Scholastic (SCHL) EPS Rebound to $2.20 Tests Bearish Profitability Narrative in Q2 2026

Scholastic (SCHL) has just posted Q2 2026 results with revenue of $551.1 million and net income of $55.9 million, translating to basic EPS of $2.20 for the quarter. The company has seen quarterly revenue move from $544.6 million in Q2 2025 to $551.1 million in Q2 2026, while EPS shifted from $1.73 to $2.20 over the same period, setting the stage for investors to focus closely on how sustainable these margins look after a volatile run of prior quarters.

See our full analysis for Scholastic.

With the latest numbers on the table, the next step is to see how this earnings print lines up with the prevailing narratives about Scholastic’s growth path, profitability trajectory, and where the real pressure points might be for margins.

See what the community is saying about Scholastic

Volatile EPS Swings Around Modest TTM Loss

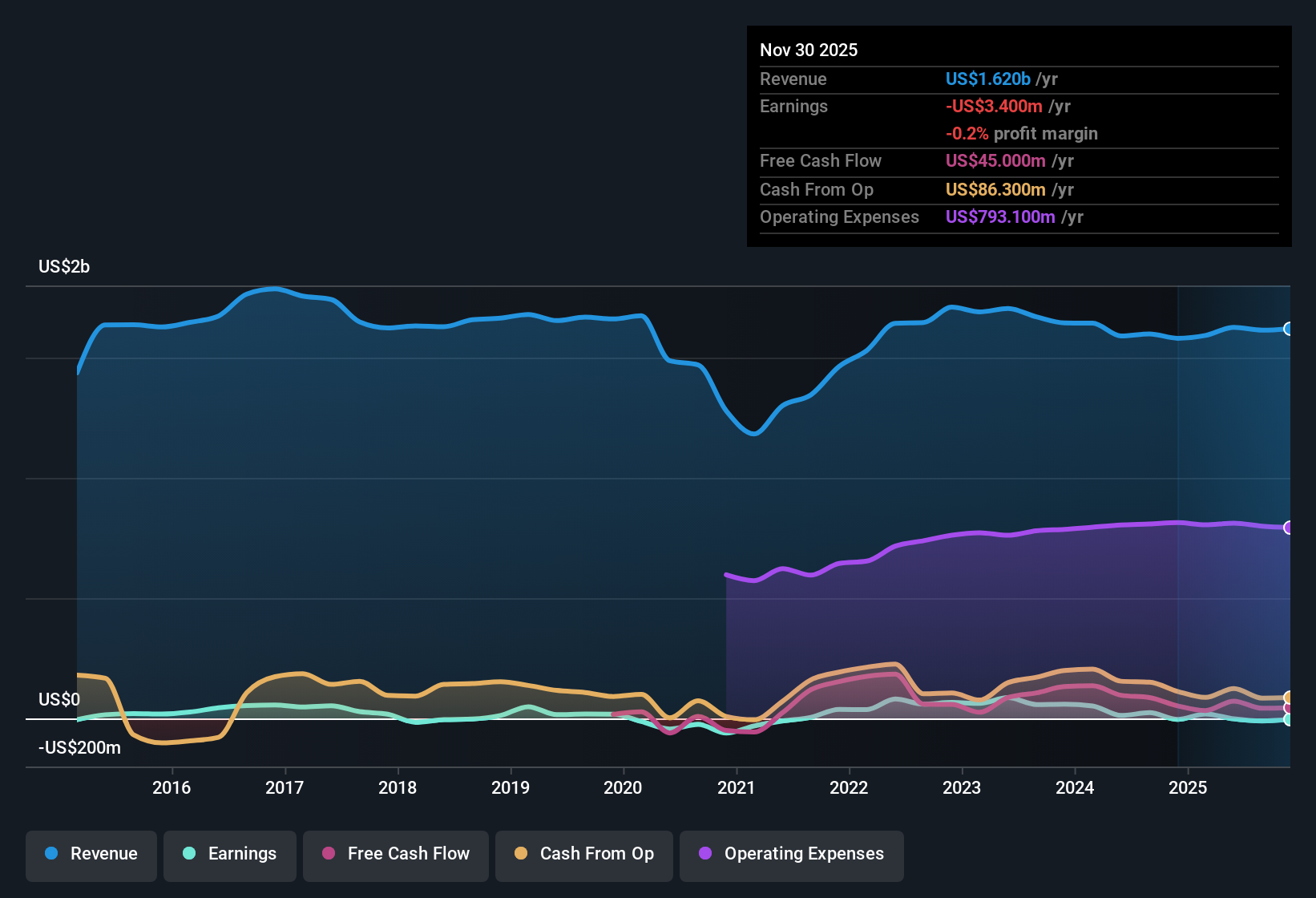

- On a trailing twelve month basis, Scholastic has generated total revenue of about $1.6 billion and a small net loss of $3.4 million, which compares with large single quarter EPS moves from negative $2.82 in Q1 2026 to positive $2.20 in Q2 2026.

- Bears focus on the trailing loss and pressure in core education and international segments, yet the latest swing back to profitability complicates that view:

- Critics highlight that revenue in the Education segment has fallen 12 percent year over year and that international revenue and profits are expected to decline modestly, which lines up with the subdued 4 percent annual revenue growth forecast versus 10.6 percent for the broader US market.

- At the same time, the narrowing TTM loss and a profitable Q2 run against the concern that earnings will remain structurally weak, especially if restructuring and cost reductions continue to flow through.

Forecast 123.6 Percent EPS Growth vs Ongoing Losses

- Analysts expect earnings to grow about 123.6 percent per year, with profits reaching $86.7 million and EPS of $3.67 by around 2028, even though the latest TTM figures still show a small net loss of $3.4 million.

- The bullish narrative around restructuring and digital growth leans heavily on this turnaround path, and Q2 gives it some numerical backing:

- Supporters point to rising forecast profit margins from roughly negative 0.1 percent today to 4.9 percent in three years, alongside operational changes like merging Trade Publishing with Book Fairs and Clubs that are designed to lower the cost base.

- They also note that modest 3.1 percent annual revenue growth, combined with projected margin expansion, is expected to drive EPS from roughly flat on a TTM basis to $3.67, which underpins the view that today’s losses are more temporary than structural.

Low 0.4x Sales Multiple vs $36.00 Target

- At a share price of $27.00 and a price to sales ratio of 0.4 times against peer and US Media industry averages of 1.8 times and 1.0 times, respectively, the stock also sits below the $36.00 analyst price target and slightly under the $16.97 DCF fair value.

- Analysts' consensus narrative ties this valuation gap to expectations of steadier growth from literacy programs and asset monetization:

- They assume revenue will climb to about $1.8 billion and earnings to $86.7 million by 2028, which would imply a future price to earnings multiple of 10.4 times at the $36.00 target, below the current 20.3 times industry multiple.

- At the same time, the 2.78 percent dividend yield is not well covered by recent earnings, so the relatively low sales multiple and upside to the target depend on the forecast margin improvement and share count reduction of about 7 percent per year actually playing out.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Scholastic on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens on Scholastic’s story and turn that view into a concise narrative in just minutes, Do it your way.

A great starting point for your Scholastic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternative Opportunities

Scholastic’s modest growth, thin and recently negative margins, and uncovered dividend highlight how fragile its earnings power still looks despite the latest rebound.

If you want steadier compounding instead of earnings whiplash, use our stable growth stocks screener (2104 results) to quickly focus on companies delivering consistent, repeatable growth across cycles right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com