Nike (NKE) Q2 2026 Margin Compression Reinforces Bearish Profitability Narratives

Nike (NKE) just posted its Q2 2026 numbers, with revenue at $12.4 billion, basic EPS of $0.54 and net income of $792 million setting the tone for the latest quarter. The company has seen revenue move from $12.4 billion in Q2 2025 to $12.4 billion in Q2 2026, while basic EPS shifted from $0.78 to $0.54 over the same period, giving investors plenty to dissect around how underlying margins are tracking.

See our full analysis for NIKE.With the headline figures on the table, the next step is to compare these results with the most widely followed narratives around Nike’s growth, profitability and execution to see which stories still hold up and which ones need a rethink.

See what the community is saying about NIKE

Margins Squeezed Despite Stable Sales

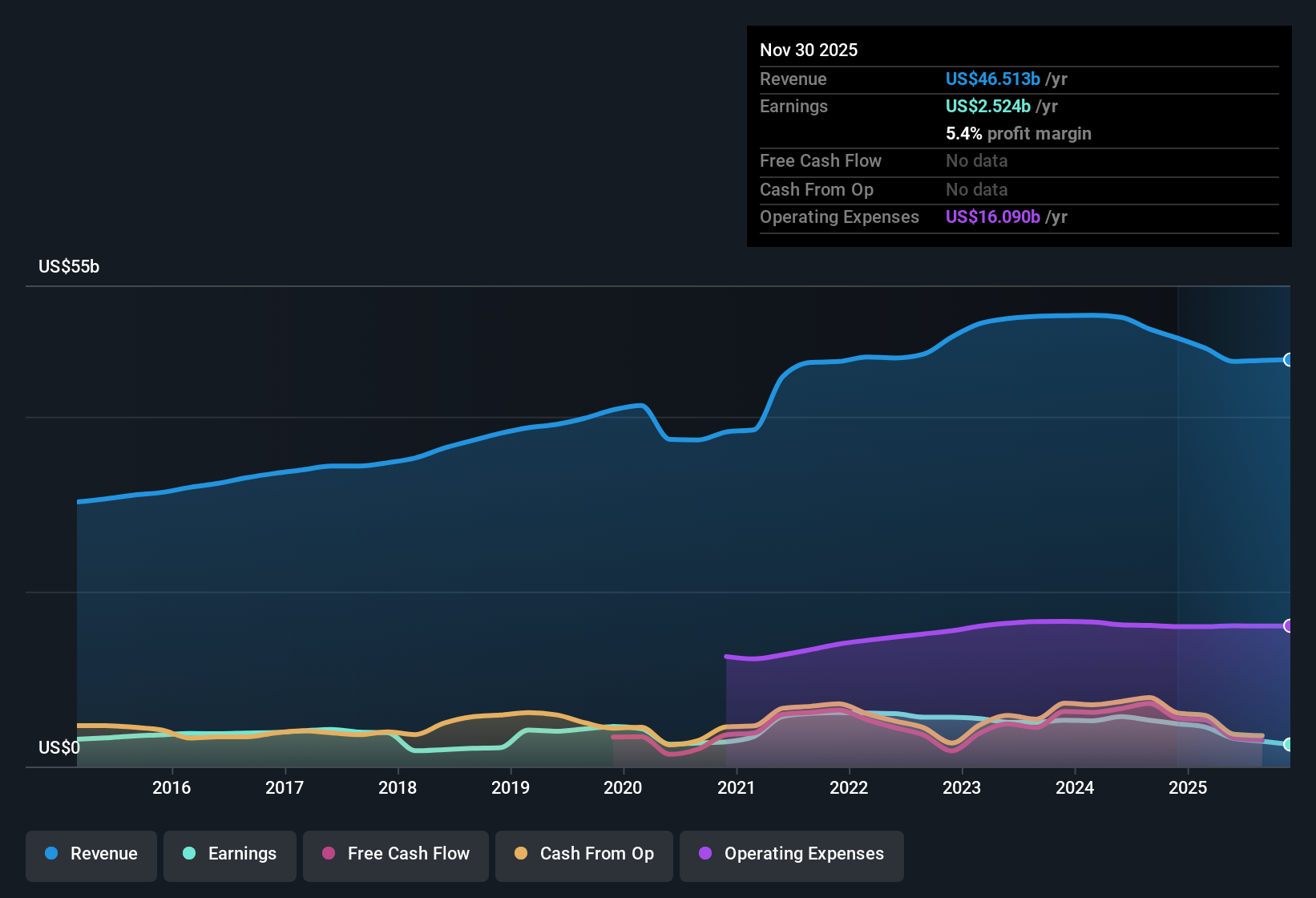

- Trailing net income fell from about $4.9 billion to $2.5 billion over the last year, dragging net margin from 10 percent to 5.4 percent even though trailing revenue only eased from roughly $50.0 billion to $46.5 billion.

- Critics highlight that gross margin pressures from markdowns and discounts are weighing on Nike Sportswear and Jordan, and the drop in net margin to 5.4 percent versus 10 percent a year ago aligns with that bearish concern even as management pushes cleaner inventories and fewer promotional days to rebuild profitability over time.

- The consensus narrative points to higher markdowns, wholesale discounts and inventory obsolescence, which is consistent with net income sliding from $4.9 billion to $2.5 billion on a trailing basis.

- At the same time, efforts to reduce excess inventory in classic footwear and tighten distribution are intended to support margins later but are clearly not yet visible in the current 5.4 percent net margin.

Short Term EPS Stabilising

- Basic EPS for the last four quarters moved from $0.70 in Q1 2025 to $0.54 in Q2 2026, but the path has been uneven, with a low of $0.14 in Q4 2025 followed by a rebound to roughly $0.49 in Q1 2026.

- Consensus narrative notes that Nike is leaning into sport performance and brand storytelling to support earnings, and the recovery from the $0.14 EPS trough to around the mid $0.50 range over recent quarters gives bulls some evidence that profitability initiatives are flowing through, even if EPS is still below the $0.78 level seen in Q2 2025.

