Wall Street's diversified strategy is on the rise! The trend called “rotation” quietly kicks off in global stock markets

In 2025, under the unprecedented AI investment boom that has taken the global stock market by storm, an old school (old school) college stock trading strategy dominated by Wall Street investment institutions for a long time once again took the market by storm — a diversified stock asset allocation strategy with index ETFs as the core, that is, it not only focuses on popular technology stocks, but also pursues diversified allocation strategies for various stock market styles and segments, as well as comprehensive bond asset allocation strategies.

This year, this strategy, which focuses on diversification, has had excellent returns throughout the year — especially in the fourth quarter, when it completely outperformed the “Seven Big Tech Giants” strategy (that is, the strategy of investing only in the Magnificent Seven in the US stock market), which completely outperformed the AI bull market narrative. However, in 2025, its light was completely overshadowed by this AI boom two years after the previous two years.

Needless to say, in 2025, the global stock market already showed clear signs of rotation in various market segments, from technology stocks to value to cycle. Therefore, this diversified investment strategy, which tends to “diversify” stock allocation portfolios, has begun to reap strong excess alpha returns in the global stock market, especially since popular AI technology stocks such as Oracle, Nvidia, and Broadcom showed a significant correction trajectory in November.

As for 2026, as the market became more fearful about the AI bubble storm that blew up in November, and began to doubt that this irrational AI bubble was forming and getting closer to bursting, top Wall Street institutions, including Goldman Sachs and Morgan Stanley, predicted that large stock market rotation covering styles such as old-school value stocks, small to medium capitals, and cyclical stocks, as well as stock market rotation in different industry sectors other than technology will continue to unfold. This means that stocks other than popular AI technology stocks are likely to reap far better investment returns throughout the year.

Research reports recently released by Goldman Sachs show that large technology companies that invest the most money to “win” this AI equipment competition may face a highly uncertain return on investment for quite some time. Goldman Sachs said that the story about AI is now at the “end of the prelude” — that is, it is now at the “end of the beginning” of the AI story in the market. The bull market where most of the value created by AI will be attributed to the AI language model and the general bullish market for all assets “associated with the AI concept” is likely to have come to an end, and the market's screening of the real beneficiaries will become more strict.

A number of major Wall Street banks, including Goldman Sachs, Bank of America, Yardeni Research, and Morgan Stanley, recently stated in their annual summary and outlook that the market's growing skepticism about the high valuations of popular AI technology stocks and whether huge AI investments can bring significant returns is driving the market to pay more attention to traditional cyclical sectors such as industry and energy, as well as the small to medium markets, rather than the “Big 7 US stocks” such as Nvidia and Amazon, which have high valuations and are at the “center of the AI bubble.” Ed Yardeni, founder of Yardeni Research, recently even suggested that investors “reduce” their holdings of the top seven tech giants compared to the rest of the S&P 500 index. This is the first time since 2010 that he has changed his position on increasing his holdings in the major US technology sector.

The winners amidst the AI hustle and bustle cannot be ignored: in 2025, “decentralization” will gradually return

Amidst the hustle and bustle of the AI wave, the overwhelming rise in retail sentiment, and the “drastic reversal” of cryptocurrencies, the global stock market quietly unfolded in 2025: multiple types of diversified portfolio strategies focusing on asset diversification recorded the strongest return on investment in recent years. This is an excellent achievement that has been largely overlooked.

First, a simple combination of stocks and bonds each yielded double-digit gains, the best year since 2019. The multi-asset “quantitative strategy cocktail” — a benchmark return index that measures a diverse combination of commodities, bonds, and global equities — has significantly outperformed the US stock benchmark — the S&P 500 index.

Diversified stock asset allocation strategies focusing on various investment styles (such as value, cycle, and technology) and multiple industry sectors seem to have had the strongest return performance throughout the year. Asset management giant Cambria Investments, a transactional open-ended index fund with 29 ETFs covering the global stock market, recorded the best annual performance in history and benefited from a sharp rise in overseas markets other than the US.

