KB Home (KBH) Margin Compression Deepens, Reinforcing Bearish Profitability Narrative

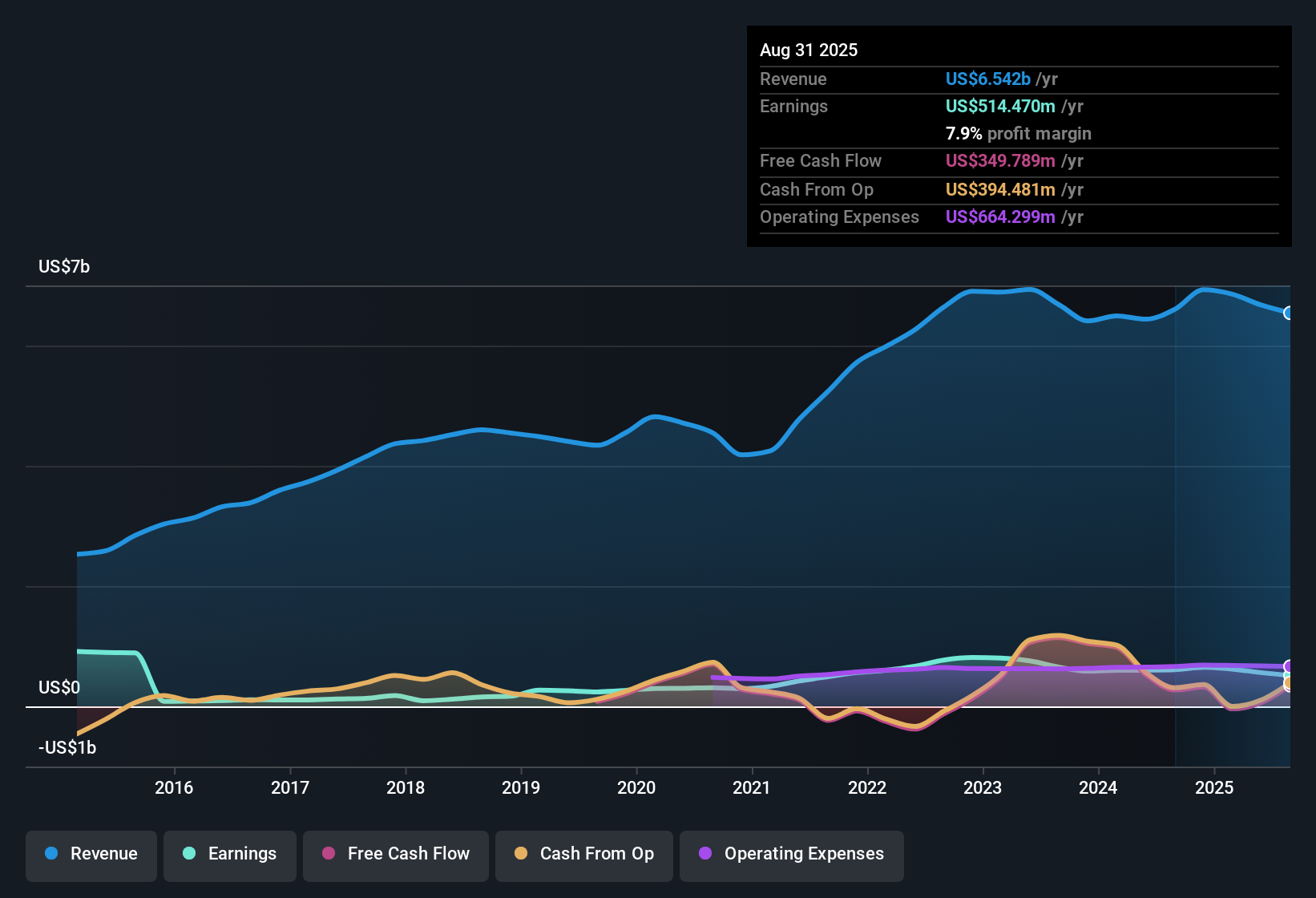

KB Home (KBH) has wrapped up FY 2025 with fourth quarter revenue of about $1.7 billion and basic EPS of roughly $1.59, setting a clear marker for how its homebuilding cycle is playing out amid softer profitability trends over the past year. The company has seen quarterly revenue ease from around $2.0 billion and EPS of about $2.59 in Q4 2024 to $1.7 billion and $1.59 in Q4 2025, while trailing net profit margins have compressed. This puts the spotlight firmly on how sustainable its current earnings power really is for investors.

See our full analysis for KB Home.With the headline numbers on the table, the next step is to weigh these results against the dominant narratives around KB Home, testing where the latest earnings back up the prevailing story and where they start to push back on it.

See what the community is saying about KB Home

Margins Squeeze as Net Income Falls from $189 million to $102 million

- Net income in Q4 2025 was about $102 million on $1.7 billion of revenue, down from roughly $189 million on $2.0 billion of revenue in Q4 2024, which lines up with the drop in trailing net profit margin from 9.4 percent to 6.9 percent.

- Bears point to this margin compression as evidence of weaker profitability, and the numbers give them support:

- On a trailing basis, revenue has slipped from about $6.9 billion to $6.2 billion while net income moved from roughly $650 million to $429 million, so the business is generating less profit from a slightly smaller sales base.

- Analysts also see margins continuing to shrink, with profit margin expectations moving from around 9.1 percent to 7.3 percent in three years, which fits the narrative that earnings power is under pressure.

Top line Holds Up Better Than Earnings in FY 2025

- Across FY 2025, quarterly revenue stepped up from about $1.4 billion in Q1 to $1.7 billion in Q4, yet quarterly net income slipped from roughly $109 million to $102 million over the same span, showing that sales have been steadier than profit.

- Analysts' consensus narrative talks about better build times, strategic land buys, and pricing actions helping demand, and the figures partly back that up while also showing strain:

- Trailing twelve month revenue has eased only modestly from roughly $6.9 billion to $6.2 billion, which is more resilient than the sharper move in net income from about $650 million to $429 million, suggesting operational or pricing pressure rather than a collapse in demand.

- At the same time, analysts still forecast revenue to drift down around 0.5 percent per year and earnings to fall about 6.6 percent per year over the next three years, so even with operational improvements the numbers embed a softer growth path than the optimistic narrative might imply.

Cheap on P/E, but Below DCF Fair Value

- KB Home trades at a P E of 8.5 times compared with about 11.1 times for the US consumer durables industry and 15.4 times for peers, yet its $57.39 share price sits well above the cited DCF fair value of roughly $23.40.

- Supporters highlight the low multiple and 1.74 percent dividend as a value opportunity, but the data paints a more mixed picture:

- The trailing earnings base behind that low multiple has already slipped, with basic EPS on a trailing basis moving from about $8.70 to $6.31 while forecasts call for earnings to decline roughly 6.6 percent annually, which can justify a lower multiple than peers.

- On top of that, the DCF fair value of about $23.40 is far below the current $57.39 share price, so investors leaning on discounted cash flow rather than relative P E comparisons may see limited upside despite the apparent discount to peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for KB Home on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and think the story should read differently? Share your view in just a few minutes, Do it your way.

A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

KB Home’s compressing margins, falling earnings, and potential overvaluation versus DCF fair value raise questions about how secure its long term returns really are.

If you are wary of paying up for weakening profitability and uncertain upside, use our these 914 undervalued stocks based on cash flows to quickly zero in on stocks where price still lags fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com