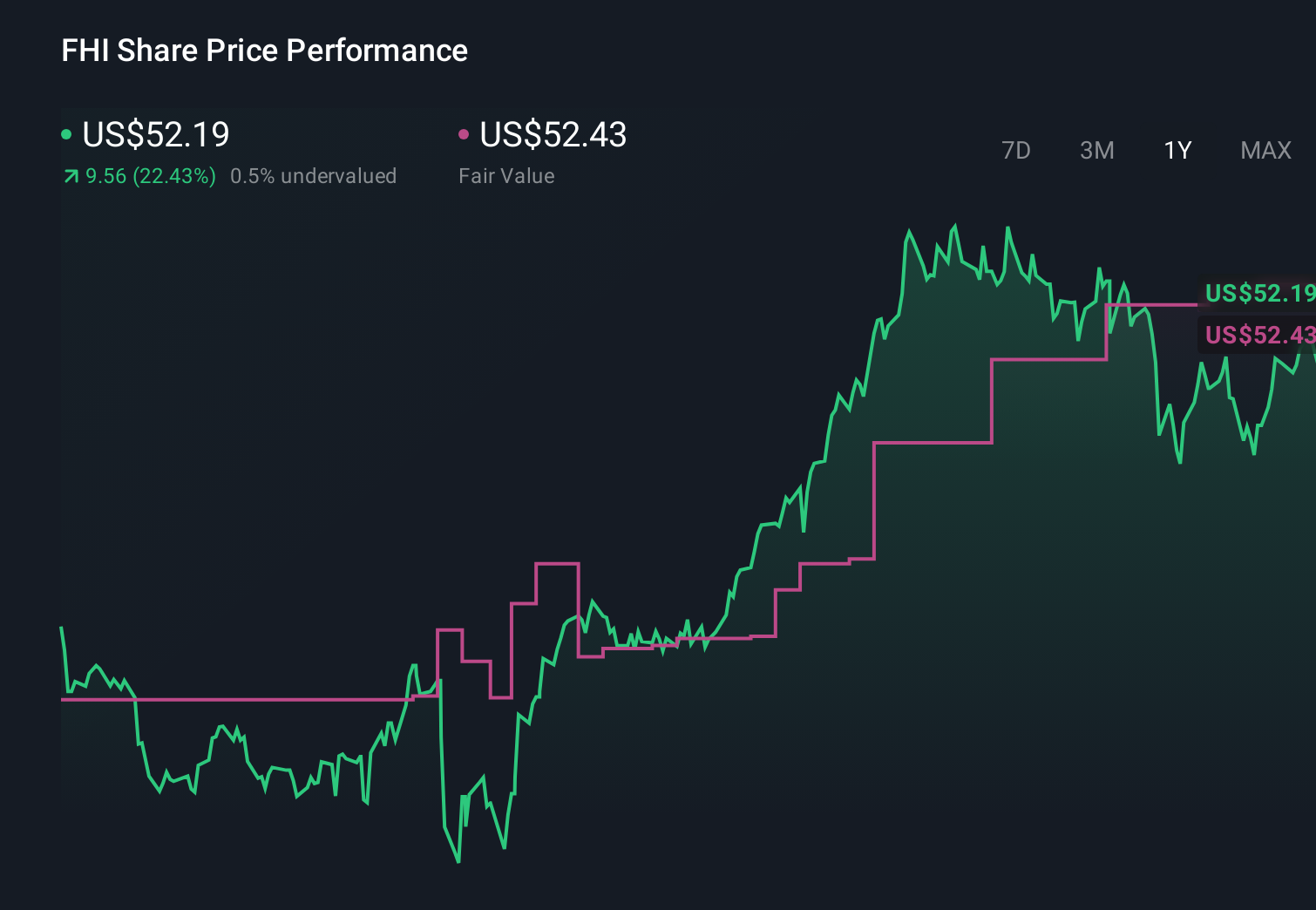

- The stock has quietly delivered a 10.2% gain over the last month and is up 32.8% over the past year, with a strong 125.1% climb over five years that is making long term holders very happy.

- Recently, the company has stayed in the spotlight as investors debate the long term appeal of active asset managers in a world where flows continue to shift toward lower cost products and ESG branded strategies. That backdrop, combined with shifting expectations for interest rates and money market yields, has been an important driver of how investors are repricing Federated Hermes today.

- On our framework, Federated Hermes currently scores a 4 out of 6 on valuation. This suggests the market may still be underestimating parts of the story and sets us up to compare different valuation approaches before exploring an even more intuitive way to think about what the stock is really worth by the end of this article.