This week's US CPI inflation report, which fell far short of expectations, is a lesson in the wisdom of these strategies. The US CPI inflation data released on Thursday fell far short of expectations, triggering a rare simultaneous rise in stocks and bonds. So-called risk parity funds recorded strong returns this week. This trend certainly reminds investors that even in a world where the AI boom still infuriates investors, the market environment will still reward “diversified allocation.”

However, while 2025-2026 may mark a return to the old school Wall Street diversification style, 2025 will also be recorded as another year for investors to stay away from these strategies. Capital continues to migrate to centralized allocation of popular AI technology stocks that benefit from AI, such as Magnificent Seven, as well as cutting-edge technology-themed transactions from nuclear power to quantum computing, plus “direct risk hedging tools” such as gold and silver.

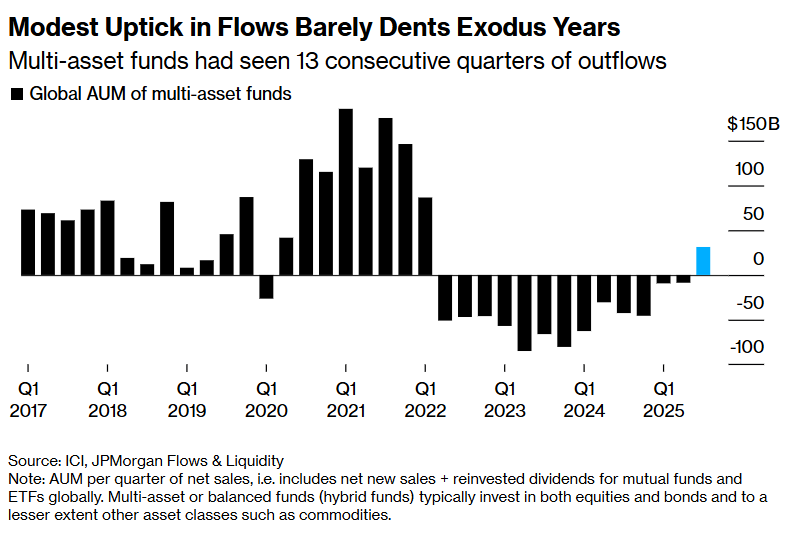

As shown in the chart below, global capital inflows have rebounded slightly, but have hardly shaken the “exit wave” over the years — diversified asset funds have experienced net outflows for 13 consecutive quarters.

The “super bull market” where the S&P 500 index has accumulated a cumulative increase of about 30 trillion US dollars over the past three years is largely driven by the world's largest tech giants (such as the seven major US tech giants), and also by companies that promote large-scale investment in AI computing power infrastructure (such as Micron, TSMC, Broadcom, etc.) and power system suppliers (such as Constellation Energy).

The so-called “seven tech giants” that occupy a high weight in the S&P 500 index (about 35%), or “Magnificent Seven,” include Apple, Microsoft, Google, Tesla, Nvidia, Amazon, and Facebook's parent company Meta Platforms. They are the core driving force behind the S&P 500 Index's record highs, and are also regarded by top Wall Street investment institutions as the combination most capable of bringing huge returns to investors in the context of the biggest technological changes since the Internet era .

2025 is by no means just a year for AI

“Although almost everyone's attention is focused on AI-related bull market narratives, 2025 isn't 'just a year of AI investment boom',” said Marko Papic (Marko Papic), chief strategist from BCA Research. “Everything is focused on globally decentralized configurations.”

As market valuations stretch and become more concentrated — especially in benchmark indices such as the Nasdaq 100 Index, where popular AI tech stocks are heavily weighted — some strategists warn that abandoning diversification at this time could expose their portfolios to risk at the most inopportune moment.

Retail investors, in particular, have been leaving balanced and diversified funds for years. According to the above statistics from J.P. Morgan Chase, this category — which includes publicly issued risk-parity funds and 60/40 portfolio ETFs (which traditionally allocate 60% stocks and 40% bonds) — had recorded net outflows for 13 consecutive quarters before showing a slight rebound this fall. Although capital continues to flow into pure debt funds and pure equity funds, the “middle ground” — a traditional diversification strategy, is still not popular.

