IPO Foresight | Fifth in the industry, it is difficult to stop the profit side from deteriorating. Is the new story of Midoduo's overseas e-commerce operations difficult to tell?

With advanced production capacity and diversified industrial clusters, Chinese cross-border e-commerce enterprises have shown strong competitiveness in the international market. Combined with strong support from China's policies for the development of the cross-border e-commerce industry, the scale of China's cross-border e-commerce industry will reach 461.7 billion US dollars in 2024.

As the cross-border e-commerce industry continues to grow, the market demand for cross-border e-commerce marketing services continues to increase. According to Insight Consulting data, by 2024, China's cross-border e-commerce marketing market had reached 14.3 billion US dollars.

Meanwhile, Midoduo, which has begun a new listing process in Hong Kong, is a representative enterprise that has emerged in the cross-border e-commerce marketing market. The Zhitong Finance App observed that Midoduo submitted a listing application to the main board of the Hong Kong Stock Exchange on December 9, with CCB International as its sole sponsor.

According to Insight Consulting data, in terms of revenue in 2024, Midoduo is the fifth largest cross-border e-commerce marketing service provider in China, and Midoduo is also the company that provides the most comprehensive service portfolio and serves the largest number of customers.

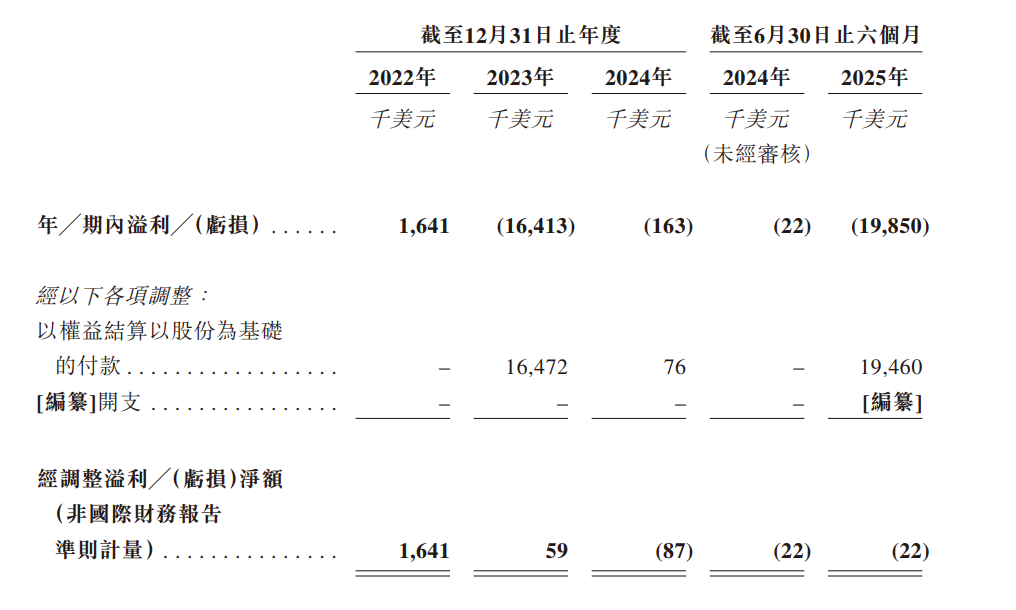

However, judging from the performance, Midoduo is still in continuous loss. According to the prospectus, from 2022 to 2024, Midoduo's revenue was US$65.17 million, US$708.51 million, and US$71.32 million, respectively, and net profit for the period was US$1.641 million, -US$16.413 million, and -US$163,000, respectively. In the first half of 2025, although Miduo's revenue surged 81.6% to US$557.79 million, the net loss during the period further expanded, from a loss of US$22,000 to a loss of US$1.85 million.

However, if compared to continuous losses, Midoduo may face a greater problem.

Highly dependent on overseas marketing services, the decline in gross margin became the main cause of loss

The development history can be traced back to Midoto in May 2014, and its development history of over ten years can be divided into three different stages. From 2014 to 2017, Midoto was an intermediary for traditional cross-border trade, and joined the Google Partner Program in 2015, which laid the foundation for it to later become an elite partner.

From 2018 to 2021, Miduo transformed into a digital advertising agency to help international digital media platforms such as Google, TikTok, and Amazon increase their advertiser base related to cross-border e-commerce in China.