Approach 1: Federated Hermes Excess Returns Analysis

The Excess Returns model estimates what Federated Hermes can earn on its existing equity base above the return investors require, then capitalizes those extra profits into an intrinsic value per share.

In this framework, Federated Hermes has a Book Value of $16.06 per share and a Stable EPS of $3.31 per share, based on the median return on equity from the past five years. With an Average Return on Equity of 23.78% on a Stable Book Value of $13.90 per share, the company is generating solid profitability on its capital base.

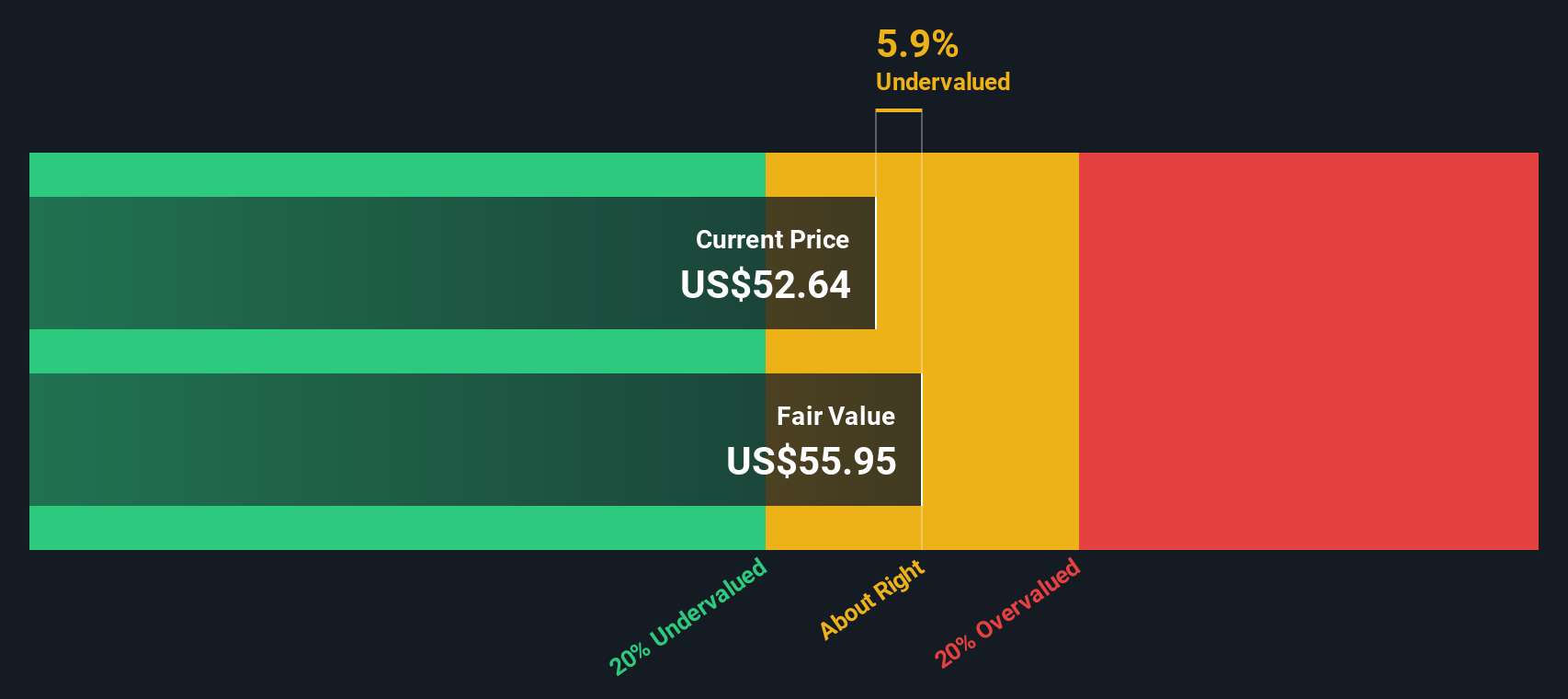

Against a Cost of Equity of $1.16 per share, the business is estimated to produce an Excess Return of $2.14 per share, which is what drives value creation in this model. When these excess earnings are projected forward and discounted, the Excess Returns valuation points to an intrinsic value of about $56 per share, indicating the stock is roughly 5.5% undervalued at current prices.

Result: ABOUT RIGHT

Federated Hermes is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Federated Hermes Price vs Earnings

For profitable asset managers like Federated Hermes, the Price to Earnings (PE) ratio is a practical way to judge value because it links what investors pay today to the earnings the business is already generating. In general, companies with stronger, more reliable growth prospects and lower perceived risk tend to justify higher PE ratios, while slower growth or higher uncertainty should translate into a lower, more cautious multiple.