Nikolaos Panigirtzoglou, a stock strategist at J.P. Morgan Chase, pointed out that the problem is that the AI benefits brought about by betting in recent years are too strong and the overall performance of diversified allocations is weak. Coupled with the unusual cross-asset correlation in recent years, the return on investment has been depressed. The sharp decline in the bond market in 2022 — triggered by the Federal Reserve's aggressive monetary policy tightening policy, can be described as further weakening investors' confidence in fixed income as a buffer against cross-asset portfolios.

“That one basically destroyed retail investors' psychological expectations of the bond market.” Jim Bianco (Jim Bianco), founder and helmsman of Bianco Research, said. “And that's the key — that's why investors keep jumping between different assets.”

Another new “fright” event was offered in April. When US President Donald Trump announced aggressive global trade tariffs on a televised “Liberation Day”, the global market fell, and no assets were spared. The S&P 500 index fell 9% in a week; a benchmark 60/40 combination also fell more than 5%. At the time, almost all strategies failed, and diversification failed to provide any safe-haven effect. US Treasury bonds rose slightly, while gold fell sharply. Bitcoin fell sharply, but then quickly rebounded.

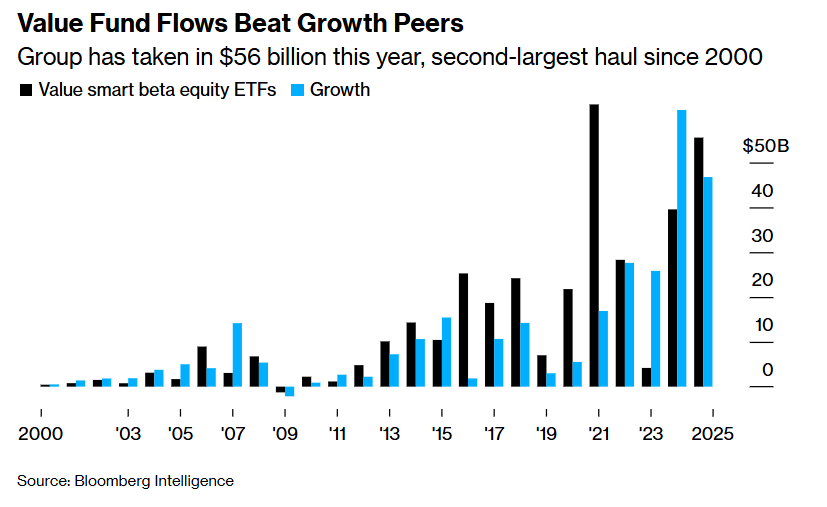

However, under the surface, the “breadth” of the market has been expanding for most of the year — highlighting that capital has begun to rotate from popular AI tech stocks benefiting from AI to other sectors. Biased stock ETFs — many of which avoid large, overweighted technology sectors — attracted more than $56 billion in capital inflows this year, the second-largest annual net inflow since at least 2000.

The trading price of Cambria's global value benchmark ETF rose sharply by about 50% this year, the best performance since its inception. International stock markets other than the US rebounded, driven by favorable fiscal reforms and the weakening of the US dollar. Small-cap stocks significantly outperformed the S&P 500 index in the fourth quarter.

The above chart shows that value funds unexpectedly outperformed growth ETFs in terms of capital inflows. This group attracted 56 billion US dollars in capital inflows this year, making it the second largest annual capital intake since 2000.

The “big rotation” may be fully staged in 2026, and a broader bull market will sweep through

Wall Street's top strategists, including Goldman Sachs and Morgan Stanley, believe this “big rotation” beyond popular AI technology stocks will continue until 2026. Greg Calnon (Greg Calnon), global co-head of public investment from Goldman Sachs Asset Management (Goldman Sachs Asset Management), predicts that US profit growth will be more widely covered, and that small and medium capitalization stocks and international stocks centered on the European and Chinese markets will outperform the US stock market. He believes that municipal bonds will continue to strengthen, and the support behind it comes from tax-adjusted yields, which are more attractive compared to US Treasury bonds, and strong investor demand.

