OPENLANE (KAR): Assessing Valuation After a 22% Monthly Gain and 51% Year‑to‑Date Rally

OPENLANE (KAR) has quietly put together a strong run, with the stock up about 22% over the past month and roughly 51% year to date, reflecting growing confidence in its digital auto marketplace model.

See our latest analysis for OPENLANE.

With the share price now at $30.55 and a 30 day share price return above 20 percent feeding into a year to date gain above 50 percent, momentum looks to be rebuilding on the back of improving sentiment around OPENLANE s digital first strategy. At the same time, the strong three year total shareholder return highlights how longer term holders have already been rewarded.

If OPENLANE s move has you thinking about where else value and momentum might be lining up in autos, it is a good time to scan auto manufacturers for other ideas.

With earnings growing faster than revenue and the share price now sitting just below analyst targets, investors face a key question: Is OPENLANE still trading below its true potential, or has the market already priced in future growth?

Most Popular Narrative Narrative: 4% Undervalued

With OPENLANE closing at $30.55 against a narrative fair value of $31.81, the storyline points to modest upside driven by improving profitability and capital returns.

The accelerating shift from physical to digital platforms in the wholesale vehicle auction industry, evidenced by OPENLANE's double digit growth in dealer to dealer digital volumes and sustained market share gains, points to continued secular tailwinds for revenue growth as digital adoption remains in its early stages within a large total addressable market. Ongoing investment in AI driven products, process automation, and user experience enhancements is driving higher transaction values and operational efficiencies, which are already resulting in significant margin expansion and are likely to further improve net margins over time.

Curious how steady revenue growth, sharply higher margins and a lower future earnings multiple can still imply upside from here? The full narrative unpacks the math behind that call.

Result: Fair Value of $31.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and dilution risk from the 2026 preferred share overhang could limit multiple expansion and put pressure on earnings expectations.

Find out about the key risks to this OPENLANE narrative.

Another Angle on Valuation

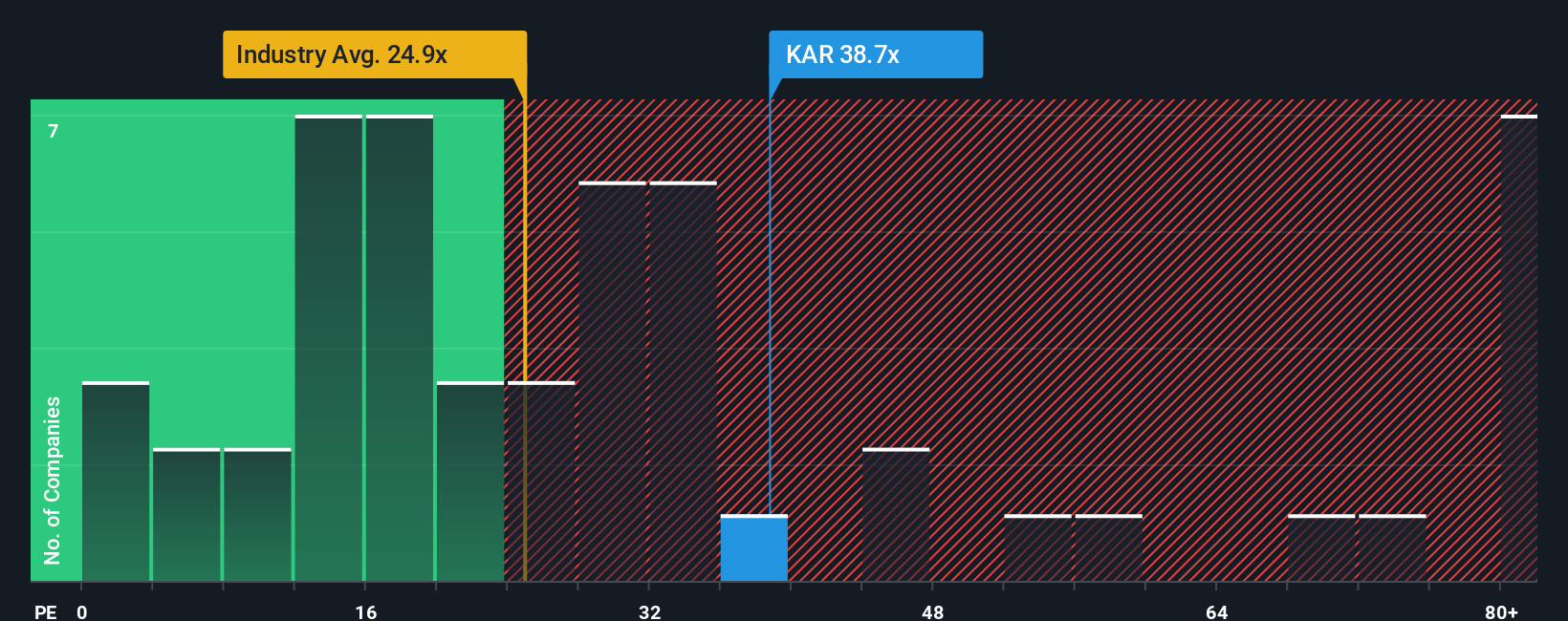

While the narrative fair value suggests OPENLANE is about 4 percent undervalued, our fair ratio work tells a different story. The current P E of 34.3 times sits above both the industry at 23.8 times and a fair ratio of 28.4 times, hinting at downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OPENLANE Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way

A great starting point for your OPENLANE research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single opportunity when you can quickly scan targeted stock ideas on Simply Wall Street and position yourself ahead of the next big move.

- Capture potential early stage growth by reviewing these 3624 penny stocks with strong financials that already show strong balance sheets and resilient fundamentals.

- Explore powerful technology trends by checking out these 25 AI penny stocks that use artificial intelligence to support scalable, long term earnings growth.

- Identify income opportunities by targeting these 13 dividend stocks with yields > 3% offering yields above 3 percent, supported by sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com