Revisiting Freddie Mac (FMCC) Valuation After Kenny M. Smith’s Appointment as CEO and Board Member

Federal Home Loan Mortgage (FMCC) is back in focus after Freddie Mac tapped veteran adviser Kenny M. Smith as its new CEO and board member, a leadership shift that naturally invites fresh views on valuation.

See our latest analysis for Federal Home Loan Mortgage.

The leadership shake up appears to be landing well with investors, with a 1 day share price return of 2.36 percent at 10.39 dollars and strong longer term total shareholder returns suggesting momentum is still broadly intact, despite a softer 90 day share price return of negative 15 percent.

If this leadership change has you rethinking your financials exposure, it could be worth exploring fast growing stocks with high insider ownership as another source of ideas before markets reprice the next wave of potential winners.

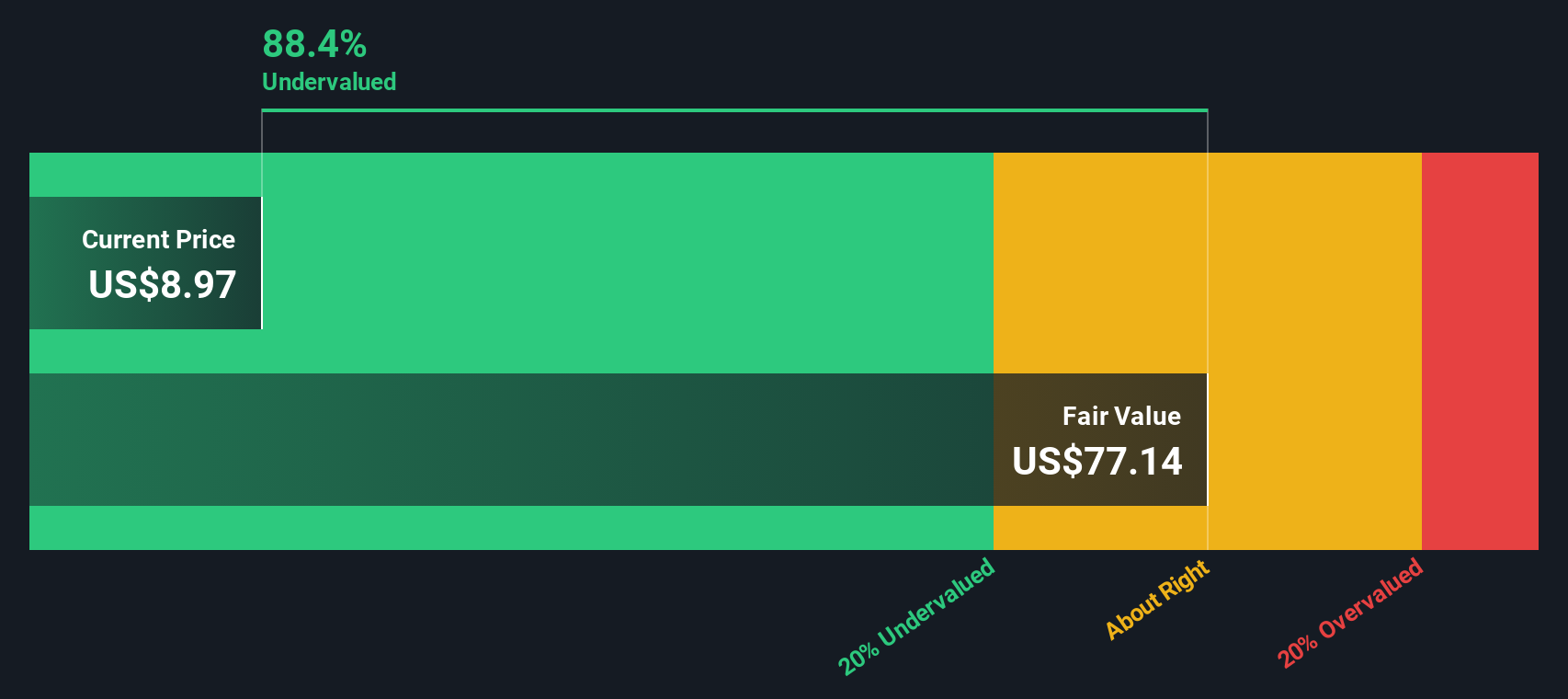

With shares still trading well below analyst targets but recent gains hinting at renewed confidence, is Federal Home Loan Mortgage quietly undervalued, or is the market already baking Kenny Smith’s tenure into expectations for future growth?

Price-to-Sales of 1.5x: Is it justified?

On a price-to-sales basis, Federal Home Loan Mortgage looks discounted, with its 1.5x multiple sitting well below peers despite the recent share price rebound.

The price-to-sales ratio compares the company’s market value to the revenue it generates. This can be a useful lens for a capital intensive, often cyclical mortgage finance business where earnings can swing with credit cycles and accounting charges.

With FMCC still unprofitable and forecast to remain so over the next three years, a low price-to-sales multiple suggests investors are heavily discounting its ability to translate its sizable 22.5 billion dollars in revenue into sustainable profits, or are wary of its 100 percent reliance on higher risk wholesale funding.

Compared with both its direct peers at 4.1x sales and the broader US diversified financials industry at 2.6x, FMCC’s 1.5x multiple points to a deep relative discount. Our fair price-to-sales estimate of 5.4x indicates substantial potential upside in valuation if sentiment around profitability and balance sheet risk improves.

Explore the SWS fair ratio for Federal Home Loan Mortgage

Result: Price-to-Sales of 1.5x (UNDERVALUED)

However, persistent losses and heavy reliance on wholesale funding could quickly undermine any valuation catch up if credit conditions tighten or investor confidence falters.

Find out about the key risks to this Federal Home Loan Mortgage narrative.

Another View: DCF Points to Far Deeper Upside

While the 1.5x sales multiple makes FMCC look cheap against peers, our DCF model goes much further and suggests the stock is trading about 91 percent below its estimated fair value of 119.21 dollars. Is the market too skeptical, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Home Loan Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Home Loan Mortgage Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Federal Home Loan Mortgage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investment move?

Do not leave your portfolio chained to one story. Use the Simply Wall Street Screener to uncover fresh ideas before other investors seize the opportunity.

- Capitalize on overlooked potential by scanning these 3623 penny stocks with strong financials that pair tiny share prices with surprisingly solid business fundamentals.

- Ride powerful structural trends by targeting these 29 healthcare AI stocks pushing the boundaries of predictive diagnostics and personalized medicine.

- Boost your income strategy by focusing on these 13 dividend stocks with yields > 3% that can add steady cash flow alongside capital growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com