Goldman Sachs Asset Management also said that in 2026, the global stock market will continue its bullish market. Under the influence of global populist sentiment and far-right forces, not only will the Trump administration focus on “making America great again,” but the world will also focus more on boosting domestic economic growth. Therefore, the global stock market will show a wider range of diversified rotation characteristics, and future investment opportunities will no longer focus on AI; it also stated that the so-called “AI dividend” will spread from the core seven tech giants to a wider range of fields.

Goldman Sachs said that in 2025, the global stock market has shown a clear trend of broadening sector growth and rotation. This trend will continue to strengthen in 2026, breaking the previous pattern where the market was highly concentrated on AI technology stocks, so the non-US and non-tech sectors will continue to perform strongly under rotation in 2026.

David Lebovitz (David Lebovitz) from J.P. Morgan Asset Management favors allocating emerging market bonds and UK gilts (UK gilts) while maintaining selective allocation exposure to US stocks and AI technology stocks.

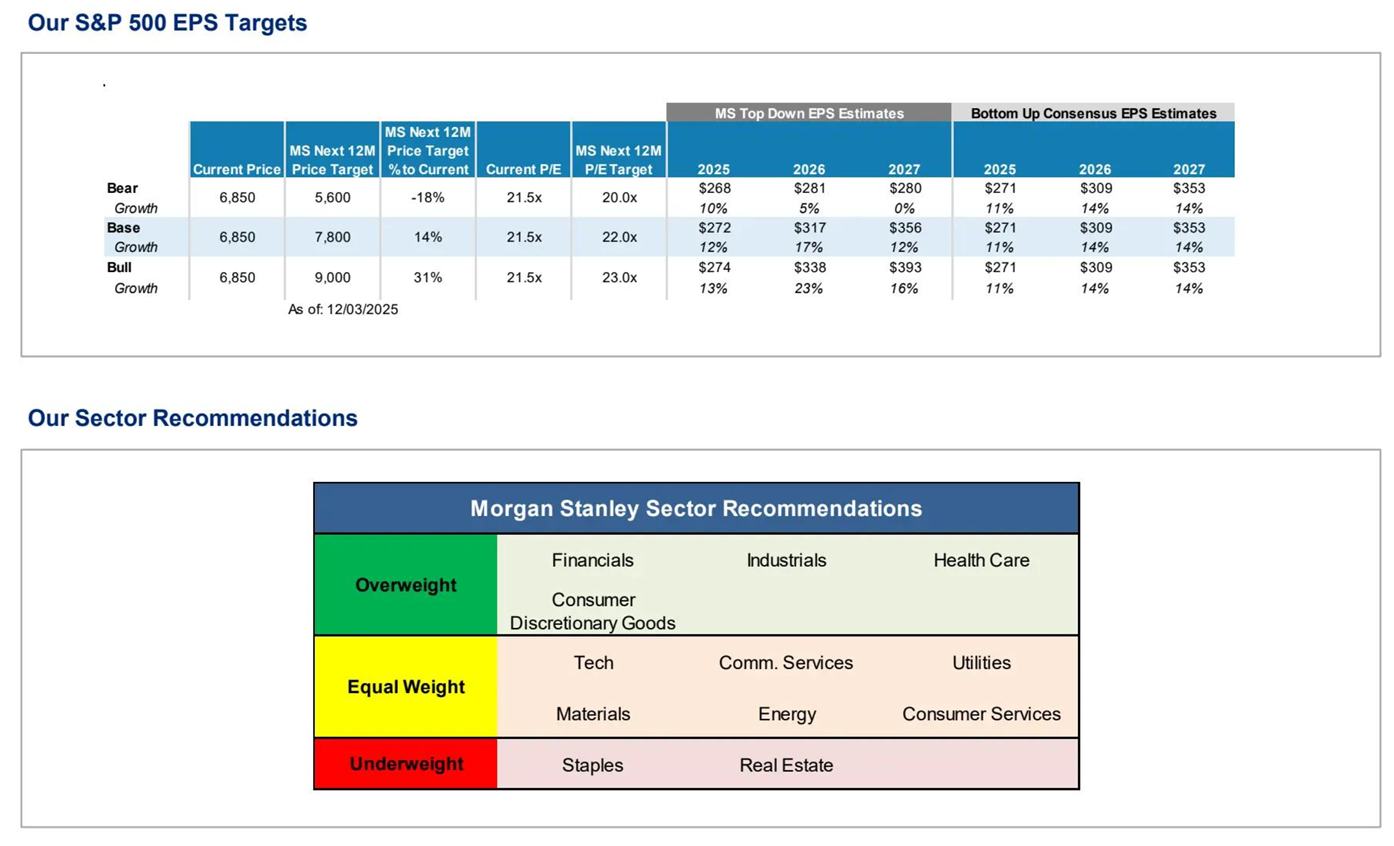

Wall Street financial giant Morgan Stanley recently released a research report saying that the OBBBA (the so-called “big and beautiful” bill) passed by the Trump administration in 2025 will strongly promote economic growth effects starting in 2026. Combined with the price increase brought about by Trump's tariff policy, it was eventually proven to be a temporary inflation disturbance until short-term inflation gradually dissipates, and technology giants such as Google are in full swing. They will jointly drive the US economy to show a “golden girl-style soft landing” of growth in 2026 environment.

Therefore, Damo defines 2026 as a “broad-spectrum stock market bull market under rolling recovery,” betting that the S&P 500 index is expected to hit 9,000 points, and argues that the return of “point-to-point” market risk appetite resonates upward with many cyclical industries.