- The focus on refreshing the product mix toward performance lines is meant to reduce reliance on declining classic franchises, which could help explain EPS stabilising near $0.50 after the sharp dip in Q4 2025.

- Repositioning Nike Digital to cut promotional days ties directly to protecting per pair profitability, which is consistent with EPS improving from $0.14 to above $0.49 over the last two reported quarters.

Premium Valuation Needs 20 percent EPS Growth

- With the share price at $58.71, analysts see roughly 3 percent upside to their $78.84 price target and a DCF fair value of $61.71, while Nike trades on a 34.4 times P E multiple that is above both the US Luxury industry at 20.2 times and peers at 29.1 times.

- Supporters argue that forecast earnings growth of about 20.2 percent per year and an expected margin lift from 7.0 percent to 8.6 percent justify paying that premium, but the history of five year earnings declining roughly 5.8 percent annually and trailing revenue growth forecast at only 4.7 percent per year means the bullish case is heavily dependent on those margin and EPS upgrades actually materialising.

- The small discount to DCF fair value, with the stock about 4.9 percent below $61.71, gives some valuation buffer, yet a 34.4 times P E leaves limited room if the 20.2 percent earnings growth pace slows.

- Analysts also expect earnings to reach about $4.4 billion by 2028 with a price target implying a mid 30s P E, which contrasts sharply with the recent trailing net income of $2.5 billion and underlines how much improvement the market is already baking in.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NIKE on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and think the story is evolving? Capture that view in minutes and shape your own narrative today, Do it your way.

A great starting point for your NIKE research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Nike’s compressed margins, patchy earnings trajectory and rich multiple versus peers leave little room for error if forecast profit and growth improvements stall.

If that trade off feels too tight, use our stable growth stocks screener (2105 results) to quickly shift your focus toward businesses already delivering consistent revenue and earnings momentum across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com