Kanzhun (NasdaqGS:BZ) Executive Shake-Up: A Fresh Look at Whether the Stock Still Looks Undervalued

Kanzhun (NasdaqGS:BZ) just reshuffled its leadership bench, moving long time finance chief Phil Yu Zhang into a new Chief Strategy Officer role while elevating Yang Mu and Wenbei Wang into boardroom and finance positions.

See our latest analysis for Kanzhun.

The shake up comes after a strong run for the stock, with the latest share price at $20.82 and a robust year to date share price return of 52.64 percent. This suggests momentum is still building even after a softer 90 day share price return of negative 14.25 percent and a 12 month total shareholder return of 53.81 percent.

If Kanzhun’s leadership reset has your attention, it could be a good moment to see what else is gaining traction in tech and AI through high growth tech and AI stocks.

Yet with analysts seeing roughly 25 percent upside and valuation models implying an even steeper discount, investors must now decide: is Kanzhun still mispriced, or are markets already baking in the next leg of its growth?

Most Popular Narrative Narrative: 19.9% Undervalued

With Kanzhun last closing at $20.82 against a narrative fair value of $25.98, the valuation story leans positive and relies heavily on earnings resilience.

Operating leverage through cost control, efficiency gains from AI integration across R&D and customer service, and a robust two-sided network effect are together driving margin expansion, suggesting continued improvement in net margins and profitability.

Want to see how steady revenue growth, rising margins and a rich future earnings multiple can still point to upside? The full narrative unpacks the precise earnings path, the margin trajectory, and the discount rate assumptions that all have to line up for this valuation to hold.

Result: Fair Value of $25.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, demographic headwinds and intensifying competition could dampen user growth and pressure margins, which may delay the earnings and valuation upside implied in the narrative.

Find out about the key risks to this Kanzhun narrative.

Another View: Market Multiples Send a Caution Flag

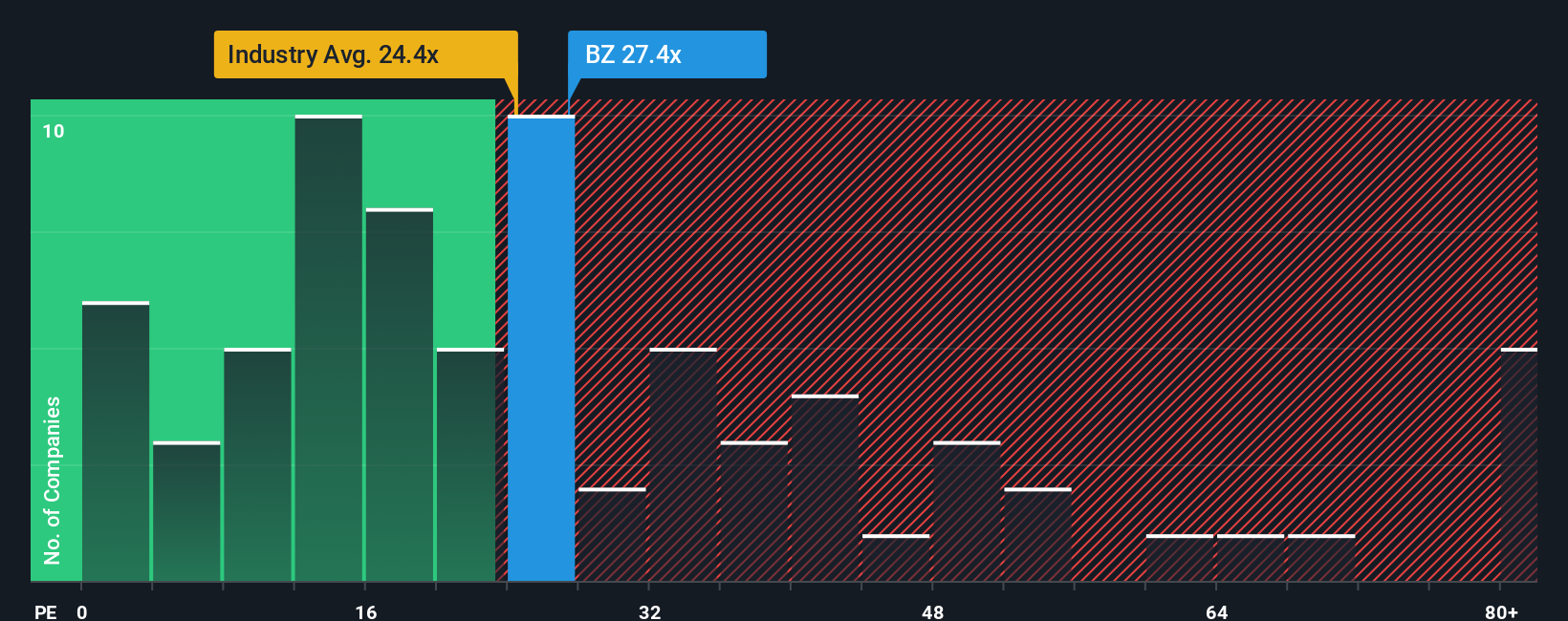

While the narrative fair value points to upside, the price to earnings lens looks less generous. Kanzhun trades on about 27.4 times earnings, above the US Professional Services average of 24.2 times and its own fair ratio of 27.2 times. This hints at limited margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kanzhun Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kanzhun.

Looking for more investment ideas?

Before markets move on without you, load up your watchlist with fresh opportunities using the Simply Wall Street Screener and stay ahead of the next big swing.

- Accelerate your hunt for overlooked value by scanning these 914 undervalued stocks based on cash flows that may be trading well below their long term cash flow potential.

- Capitalize on the AI wave by targeting these 25 AI penny stocks positioned at the intersection of rapid innovation and scalable business models.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that can potentially provide steady cash returns alongside capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com