According to the latest research report released by the Daimo strategist team led by top Wall Street strategist Michael Wilson, they believe that the current stock market is at the beginning of a new round of profit cycles and a structured bull market. It is expected that in 2026, the core leadership of the US stock market will spread from Nvidia, Google, and Microsoft, which benefit from AI to small to medium capitalization and cyclical core industries. Daimo strategists emphasized that under the main investment line of “soft landing+rolling recovery of the US economy” in 2026, cyclical stocks (especially high-cycle industries, finance, optional consumption, and healthcare) are expected to fully benefit, and their performance will be significantly superior to the average benchmark performance of the past two to three years.

Damo said that the US stock market has come out of a three-year “rolling recession” (rolling recession) and has officially entered the “rolling recovery” (rolling recovery) stage. The continuously compressed cost structure, strong profit revisions, significant improvements in corporate operating leverage, and the release of suppressed demand all together form a “typical early cycle” environment; on the macro side, Damo expects that the Federal Reserve's interest rate cut path will begin a new round of capital expenditure cycles, and real interest rates will return to normal, and corporate investment (especially AI and manufacturing) will become a new growth engine.

According to a research report released by Bank of America, another major Wall Street bank, the Trump administration will definitely adopt a “hot” economic policy in order to maintain approval ratings, so increasing commodities in 2026 will be the best trading theme, and all commodity trend charts will eventually show an upward trend like gold. The Bank of America strategist team led by Michael Hartnett, who has the title of Wall Street's most likely strategist, said that this judgment is based on the global economy shifting from a “monetary easing plus fiscal austerity” model after the financial crisis to a new investment paradigm of “fiscal easing plus de-globalization” after the pandemic, and the cyclical sector under a rotating market has the best room for relative growth.

Notably, even though some investors have abandoned classic 60/40 bets, the market has not given up on multi-asset allocations. Money is flowing to alternative assets—from private credit and infrastructure to hedge funds and digital assets—investors are seeking private exposure outside of the open market. In some cases, this search no longer revolves more around “combinatorial balance,” but rather around the ability to obtain similar “off-balance” returns on alternative assets or to isolate them from open market fluctuations.