Assessing Lockheed Martin’s Valuation Amid Flat Share Price and Rising Defense Contracts

- Wondering if Lockheed Martin is still attractive at around $474 a share or if the best days are behind it? This article will unpack what the current price really implies about potential future returns.

- The stock has been almost flat over the past year, slipping 0.2% despite a 54.5% gain over the last 5 years and only modest moves of 0.9% over 30 days and 6.5% over 3 years. This hints at a market that is undecided rather than outright bearish.

- Recently, investors have been digesting headlines around escalating geopolitical tensions, renewed focus on defense spending by NATO members, and fresh multi year contract wins for missile defense and fighter programs. All of this reinforces Lockheed Martin's role as a core defense supplier. At the same time, political debate around US budget priorities and defense outlays has added more uncertainty to how much of that demand ultimately translates into long term cash flows.

- Right now, Lockheed Martin scores a 5/6 valuation check, suggesting the market may be underpricing the stock on several fundamentals. Next, we will walk through the main valuation approaches investors use, before finishing with a more holistic way to think about what the shares may be worth.

Find out why Lockheed Martin's -0.2% return over the last year is lagging behind its peers.

Approach 1: Lockheed Martin Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash Lockheed Martin is expected to generate in the future, then discounts those projections back into todays dollars to estimate what the business is worth now.

Lockheed Martin currently generates about $4.5 billion in Free Cash Flow in $, and analysts expect this to rise to around $7.5 billion by 2029 based on a 2 Stage Free Cash Flow to Equity approach. Simply Wall St extends analyst forecasts beyond the first five years, gradually slowing the growth rate so that cash flows in the later years, such as 2035, reach just over $9 billion rather than growing indefinitely at a high rate.

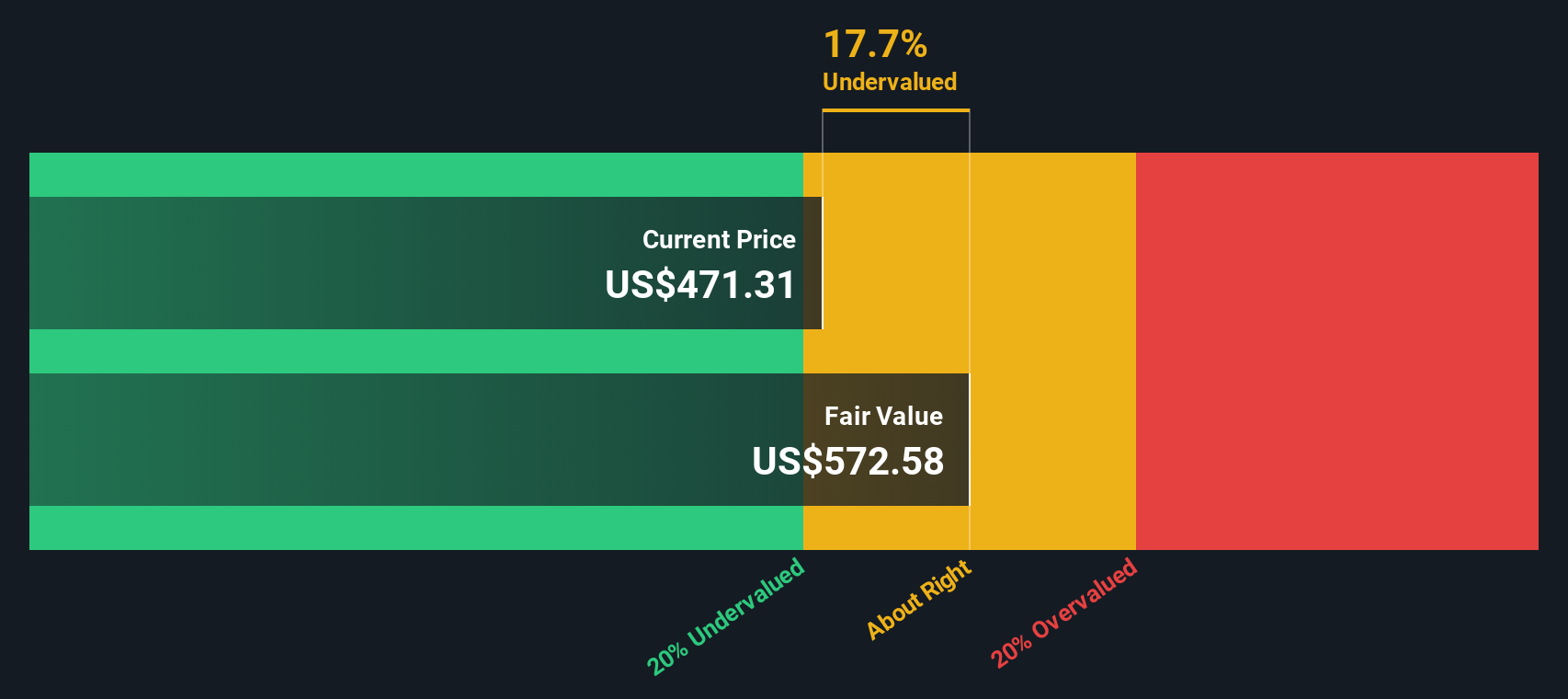

When all those future cash flows are discounted back to the present, the DCF model estimates an intrinsic value of roughly $624.92 per share. Compared with a current price around $474, this implies the stock is about 24.1% undervalued on a cash flow basis, which some investors may view as a reasonable margin of safety for long term investing.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lockheed Martin is undervalued by 24.1%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Lockheed Martin Price vs Earnings

