MercadoLibre (MELI): Evaluating Valuation as Growth, Fintech Expansion and Warehouse Robots Draw Fresh Investor Attention

MercadoLibre (MELI) is back on traders radar after a busy stretch that blends real world automation with digital scale, from humanoid robots in its warehouses to accelerating Fintech adoption in Brazil and Mexico.

See our latest analysis for MercadoLibre.

That automation push is landing against a mixed price backdrop, with the latest $1,997.61 quote coming after a soft patch that left the 90 day share price return at minus 18.54 percent. At the same time, the 3 year total shareholder return of 127.44 percent shows that long term momentum remains firmly intact.

If MercadoLibre’s story has you thinking about what else might be compounding under the radar, this is a good moment to explore fast growing stocks with high insider ownership.

With analysts still targeting prices more than 40 percent above today’s level and valuation multiples sitting below many high growth retail peers, is MercadoLibre quietly undervalued here, or is the market already pricing in its next growth chapter?

Most Popular Narrative Narrative: 29.8% Undervalued

With MercadoLibre last closing at $1,997.61 versus a narrative fair value near $2,847, the current gap sets up an ambitious growth driven thesis.

Cross platform integration of commerce, fintech, and advertising, demonstrated by accelerated ad revenue growth and enhanced tools for sellers, deepens ecosystem stickiness, reinforcing customer lifetime value and delivering operating leverage that can support above consensus net income and earnings growth.

Want to see what kind of revenue climb, margin reset, and future earnings multiple are baked into that outcome? The projections behind this target may surprise you.

Result: Fair Value of $2,847.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising credit losses or prolonged margin pressure from lower fees and shipping subsidies could quickly challenge the case for bullish margin expansion.

Find out about the key risks to this MercadoLibre narrative.

Another Take on Valuation

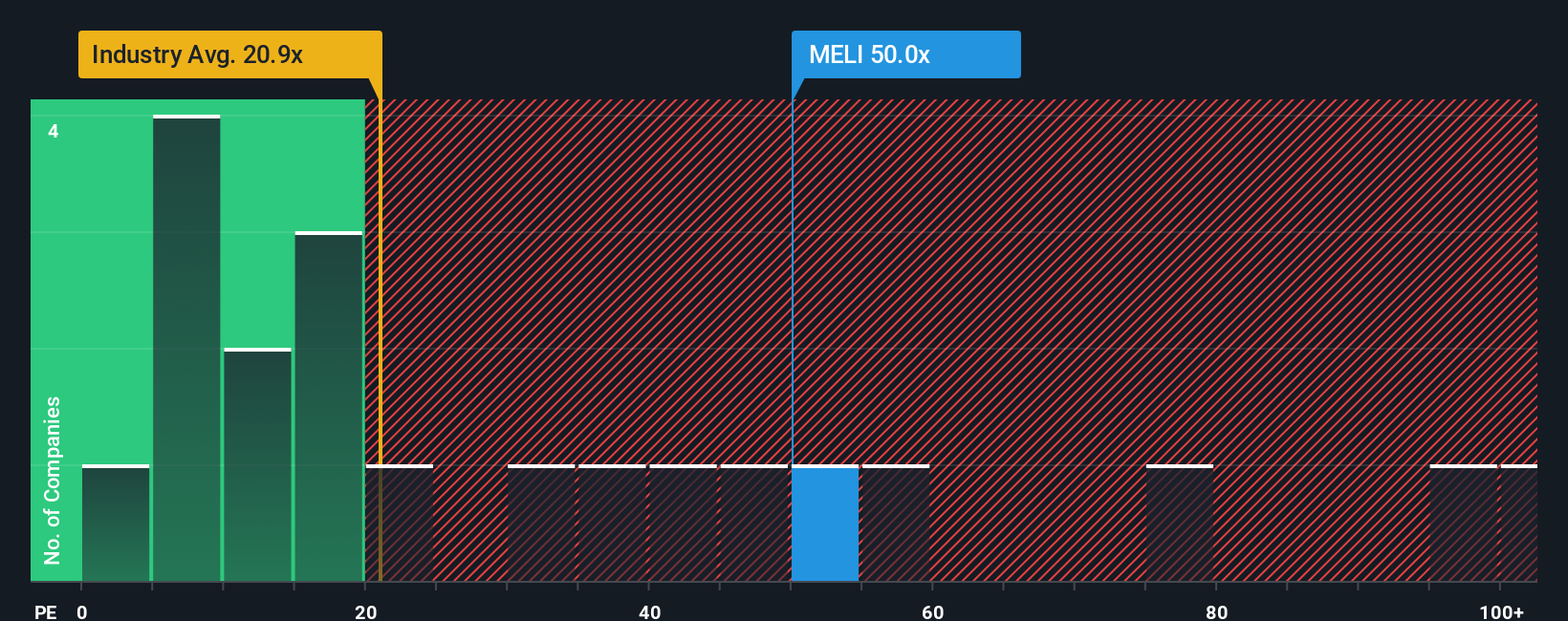

On basic valuation ratios, MercadoLibre tells a tougher story. Its 48.8x price to earnings is richer than both its 34.6x fair ratio and the 19.2x industry average, signaling meaningful multiple risk if sentiment turns. Is the growth story strong enough to keep that premium intact?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MercadoLibre Narrative

If you see things differently or want to dig into the numbers yourself, you can spin up a personalized view in just minutes: Do it your way.

A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by scanning targeted stock ideas on Simply Wall Street, so you can review more potential opportunities.

- Review these 914 undervalued stocks based on cash flows that our models flag as trading below their estimated intrinsic value.

- Explore these 25 AI penny stocks that are reshaping industries with intelligent automation and data driven products.

- Assess these 13 dividend stocks with yields > 3% offering dividend yields that may support a long term total return plan.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com