Since 2021, as the global “home economy” continues to heat up, cross-border e-commerce has exploded at an accelerated pace, and Miduo has taken advantage of industry opportunities to gradually transform into a cross-border e-commerce marketing service provider, which has helped Chinese brands sell products to overseas consumers through international digital media platforms. In the middle of this year, Miduo co-hosted the first China Cross-border E-commerce Fair and launched a digital exhibition service.

According to the prospectus, while Midoduo is an elite partner of Google, it became the official advertising agency of TikTok for Business in 2024 and the official advertising agency of Amazon in 2025. Since 2022, Midoto has successfully assisted more than 1,700 direct customers to promote their brands, services or products to more than 20 countries in Europe, America, Asia and Oceania.

At present, Midoduo has formed three major business lines, namely overseas marketing services, overseas e-commerce operations, and digital exhibition services. Among them, overseas marketing services refer to helping advertisers promote their brands, services and products on international digital media platforms; digital exhibition services refer to co-hosting the China Cross-Trade Fair with Huiyuan International Exhibition and providing booths for exhibitors; while overseas e-commerce operations are where Miduo orders and purchases products from brand partners and sells products directly to overseas individual consumers through international digital media platforms. It is worth noting that overseas e-commerce operations are a new business that Midoduo only restarted in May 2025.

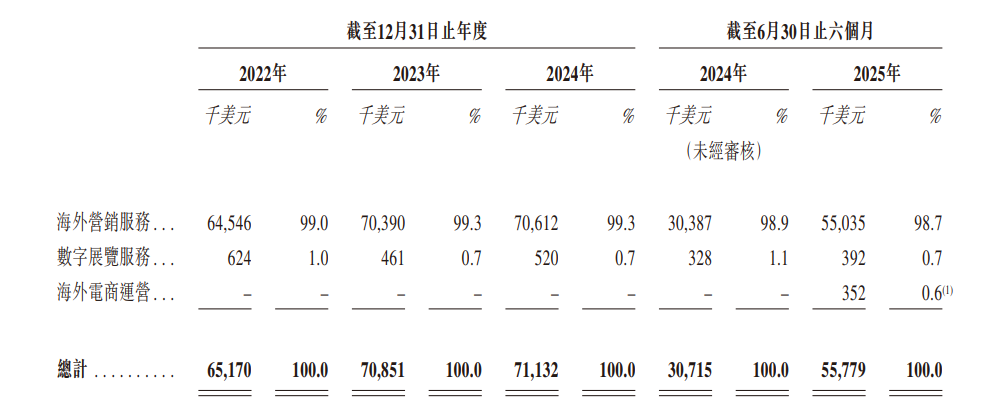

However, judging from the revenue structure, Miduo currently relies heavily on the single business of overseas marketing services. According to the data, from 2022 to 2024, Miduo's overseas marketing services accounted for 99%, 99.3%, and 99.3% of revenue, respectively, while digital exhibition services accounted for less than 1% of revenue in 2023 and 2024. However, in the first half of 2025, although overseas e-commerce operations have already recorded revenue, their share is still small, and overseas marketing services still account for 98.7% of revenue.

Thanks to the steady development of overseas marketing services, Miduo's revenue from 2022 to 2024 showed a slight increase, but its profit side continued to lose money. Even when viewed using the adjusted net profit indicator, you can clearly feel the deterioration of Midoduo's profit side. Its adjusted net profit from 2022 to 2024 was US$1,641 million, US$59,000, and -87,000, respectively, and a loss of US$22,000 in the first half of 2025.

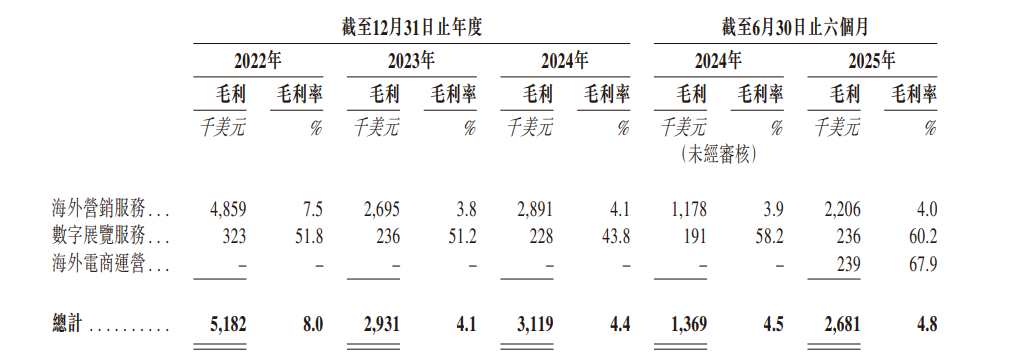

The key reason for the deterioration in Midoduo's profit side is the sharp decline in the company's gross margin compared to 2022. According to the data, in 2022, Mido's gross margin was 8%, but in 2023 and 2024, its gross margins were 4.1% and 4.4%, respectively, almost “falling short”. Gross margin rebounded to 4.8% in the first half of 2025 because the introduction of high-margin overseas e-commerce operations optimized profit levels to a certain extent.

