Will Reform-Friendly Takaichi Policies Unlock New Value for Japan Post Insurance's (TSE:7181) Shareholders?

- Japan Post Insurance has recently gained attention as investors reassess its prospects under Prime Minister Sanae Takaichi, whose policy agenda is expected to support a more favorable investment climate for major financial groups.

- A key angle for investors is how potential reforms of large, post-linked financial entities could enhance operational flexibility and unlock fresh value for Japan Post Insurance shareholders.

- We’ll now examine how the prospect of reform-friendly policies under Takaichi could reshape Japan Post Insurance’s existing investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Japan Post Insurance Investment Narrative Recap

To own Japan Post Insurance, you have to believe it can convert Japan’s aging demographic and its nationwide network into steady insurance demand, while gradually improving capital efficiency and profitability. The Takaichi administration’s reform-friendly stance supports this thesis in the near term, but does not materially change the key short term catalyst, which remains execution on investment income and cost control, nor the biggest risk, which is lingering skepticism about the sustainability and quality of profits.

Against this backdrop, the recent share buyback authorization of up to 20,000,000 shares for ¥4,000 million, alongside rising dividends, stands out as the most relevant development. It reinforces the focus on capital efficiency and shareholder returns at a time when policy momentum could favor large financial groups, but market doubts about earnings durability and low return on equity still anchor how far the re-rating of Japan Post Insurance can go.

Yet while policy support looks constructive, investors should also be aware that concerns around profit quality and low valuation multiples could still...

Read the full narrative on Japan Post Insurance (it's free!)

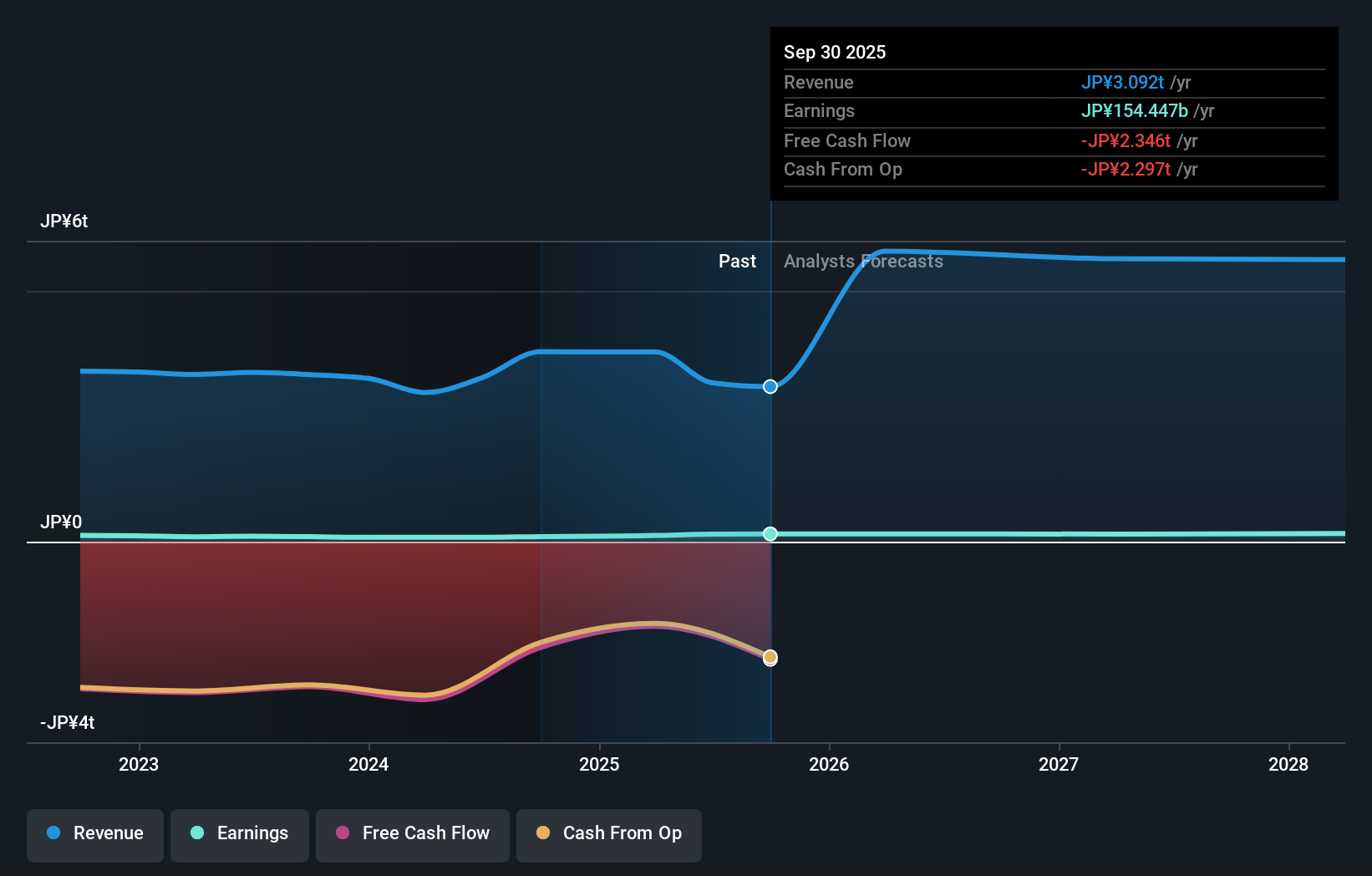

Japan Post Insurance's narrative projects ¥6,605.3 billion revenue and ¥152.1 billion earnings by 2028. This requires 25.2% yearly revenue growth and about ¥14.9 billion earnings increase from ¥137.2 billion today.

Uncover how Japan Post Insurance's forecasts yield a ¥4415 fair value, a 3% downside to its current price.

Exploring Other Perspectives

One Simply Wall St Community estimate pegs fair value at ¥10,086.65 per share, highlighting how individual views can diverge sharply from current pricing. Against this, questions around earnings quality and low return on equity may shape how durable any perceived upside really is, so you are encouraged to consider several viewpoints before forming your own view.

Explore another fair value estimate on Japan Post Insurance - why the stock might be worth over 2x more than the current price!

Build Your Own Japan Post Insurance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Japan Post Insurance research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Japan Post Insurance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Japan Post Insurance's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com