Assessing Kusuri No Aoki Holdings (TSE:3549)’s Valuation After Strong November 2025 Sales Growth

Kusuri No Aoki Holdings (TSE:3549) just posted its preliminary November 2025 sales, with all stores up roughly 114% and existing stores around 105% year on year, which may indicate a healthy growth trajectory.

See our latest analysis for Kusuri No Aoki Holdings.

The latest sales beat lands after a choppy spell, with a 1 month share price return of minus 5.9% and a year to date share price return of 18.3%. The 3 year total shareholder return of 33.2% points to still solid long run compounding and suggests sentiment may be rebuilding around its growth story.

If strong monthly numbers have you rethinking the sector, it could be worth scanning other Japanese and global healthcare stocks that might be riding similar demand trends.

With solid double digit sales growth, but a modest 11% gap to analyst targets and only a slight discount to intrinsic value, is Kusuri No Aoki a mispriced compounder, or is the market already baking in its next leg of expansion?

Price to Earnings of 20.2x: Is it justified?

Kusuri No Aoki trades on a 20.2x price to earnings ratio against a last close of ¥3,699, pointing to a valuation that broadly aligns with its earnings power.

The price to earnings multiple compares what investors pay today with the company’s current profits, a key gauge for stable, steadily growing retailers. For Kusuri No Aoki, solid recent earnings momentum and improving margins suggest the market is willing to pay a full, but not extreme, premium for its profit base.

Against direct peers, the picture is mixed. The stock screens as good value versus the peer average multiple of 20.4x and almost exactly in line with our estimated fair price to earnings ratio of 20.2x, yet it still looks expensive relative to the broader JP consumer retailing industry on 13.4x, underlining that investors are pricing in stronger growth and quality than the typical sector name.

Explore the SWS fair ratio for Kusuri No Aoki Holdings

Result: Price to Earnings of 20.2x (ABOUT RIGHT)

However, softer earnings growth than sales, or renewed share price weakness, could quickly challenge the idea that Kusuri No Aoki is still a mispriced compounder.

Find out about the key risks to this Kusuri No Aoki Holdings narrative.

Another View on Value

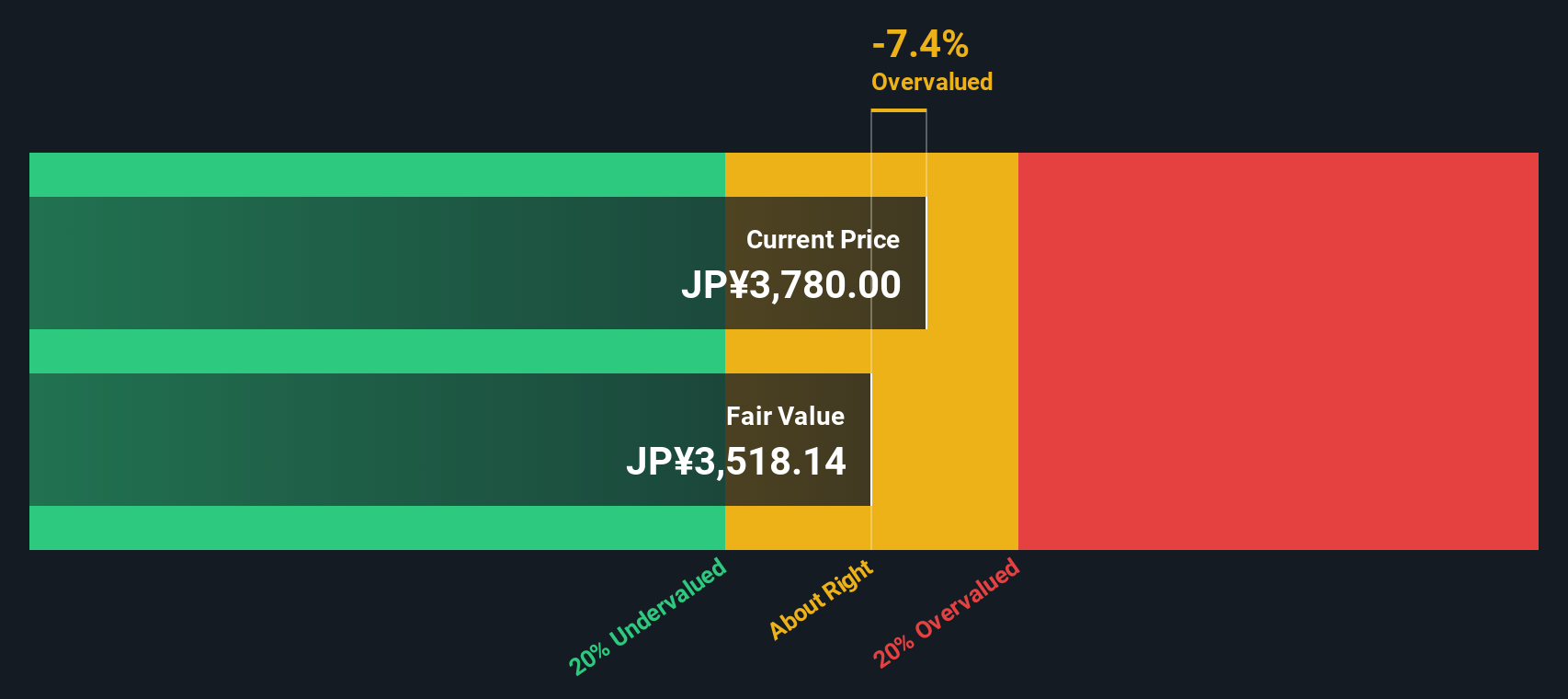

Our DCF model actually sees Kusuri No Aoki as slightly overvalued, with the current ¥3,699 price a touch above an estimated fair value of around ¥3,635. If cash flows are already priced in, future upside may depend more on sentiment than on fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kusuri No Aoki Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kusuri No Aoki Holdings Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Kusuri No Aoki Holdings.

Ready for your next investing edge?

Do not stop at one idea, you will uncover more compelling opportunities, sharpen your strategy, and stay ahead of slower investors using the Simply Wall St screener.

- Capture potential mispricings by targeting companies trading below intrinsic value with these 913 undervalued stocks based on cash flows, and position yourself before the crowd catches on.

- Capitalize on the AI revolution by zeroing in on innovators shaping tomorrow’s technology landscape through these 25 AI penny stocks before their growth stories go mainstream.

- Strengthen your income strategy by focusing on reliable cash generators offering attractive yields using these 13 dividend stocks with yields > 3%, so your portfolio keeps working even in quieter markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com