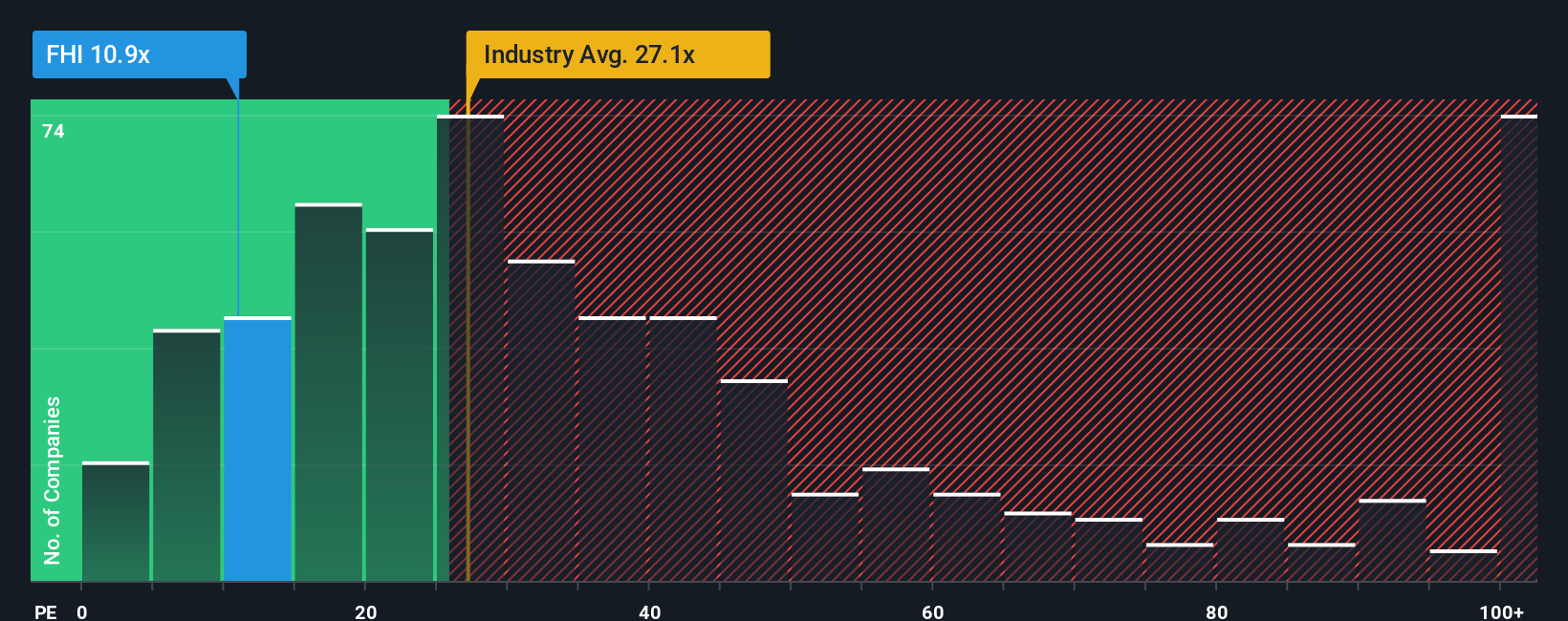

Federated Hermes currently trades on a PE of about 10.7x, which sits well below the broader Capital Markets industry average of roughly 25.3x and also under the peer group average of around 14.6x. Rather than stopping at simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE a stock should trade at after accounting for its earnings growth outlook, profitability, risk profile, industry and market cap. This makes it a more tailored benchmark than blunt industry or peer averages that may bundle together businesses with very different quality and risk characteristics.

On this framework, Federated Hermes has a Fair PE Ratio of around 11.9x, modestly above where the stock trades today. This suggests the market is still applying a small discount to its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1466 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Federated Hermes Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your own story about Federated Hermes to the numbers by turning your views on its future revenue, earnings and margins into a financial forecast. You can then link that forecast to a Fair Value, and compare it to today’s Price to decide whether you think the stock is a buy, hold or sell.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible tool to capture their perspective on a company. Those Narratives automatically update when new information, such as earnings results or major news, comes in so your Fair Value view stays in sync with reality instead of going stale.

For Federated Hermes, for example, one investor might build a Narrative that assumes digital assets, ETF launches and demographic tailwinds support higher growth and a Fair Value above $55. Another more cautious investor might emphasize fee pressure, competition and interest rate risk to arrive at a Fair Value closer to $42. By comparing each Fair Value to the current price they can instantly see how their different stories translate into very different investing decisions.

Do you think there's more to the story for Federated Hermes? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com