Looking at the details, there are various factors that led to a sharp decline in Mido's gross margin compared to 2022. In mid-2023, the main reason for the decline in gross margin was higher media costs. Media costs rose from 98.6% to 99.3%, which suppressed the release of gross profit. Although media costs declined in 2024, other costs, including the costs of organizing cross-trade fairs in China, the cost of products sold under overseas e-commerce operations, and expenses such as taxes and surcharges increased dramatically. This hedged the benefits of falling media costs to a certain extent, so gross margin only increased slightly to 4.4%.

Looking through the three-fee structure of Midoduo in 2022 and 2024, it can be seen that the three expenses of marketing, administration, and R&D together account for about 4% of total revenue. This data means that when the company's gross margin falls to around 4%, it becomes a critical tipping point — because as long as three expenses or other expenses increase, it may directly squeeze profit margins and increase the possibility that the company will fall into losses.

The “fragility” of overseas marketing services and the “weakness” of the new growth curve

In fact, cross-border e-commerce marketing services are not a good business because the business model of this business is prone to double “pinch” between the cost side and the demand side. Take Midoduo as an example. It is highly dependent on overseas marketing services. The cost side of media costs is absolutely huge. Once downstream demand is strong, the media side will take the opportunity to increase traffic costs, which will affect the release of gross profit. The best proof is that Miduo's media costs rose to 99.3% in 2023, causing the gross profit margin to “drop”.

And when media costs drop, does this mean that the environment facing Miduo will improve? The answer is probably not. The logic behind this is that the decline in media costs is often due to weakening downstream demand, that is, the desire of customers to launch is already relatively low. At this time, customers will not only reduce the scale of marketing, but there is also a possibility that prices will be depressed.

According to the prospectus, Miduo's overseas marketing service reached 1,075 customers in 2024, which is nearly three times that of 362 in 2023, but Miduo's total procurement expenses from digital media platform vendors were only US$63.82 million, down from US$69.59 million in 2023. There is a sharp rise in the number of customers and a decrease in total expenses. There are two possibilities: either the customer has drastically cut expenses or the loss of major customers.

It can be seen from this that Miduo's overseas marketing service business model has obvious “fragility,” and the core reason for the “fragility” is that the business is essentially a “traffic intermediary,” but traffic is highly concentrated on a few international digital media platforms. As a result, Miduo lost its bargaining power, which led to narrow profit margins.

In order to get rid of its dependence on a single marketing service, Miduo has begun trying to expand digital exhibition services in recent years, but progress has been slow. Since 2022, the business still accounts for less than 1% of revenue. In view of this, Miduo launched a new overseas e-commerce operation business in May of this year, hoping to tell a new growth story for the capital market.

Judging from the synergy effect, Miduo's overseas e-commerce operation business does have obvious synergetic advantages based on the accumulation of overseas marketing services, but e-commerce operations require integrating multiple links such as supply chain, logistics, and after-sales. The cost is high and the cycle is long, and it may be difficult to form a large-scale effect in the short term. Moreover, competition in the cross-border e-commerce market is also intense. Platforms such as SHEIN and TEMU already occupy a large market share. As a new entrant, Midoduo is facing challenges in customer acquisition and brand recognition.

Furthermore, since overseas e-commerce operations require high investment in the early stages, this will continue to affect Midoduo's profit performance. This is already reflected in the 2024 financial report. The sharp increase in other costs under revenue costs is related to the expansion of overseas e-commerce operations.

Overall, based on Midoduo's current heavy reliance on overseas marketing services with a weak business model and the dilemma of a weak new growth curve, it is difficult to obtain a high valuation in the capital market. However, the key to changing the market's perception is whether a new growth curve can be successfully constructed, but it will be difficult to achieve results in the short term, and may even drag down the profit side, so Midoduo may enter a “painful period” of development.