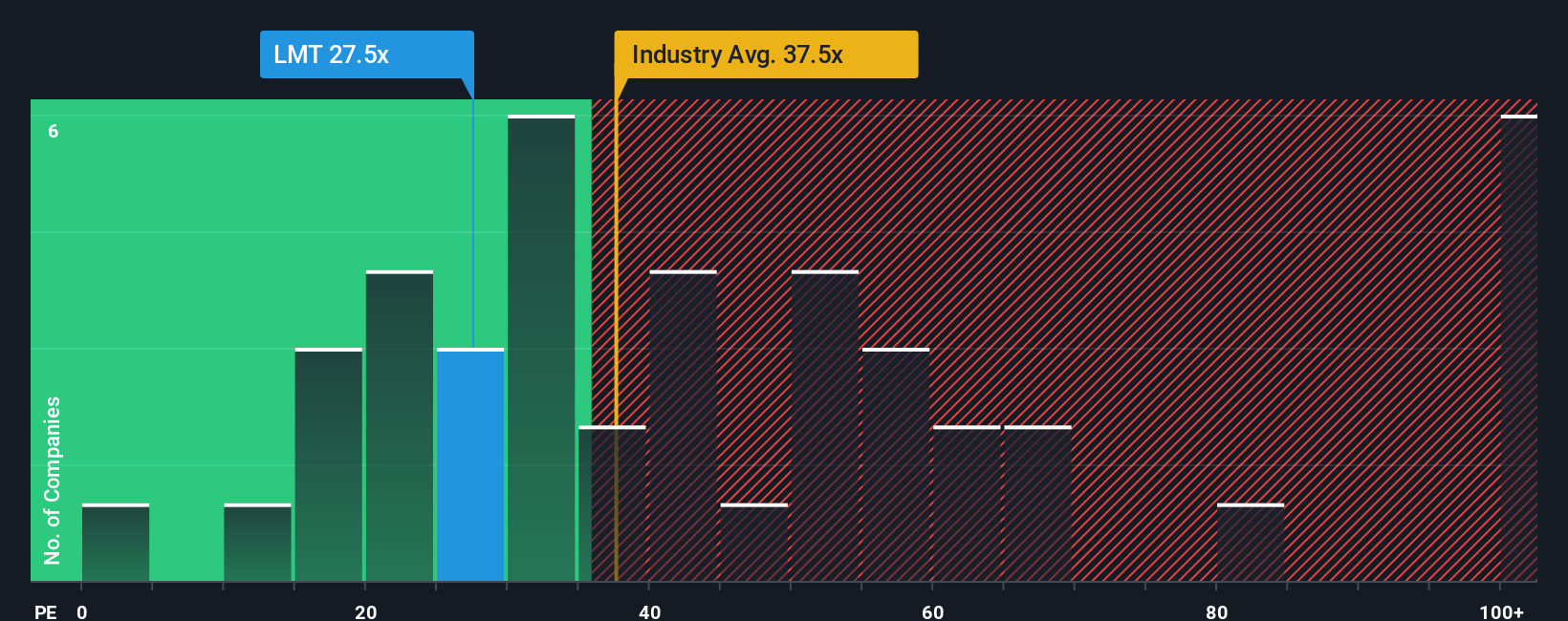

For a mature, consistently profitable company like Lockheed Martin, the Price to Earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, higher growth and lower perceived risk justify a higher PE, while slower growth or elevated uncertainty usually call for a lower, more conservative multiple.

Lockheed Martin currently trades on a PE of about 26.1x, which sits below both the Aerospace and Defense industry average of roughly 36.5x and the broader peer group average around 34.2x. Simply Wall St also calculates a Fair Ratio of about 34.5x for Lockheed Martin, which is the PE you might expect given its earnings growth profile, margins, size, sector, and risk characteristics. This is more tailored than a simple comparison with peers, because it adjusts for the company’s own fundamentals rather than assuming every defense stock deserves the same valuation.

With the fair PE of 34.5x above the current 26.1x, the multiple based view points to Lockheed Martin being undervalued on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1466 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lockheed Martin Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company, translated into numbers like fair value, future revenue, earnings and margins, then linked to a clear buy or sell decision.

On Simply Wall St, Narratives live in the Community page and make this process accessible, helping you connect what you believe about Lockheed Martin’s programs, budgets and risks to a concrete financial forecast and an explicit fair value that you can compare with today’s share price.

Because Narratives on the platform are dynamic and update as new news, earnings and guidance arrive, they act like a living investment thesis. This means you can see when changing facts push fair value further above or below the current price and adjust your decision accordingly.

For example, one Lockheed Martin Narrative might lean bullish with a fair value near $544, assuming resilient demand and improving margins. A more cautious Narrative may sit closer to $398, highlighting budget risks and contract execution issues. Those two perspectives will naturally lead to very different choices about whether to add, hold, or trim the stock at current levels.

Do you think there's more to the story for Lockheed Martin? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com