Assessing Warner Bros. Discovery (WBD)’s Valuation After Its Strong Recent Share Price Rally

Why Warner Bros. Discovery Stock Is Back in Focus

Warner Bros. Discovery (WBD) has quietly staged a strong comeback, with the stock up about 44% over the past 3 months and more than doubling over the past year.

See our latest analysis for Warner Bros. Discovery.

The recent leg higher looks more like momentum building than a one off bounce, with a 20.3% 1 month share price return feeding into a triple digit year to date gain and a similarly powerful 1 year total shareholder return, even as the share price has cooled slightly over the last week.

With media and streaming sentiment turning more selective, this is also a good moment to compare Warner Bros. Discovery with other content players and explore fast growing stocks with high insider ownership.

With shares now near analyst targets yet still trading at a modest intrinsic discount, investors face a key question: Is Warner Bros. Discovery still undervalued, or has the market already priced in the next leg of growth?

Most Popular Narrative: 15.2% Overvalued

With Warner Bros. Discovery closing at $27.77 versus a most popular narrative fair value of $24.10, expectations already stretch beyond the implied base case.

Street research remains divided on Warner Bros. Discovery, with a cluster of recent upgrades and price target increases offset by growing concerns around deal execution risk and valuation after the stock's sharp run.

Why are some analysts comfortable penciling in a richer future multiple despite slower growth and slimmer margins? One central valuation lever dominates this story. Discover how it shapes the fair value math.

Result: Fair Value of $24.10 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy dependence on tentpole franchises and unresolved linear TV headwinds could quickly undercut bullish deal assumptions if audience or ad trends disappoint.

Find out about the key risks to this Warner Bros. Discovery narrative.

Another Angle on Valuation

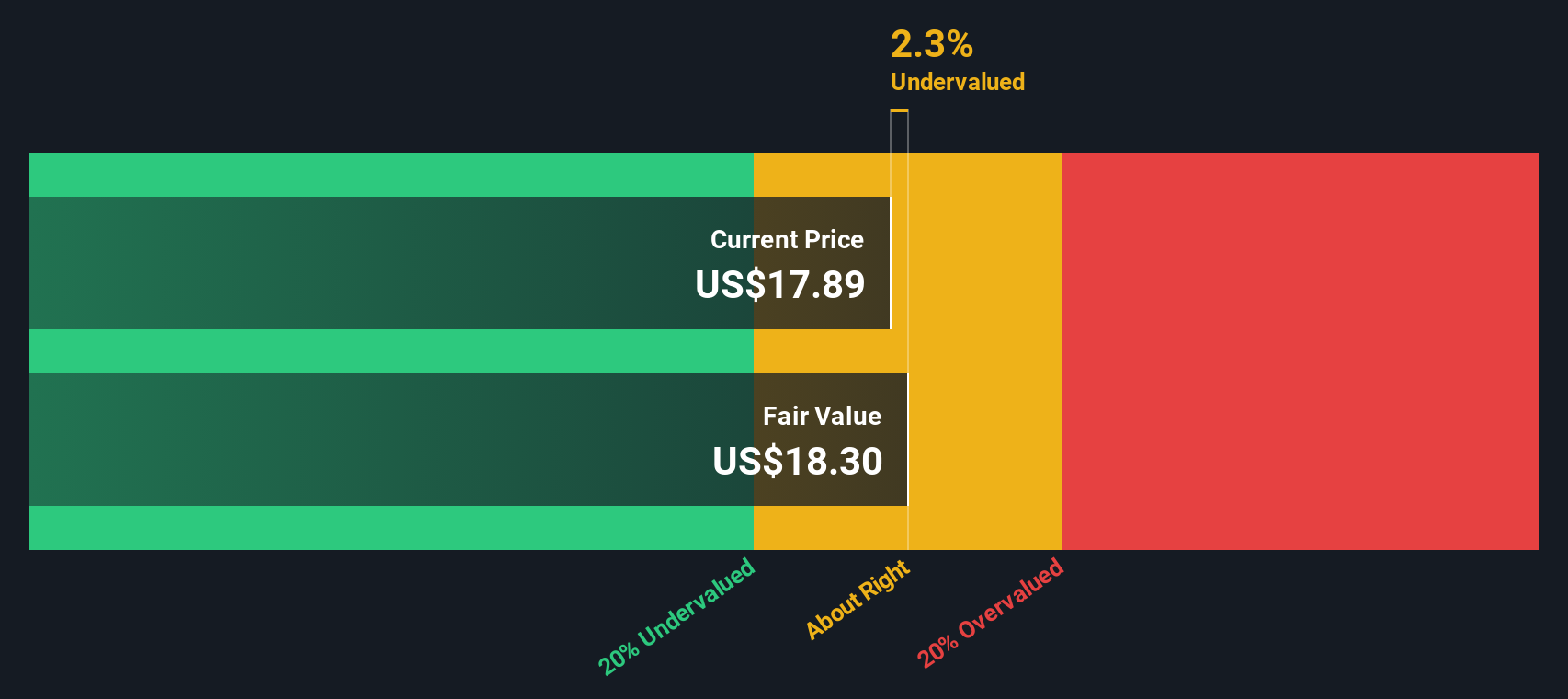

Our DCF model paints a softer picture than the narrative based fair value, suggesting Warner Bros. Discovery trades around 4% below its estimated intrinsic value. That implies only a thin margin of safety, not a deep bargain, so how much deal optimism are you really willing to underwrite?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Warner Bros. Discovery for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Warner Bros. Discovery Narrative

If you see the numbers differently or simply want to dig into the details yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Warner Bros. Discovery research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high potential opportunities?

Before markets move on without you, take the next step and uncover fresh stock ideas on Simply Wall Street tailored to different strategies and risk profiles.

- Explore income-focused ideas by targeting companies screened for reliable payouts through these 13 dividend stocks with yields > 3% with yields above 3%.

- Look into innovative opportunities by focusing on early stage innovators within these 25 AI penny stocks that are harnessing artificial intelligence.

- Review your portfolio’s value foundation by zeroing in on quality businesses trading below intrinsic estimates using these 916 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com